Dear PGM Blog reader,

In this yearend blog article, we want to take the opportunity to review the year 2017 and try to give an outlook for the year 2018.

THE YEAR 2017 IN REVIEW:

The year 2017, has been a tumultuous year marked by natural disasters, geopolitical tensions, and deep political divisions in many countries.

On the economic front, however, 2017 is ending on a high note, with GDP continuing to accelerate over much of the world in the broadest cyclical upswing since the start of the decade.

Here below we will outline the 5 most important economic facts of 2017:

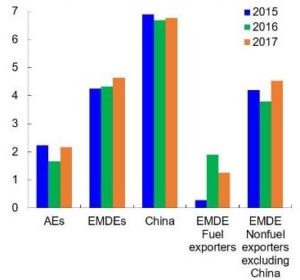

- As can seen from below chart, one of the notable aspect of 2017 is, that growth accelerated in about three quarters of countries – the highest share since 2010 -.

- Some of the larger emerging market economies, such as Argentina, Brazil, and Russia, exited their recessions.

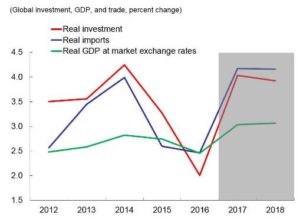

- As can be seen from below chart, boosted by a recovery in investment, global trade growth rebounded from its slowest pace since 2001.

- Metal and fuel prices were supported by stronger momentum in global demand as well as supply restraints in the energy sector.

- As can be seen from below chart, equity valuations have continued their ascent and are near record highs, as central banks have maintained accommodative monetary policy settings amid weak inflation.

TOP 10 BEST PERFORMING SECURITIES IN THE PGM-INDEX:

In the year 2017, the PGM Component 50 Index, appreciated with 15.13 procent as can be seen from below chart.

The certified PGM Component 50 Index, comprises the Top 50 of all the securities in the portfolios under our management with their respective weight factors.

The certified PGM Component 50 Index, comprises the Top 50 of all the securities in the portfolios under our management with their respective weight factors.

Here below we’ll give you a breakdown of the Top-10 best performing securities in the PGM Component Index in 2017. For the case of transparency we have calculated the performance of these securities in the USD.

N0 10. – Industrial and Commercial Bank of China -:

As can be seen from below, chart “The Industrial and Commercial Bank of China“, world’s biggest bank, has appreciated in 2017 with 35.3 percent, on top of this, the stock of the company has dividend yield of approx. 4.13%.

No 9. – China Shenhua Energy -:

As can be seen from below, chart “China Shenhua Energy“, the world’s largest coal mining enterprise, has appreciated in 2017 with 38.7 percent, on top of this, the stock of the company has dividend yield of approx.16.3%.

No 8. – Heineken -:

As can be seen from below, chart “Heineken” the number one brewer in Europe and one of the largest brewers by volume in the world, has appreciated in 2017 with 39.3 percent, on top of this, the stock of the company has dividend yield of approx. 1.2%.

No. 7. – Diageo -:

As can be seen from below, chart “Diageo” the world’s largest distiller until being overtaken by China’s Kweichow Moutai on 9 April 2017, has appreciated in 2017 with 40.5 percent, on top of this, the stock of the company has dividend yield of approx. 2.8%.

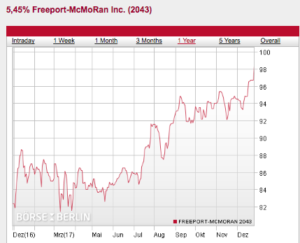

No 6. – Freeport-McMoRan -:

As can be seen from below, chart “Freeport-McMoRan” the largest producer of molybdenum, and second largest copper producer in the world, has appreciated in 2017 with 43.7 percent.

No 5. – LVMH -:

As can be seen from below, chart “LVMH Moët Hennessy Louis Vuitton SE“, better known as LVMH, an European multinational luxury goods conglomerate, has appreciated in 2017 with 45.5 percent, on top of this, the stock of the company has dividend yield of approx. 1.6%.

