Dear PGM Capital Blog readers,

In this weekend’s blog edition we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of January 23, 2017:

- The Dow Jones Industrial breaks the 20,000 mark for first time ever.

- USA Economic growth slowed in Q4-2016 more than expected.

DOW CROSSED 20,000 MARK ON OPENING BELL:

As can be seen from below chart, on Wednesday, January 25, when the stock markets opened, the Dow Jones Industrial Average eclipsed the psychologically relevant 20,000 mark milestone, for the first time in its 120-year history.

It took the Dow, a stock gauge made up of 30 of America’s best-known blue-chip companies, just 64 calendar days to climb from 19,000 to 20,000, its second-fastest thousand-point sprint, according to S&P Dow Jones Indices. The climb from 10,000 to 11,000 back in 1999 took 35 days.

THE USA ECONOMIC GROWTH SLOWED IN Q4-2016

On Friday, January 27, the US Commerce Department says the country’s gross domestic product grew at an annual rate of just 1.9 percent in the October-December period, a slowdown from 3.5 percent growth in the third quarter.

For the fourth quarter, the biggest factor contributing to the slowdown was a widening in the trade deficit. Exports, which had been temporarily bolstered by a surge in sales of soybeans to Latin America, retreated in the fourth quarter.

The fourth-quarter drop in exports was the biggest since the first quarter of 2015, while import surged.

For all of 2016, the economy grew 1.6 percent, which was the worst showing in five years since a similar 1.6 percent gain in 2011. The country’s GDP grew 2.6 percent in 2015, and since the recession ended in mid-2009, growth has averaged a weak 2.1 percent.

PGM CAPITAL ANALYSIS AND COMMENTS:

The DOW breaks 20,000, what’s Next:

What’s in a number anyway? That may be the question stock-market investors pose as the Dow Jones Industrial Average ends at the psychological milestone of 20,000.

But, is the rise for the Dow really that significant?

Some critics point out the benchmark only represents a smattering (30 in total) of the thousands of stocks that make up the broader equity market. Moreover, outsize moves in any one of its components, because the gauge is price weighted, can have a big effect on the DOW.

It is also worth pointing out that 1,000-point moves for the Dow aren’t what they used to be. In other words, when the Dow struggled and finally doubled from 1,000 to 2,000 in 1987 that move represented a 100% advance, but a climb to 20,000 from 19,000 represents a comparatively pedestrian 5.3% rise as can be seen from below chart.

DOW to GOLD ratio:

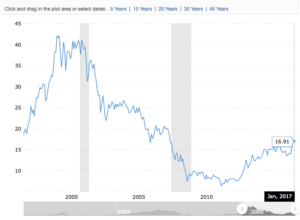

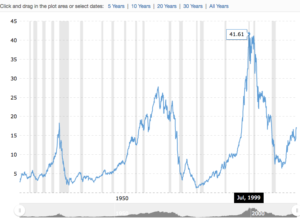

DOW 20,000 is the value of the DOW, measured in US-Dollars, however when we measured the value of the DOW in Gold, which is real money, we’ll see that the highest value of the DOW measured in Gold was reached in the summer of 1999 and that measured in Gold the DOW has decreased since than, to close on Friday January 27 at 16.91.

The above implicates that the purchasing power of an USA-Blue chip investor, has declined since the peak of the DOW in July of 1999 at 41.98 ounces of Gold, as can be seen from below chart.

Based on this we believe that all the celebration and hype around 20,000, isn’t anything to write home about.

USA Q4-2016. Economic growth slowed:

Economists are forecasting a better performance in 2017, with many raising their forecasts to incorporate the potential impact of Trump’s stimulus program.

President Donald Trump has set a goal of doubling growth to 4 percent in the coming years through an ambitious stimulus program featuring tax cuts, deregulation and higher infrastructure spending.

Private economists believe sustained annual growth rates of 4 percent will be a high hurdle, given underlying trends such as slow growth in the labor market and weak productivity. However, many analysts have been boosting their forecasts believing that Trump will succeed in getting at least a portion of his program approved by a Republican-led Congress.

Economists at the International Monetary Fund last week boosted their outlook for U.S. GDP to 2.3 percent this year and 2.5 percent in 2018, saying the increase reflected expectations that Trump’s economic program of tax cuts, regulatory relief and higher infrastructure had boosted growth prospects.

On the other side, history has proven that protectionism will lead to trade and currency wars, which at the end will lead to stagflation.

Until next week.

Yours sincerely,

Eric Panneflek