Dear PGM Capital Blog readers,

Thursday October 19th, marked the 30th anniversary of the 1987 “Black Monday” when stock markets around the world crashed, shedding a huge value in a very short time.

INTRODUCTION:

The market crash of Monday, October 19, 1987, began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) fell exactly 508 points to 1,738.74 (22.61%). In Australia and New Zealand, the 1987 crash is also referred to as “Black Tuesday” because of the time zone difference.

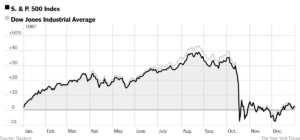

Below chart of the DOW Jones Industrial and the S&P-500 of 1987, gives a clear picture of the October 87 market crash.

PGM CAPITAL ANALYSIS & COMMENTS:

This anniversary, naturally, has brought about a number of discussions on whether another crash could happen and if markets are prepared for the possibility. And with stocks near the high end of their historical valuation range, some investors are concerned that a “stretched” stock market could see investors feel en masse amid a panic. High valuations, however, were not really a dominant feature of the markets in 1987

The market’s Case Shiller price/earnings ratio — which captures roughly how much investors are willing to pay for $1 of earnings per share using a 10-year rolling average — was right around its historical average ahead of “Black Monday”, as can be seen from below chart.

Above chart shows also that right now, stocks have only been more expensive ahead of the 1929 market crash and during the tech bubble.

Most analysts, have pointed out, that the current historically low level of interest rates is supporting the market’s valuation and on a relative basis makes stocks look more attractive than a price-to-earnings multiple might otherwise appear. And in any case it is not the price of stocks that makes markets crash — it is fear.

For technical reasons, an exact repeat of the crash cannot happen; new rules in the stock market make a 22% daily drop in the Dow Jones Industrial Average an impossibility. But as Nobel Prize-winning economist Robert Shiller notes in The New York Times on Thursday, this does not mean that panics have been removed from markets or society.

Shiller also notes that his research immediately after the crash in ’87 that, “a powerful feedback loop from human to human — not computer to computer — set the market spinning.” It was not one bad earnings report, or one bad data point, or anything happening outside of the market itself.

Since 1987, markets have continued to show that they are fully capable of gripping participants in panics.

Questions about whether another crash like 1987 can happen have a clear answer — of course it can. But we won’t know when it’s coming, and even decades later we might not have a clear picture of why.

Investors should keep in mind that the current valuations of the stock markets are only justified, by the current historical low interest rate, which mean, that at current valuation, higher interest rates might be a time bomb under the markets.

Yours sincerely,

Eric Panneflek