Dear PGM Capital Blog readers,

In this weekend’s blog article, we want to discuss with you why investing in Australia can be lucrative and the best way to do it.

ABOUT AUSTRALIA:

Australia is a developed country with an estimated nominal GDP of 1.137 trillion US-Dollar for which it ranks as the world’s 12th-largest economy.

Additional Economic facts about Australia:

- Australia ranks highly in many international comparisons of national performance, such as quality of life, health, education, economic freedom, good-governance and the protection of civil liberties and political rights

- The country’s estimated GDP per Capita (Nominal) for 2015 was US$ 51,642.00, for which it ranks as the ninth richest country in the world.

- Australia has the second-highest human development index (HDI) globally.

- The country is a member of the United Nations, G20, Commonwealth of Nations, ANZUS, Organization for Economic Co-operation and Development (OECD), World Trade Organization, Asia–Pacific Economic Cooperation, and the Pacific Islands Forum.

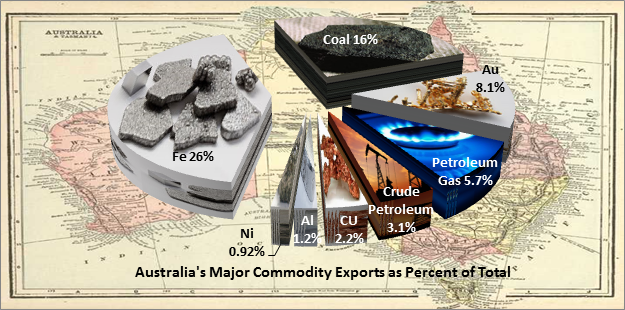

As can be seen from below chart, Australia’s economy is greatly dependent on its natural resources and mining industry.

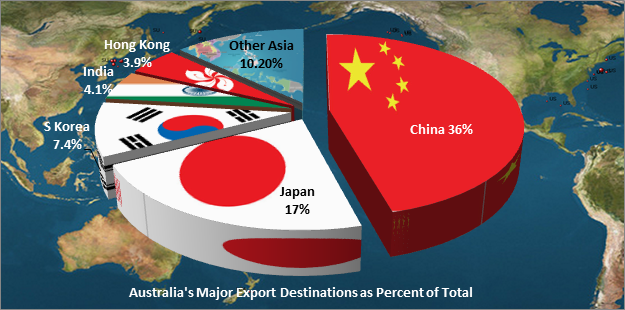

Below pie-chart gives a breakdown of Australia’s commodity exports by country, for which can be seen that most of its export are destined for China and the Asia-Pacific region.

THE BEST WAY TO INVEST IN AUSTRALIA:

One of the best way to invest in Australia is via an Australia focused Exchange Traded Fund, for which the iShares MSCI Australia ETF (NYSEARCA: EWA) has our preference.

This ETF is passively managed and tracks the MSCI Australia Index in U.S. Dollars, is listed since March of 1996 and has net asset value of over US$1.2799 billion.

Below charts shows the performance of this ETF since its introduction in March of 1996.

Over 99% of the fund is invested in Australian big-cap companies for which below table shows the 10 major holdings.

| Top 10 Holdings (52.06% of Total Assets) |

|---|

|

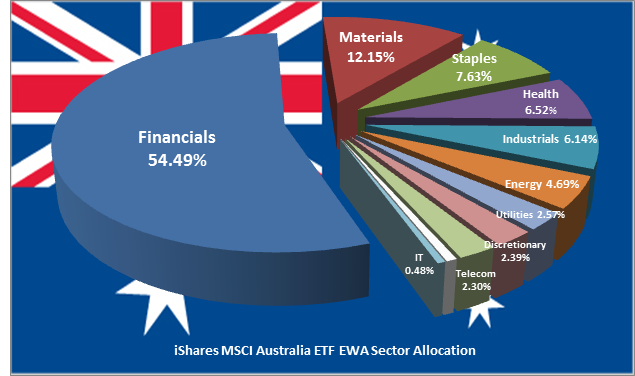

Based on the fact that Australia is a natural resources rich county, one might expect the fund to be most heavily weighted in industrials, particularly in the mining or materials sector.

As can be seen from below chart, although these sectors do carry is respectable weight, the ETF is most heavily weighted in the Financial sector at over 54% of investment allocation.

PGM CAPITAL ANALYSIS AND COMMENTS:

Australia with its diversified economy has managed to maintain a reasonable economic growth in the current rout of commodity prices and slowdown and re-orientation of the Chinese Economy.

The iShares MSCI Australia ETF, makes the fund unique is the fact that although Australia is rich in strategic commodities and metals, it only has an exposure of approx 30% to the mining and commodities sector.

This makes the downside risk of the fund (only) dependable for 30% on the effect the global commodities price-demand ‘contraction’ will have on the economy of Australia.

As can be seen from below chart the Australian Dollar (AUD) has depreciated with approx. 30% during the last 5 years, which can be seen as a risk factor for US-Dollar based investors.

Above chart shows that the AUD/USD exchanged rate might have bottomed in January of this year.

At the close of the market on Friday, March 18, 2016, the fund had a P/E ratio of 16 which is below the S&P’s average P/E and trades at a multiple of 1.73 times book.

Based on its closing price of the fund has a dividend yield of 6.1 percent, which is noticeably higher than the current 2.12% for the S&P-500 as can seen from below all-time chart of the dividend yield of the S&P-500.

Based on the above mentioned fundamentals of the fund we have a BUY rating on it and advise it to our clients who want to invest in Australia.

Last but not least, before following any investing advice, always consider your investment horizon, risk tolerance and financial situation and be aware that commodities prices and the stock of their miners might be very volatile and that sharp corrections may happen in the short term.

Yours sincerely,

Eric Panneflek