No 4. – Ecopetrol -:

As can be seen from below, chart “Ecopetrol“, formerly known as Empresa Colombiana de Petróleos S.A, the largest and primary petroleum company in Colombia, has appreciated in 2017, with 61.7 percent, on top of this, the stock of the company has dividend yield of approx. 1.2%.

No 3. – Horizons Marijuana Life Sciences ETF -:

As can be seen from below, chart “Horizons Marijuana Life Sciences ETF“, the first ETF in the world that offers direct exposure to North American-listed stocks that are involved with medical marijuana bio engineering and production, has appreciated – since its IPO date on April 5, 2017 – , with approx. 90.7 percent, on top of this, the ETF has dividend yield of approx. 2.4%.

No 2. – Sociedad Química y Minera -:

As can be seen from below, chart “Sociedad Química y Minera“, a Chilean chemical company and a supplier of plant nutrients, iodine and the world’s biggest lithium producer, has appreciated in 2017 with approx. 107.2 percent, on top of this, the stock of the company has dividend yield of approx. 1.51%.

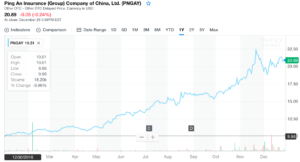

No 1. – Ping An Insurance Group-:

As can be seen from below, chart “Ping An Insurance Group“, the world’s largest and most valuable insurer worth US$204 billion, as of November 2017, which is also one of the world’s biggest investment and asset management companies, with a total asset of US$848.5 billion, has appreciated in 2017 with approx. 109.7 percent, on top of this, the stock of the company has dividend yield of approx. 1.45%.

PGM CAPITAL COMMENTS & ANALYSIS:

Above listed top 10, of the best performing securities in the PGM Component 50 Index proves, that our research team, does its research globally in order to find the best companies, which based on their business model, brands, balance sheet and quality of its management, are or has the potential to become a leading company in their sector.

FCX 5.45% Coupon Bond:

As can be seen from below chart, the FCX 5.45% Coupon bond, with maturity date in 2043, which is also a member of the PGM Component 50 Index has appreciated in 2017, with more than 20 percent and is now hovering around its parity value.

As a value investor and contrarian we don’t go with the herd, but are seeking value, mainly on this we were able to profit from the rising Euro in 2017, by buying Euro nominated securities at the bottom of the EURUSD exchange rate.

Below chart shows that the Euro has appreciated with approx. 12.2 percent against the USD in 2017.

Based on this we also completely ignored, the hype as presented by the USA media regarding the USA stock markets and have advised our clients to exchange their USD or currencies which are pegged to the USD and to flee into the EURO, CHF, CAD, AUD and CNY.

As can be seen from below 1-year USD index chart, the USD Index has decreased with more than 10.2 percent in 2017, which reduced the purchasing power of the real performance of the US Stockmarket with that amount.

OUTLOOK 2018:

The approved TAX plan of USA president Trump, will have on one hand an upwards pressure US securities, but on the other hand a downwards pressure on the US-Dollar, based on this we expect a further decline of the USD-Index in 2018.

Based on this we foresee a further appreciation of the CAD, NOK, AUD and CNY against the USD in 2018.

Legalizing of Marijuana:

The legalizing of Marijuana, will be the biggest revolution since the introduction of internet and E-Commerce stocks early nineties. Similar as what happened with the internet stocks, as cannabis becomes fully legal in all its forms in the years to come, big food and drug companies will take over the leading players at a big premium.

Due to this we expect the sky to be the limit for Marijuana stocks and the first Marijuana ETF.

The Chinese Big Banks:

As China more and more move to front and center of the world economy, we expect the shares of the 4 biggest Chines banks, which currently are under valued based on their fundamentals, to experience a break out to the upside in the year(s) to come.

Please be aware that past performances are no guarantee of future results and that in the current volatile global world, you have to educate yourself in and to have global mindset and to avoid the herd mentality.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can stay solvent.

Yours sincerely,

Eric Panneflek