Dear PGM Capital, blog readers,

In this weekend blog edition, we want to discuss the FY-2016 Financial Results – as reported in the week of March 27 -, of China’s four big commercials Banks, for which all of them are in the TOP six of world biggest public companies

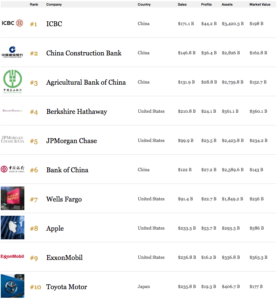

Chinese banks held on to the top three spots in the FORBES Global 2016, a comprehensive annual ranking of the world’s largest public companies.

- Number one Industrial and Commercial Bank of China (ICBC )

- Number two China Construction Bank (CCB)

- Number three Agricultural Bank of China (ABC) held onto their leading positions

- Bank of China went from fourth place to sixth.

INDUSTRIAL AND COMMERCIAL BANK OF CHINA:

Introduction:

Industrial and Commercial Bank of China Limited (ICBC) (01398.HK), is a Chinese multinational banking company, for which it is the largest and most valuable bank as well as company in the world by total assets and market capitalization as of February 2017.

It was founded as a limited company on January 1, 1984. From balance sheet information included on Bankers Almanac available at 1 February 2017, it had assets worth US$3.420 trillion.

It ranks number 1 in The Banker’s Top 1000 World Banks ranking, and first on the Forbes Global 2000 list of the world’s biggest public companies.

Earnings Report FY-2016:

On Thursday, March 30, ICBC’s announced that for the year ended 31 December 2016, net profit amounted to RMB278.249 billion (US$ 40.39), representing a yearly increase of 0.4%, slightly higher than median of brokers’ forecast (RMB277.251 billion). EPS amounted to 77 fen.

The company declared a final dividend of 23.43 fen, payable on August 2, 2017, to shareholders on record on July 05, 2017.

CHINA CONSTRUCTION BANK:

Introduction:

China Construction Bank Corporation (CCB) (O939.HK), was founded on 1 October 1954 under the name of People’s Construction Bank of China and later changed to China Construction Bank on 26 March 1996.

According with the Forbes Global 2000 list of February 2017, it ranks second as the world’s biggest public companies by market capitalization.

From balance sheet information included on Bankers Almanac available at 1 February 2017, it was ranked world’s second biggest bank by asset with a total asset of US$ 2.826 Trillion.

Earnings Report FY-2016:

On Wednesday, March 29, China Construction Bank, announced that for the year ended 31 December 2016, net profit amounted to RMB231.46 billion, representing a yearly increase of 1.45%; EPS amounted to 92 fen.

The company declared a final dividend of 27.80 fen, payable on July 20, 2017, to shareholders on record on June 24, 2017.

AGRICULTURE BANK OF CHINA:

Introduction:

Agricultural Bank of China Limited (ABC) (1288.HK) also known as AgBank, was founded in 1951, and has its headquarters in Dongcheng District, Beijing.

According with the Forbes Global 2000 list of February 2017, it ranks third as the world’s biggest public companies by market capitalization.

From balance sheet information included on Bankers Almanac available at 1 February 2017, it was ranked world’s third biggest bank by asset with a total asset of US$ 2.740 Trillion.

Earnings Report FY-2016:

On Tuesday, March 28, Agriculture Bank of China, announced that for the year ended 31 December 2016, net profit amounted to RMB204.40 billion, representing a yearly decrease of 3.75%; EPS amounted to 61 fen.

The company declared a final dividend of 17.00 fen, payable on August 03, 2017, to shareholders on record on July 07, 2017.

BANK OF CHINA:

Introduction:

Bank of China (3988.HK) was founded in 1912 by the Republican government to replace the Imperial Bank of China. It is the oldest bank in mainland China still in existence.

According with the Forbes Global 2000 list of February 2017, it ranks sixth as the world’s biggest public companies by market capitalization.

From balance sheet information included on Bankers Almanac available at 1 February 2017, it was ranked world’s fourth biggest bank by asset with a total asset of US$ 2.589 Trillion.

Earnings Report FY-2016:

On Friday, March 31, Bank of China, announced that for the year ended 31 December 2016, net profit amounted to RMB182.89 billion, representing a yearly decrease of 8.98%; EPS amounted to 60 fen.

The company declared a final dividend of 16.80 fen, payable on August 09, 2017, to shareholders on record on July 10, 2017.

PGM CAPITAL ANALYSIS & COMMENTS:

The Top-10 of Forbes-2000 list, of world’s biggest companies by market capitalization of 2016, clearly shows how China now is the dominant Economy in the world, for which four of its commercial banks as discussed in this article are in the Top six of this prestigious list as can seen from below table.

Below February 2017, ranking of world’s biggest banks by asset, in which these four Chinese commercial Banks are in the Top four of the list, sustained the above and shows us how much the world economy power is shifting from West to East.

Based on their fundamentals, potential growth, and the valuation of these four Chinese commercial banks, with P/E ratio around 6, dividend yield of approx. 5 percent, we consider these four Chines commercial banks as a Long-term holding and have a BUY rating on their shares.

Last but not least, before following any investing advice, always take your investment horizon and risk tolerance into consideration and keep in mind that securities of emerging market countries, can be very volatile and that sharp corrections might happen in the short term.

Yours sincerely

Eric Panneflek