Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you why Investing in Nestlé can be lucrative for value investors.

INTRODUCTION:

Nestlé S.A. (NESN:VTX) is a Swiss transnational food and drink company headquartered in Vevey, Vaud, Switzerland. It has been the largest food company in the world, measured by revenues and other metrics, for 2014, 2015, and 2016, with a market capitalization of roughly 231 billion Swiss francs.

The company was formed in 1905 by the merger of the Anglo-Swiss Milk Company, established in 1866 by brothers George and Charles Page, and Farine Lactée Henri Nestlé, founded in 1866 by Henri Nestlé(born Heinrich Nestlé).

Nestlé has 447 factories, operates in 194 countries, and employs around 339,000 people. It is one of the main shareholders of L’Oreal, the world’s largest cosmetics company.

The company’s products include baby food, medical food, bottled water, breakfast cereals, coffee and tea, confectionery, dairy products, ice cream, frozen food, pet foods, and snacks. Twenty-nine of Nestlé’s brands have annual sales of over 1 billion Swiss Francs (CHF), approx. 1.1 billion US-Dollars.

NESTLÉ THE CASH MACHINE:

Nestle’s business is a strong and stable cash-producing machine, which offers a 2.95% dividend yield, has increased its dividend over time, maintains a strong economic moat and has reliably generated organic growth while selectively making strategic acquisitions.

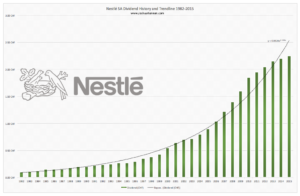

As can be seen from below chart, the company’s dividend has increased exponentially over the last 33 year, from CHF 0.10 a share for FY-1982 to CHF 2.30 a share for FY-2016, representing a 2,150% increase over the base rate on a per share basis, assuming no dividend reinvestment on the part of the owner.

As can be seen from above chart the company was able to increase its dividend during the great recession of 2008-2009 for which from fiscal year 2006 to FY-2015, the company increased its dividend from CHF 1.04 a share to CHF 2.30 a share, an increase of 121 percent in 10 years.

PGM CAPITAL ANALYSIS & COMMENTS:

It is rare to find a company with a strong dividend, a high moat, and solid growth potential, but Nestle has all three and is one of the best blue-chip dividend stocks.

Above chart of the company’s dividend payout shows, that Nestlé’s dividend pay-out up to now kept on growing Year-Over-Year over a period of war and peace, inflation and deflation, and stock market booms and busts.

When comparing the share price performance of the company with the performance of the DOW-30, over the past 21 years, we can see that the shares of Nestlé has performed approx. 250 percent better than the DOW-30 Index, as can be seen from below chart.

The blue line represents the share price performance of Nestlé and the green line shows the performance of the DOW-30

Based on the company’s fundamentals, strong Balance sheet and with an approximates a compound annual growth rate in the dividend of 9.9% per annum, we have a STRONG BUY rating on the shares of the company.

To make a long story short, Nestle is a great company, at a fair price. It’s the best dividend growth stock nobody talks about.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek