Dear PGM Capital blog readers,

In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of July 3, 2017:

- Oil getting hammered on growing stockpiles.

- The Silver flash crash of July 7, 2017.

CRUDE OIL GETTING HAMMERED:

Oil prices settled nearly 3 percent lower on Friday as rising U.S. production as OPEC exports hit a 2017 high cast doubt over efforts by producers to curb global oversupply.

Brent crude LCOc1 settled down US$1.40, or 2.9 percent, at US$46.71 a barrel, after falling to US$46.28, its lowest in more than a week.

U.S. West Texas Intermediate (WTI) crude futures CLc1 finished US$1.19, or 2.61 percent, lower at $44.36 a barrel, after trading as low as US$43.78 a barrel as can be seen from below chart.

Both benchmarks posted a sixth weekly decline in the past seven weeks with WTI down 3.9 percent on the week and Brent off 2.5 percent.

Oil has not sustained gains for more than a couple of weeks as investors have grown more worried about the stubborn global crude glut.

THE SILVER FLASH CRASH:

A sharp fall and bounce in asset prices due to an incorrect trade is often referred to as a flash crash

As can be seen from below chart, silver prices briefly dropping US$1.70 an ounce, or nearly 11 percent, in minutes on huge volume of 8,500 contracts, early in Friday’s Asian trading session, likely due to a trading error, before quickly reversing most of that decline.

A fat finger, algorithmic traders and thin market conditions ahead of the US jobs report may have all been contributing factors behind the sudden flurry of activity.

Or, of course, it could have been done on purpose.

Velocity Logic:

In the case of Friday’s silver plunge, the unusual increase in volatility triggered the so-called “velocity logic,” a safeguard set in place by CME Group, pausing the market for 10 seconds.

Velocity Logic is designed to detect market movement of a predefined number of ticks either up or down within a predefined time.

Silver futures for September delivery pared their losses to settle 3.5 percent lower at $15.425 an ounce at 1:36 p.m. in New York, after tumbling to as low as $14.34 before the CME safeguard was triggered.

PGM CAPITAL ANALYSIS & COMMENTS:

CRUDE OIL:

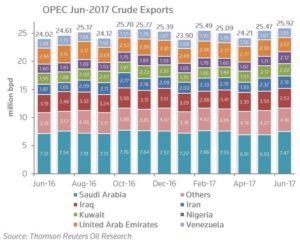

The stream of relentless supply continues, OPEC exports were 2 million barrels per day (bpd) higher in June than in 2016, despite of an extension of a 1.8 million bpd production cut deal led by the Organization of the Petroleum Exporting Countries.

Exports last month from OPEC were much stronger than they were in April and May, seemingly indifferent to the OPEC production cut deal.

Below chart from Thomson Reuters Research, shows that OPEC production is now at 12-month high.

Investors believe the Organization of the Petroleum Exporting Countries will need to make further output cuts to offset thriving shale production in the United States.

Although U.S. gasoline stocks have dropped 3.7 million barrels in the most recent week, far exceeding the expected drop of 1.1 million barrels, still, gasoline inventories remain about 6 percent above seasonal averages, so investors will watch for July data to see if demand is strong enough to whittle down stocks.

We believe that oil is oversold and that prices could rise toward US$55 a barrel and due to this consider the current price as a good entry point, for which our preferred BP Prudhoe Bay Royalty, with its dividend yield of approx. 20 percent. is our favorite pick.

The Silver Flash Crash:

The aggressive selling had all the hallmarks of a market manipulation as US$ 450 million worth of silver futures were sold in a minute.

It seems that an entity appears to have wanted silver lower on and the massive sell order achieved that goal.

This could be due to a hedge fund or institution having a short position. By manipulating prices lower they can liquidate their short positions at much lower prices, making sizable profits.

We believe that the flash crash was a good thing and may have actually helped silver get the kick in the butt it needed.

When markets make these types of moves — flash crash, panic sell or short squeeze — those are typically signs that the markets will reverse.

Thursday night’s flash crash looked like “a tap on the shoulder” — a term used when a firm or individuals are forced to liquidate because they can’t cover the margin requirements, based on this we believe that the flash crash of silver, and the decline of the silver price of Friday, July 7, looks like an excellent buying opportunity to us.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that commodity prices as well as the securities of their producers, can be very volatile and that sharp corrections might happen in the short term.

Yours sincerely,

Eric Panneflek