Dear PGM Capital Blog readers,

On Thursday, February 10, the USA, Labor Department reported that consumer prices jumped 7.5%, in January, compared with a year earlier, the steepest year-over-year increase since February 1982.

INTRODUCTION:

Thursday, February 7th showed that Inflation soared over the past year at its highest rate in four decades, hammering American consumers and wiping out pay raises.

Shortages of supplies and workers, heavy doses of federal aid, ultra-low interest rates and robust consumer spending combined, can be mentioned as the major cause for this leaping inflation figure, for which there are few signs that it will slow significantly anytime soon.

The latest inflation data according to some economists, may lead that the FED could raise its key interest rate in March by one-half a percentage point, rather than its typical quarter-point hike.

The odds for a half percent interest hike, ticked higher again after the big jobs number spiked last Friday, February 11th, sending the US Capital markets deep into the red.

As can be seen from the below chart, NASDAQ is based on the interest rate hike fear, down with almost 13 percent YTD.

PGM CAPITAL COMMENTS & ANALYSIS:

The Inflation and job figures of Thursday February 10 and Friday February 11 respectively, triggered rumors abound that the Federal Reserve won’t even wait until its March to hike interest rates and may surprise the market with a mid-term hike.

In the past, these kinds of interim interventions were not at all exceptional and were often used to reinforce monetary policy.

These types of actions were in time when the FED focused mainly on the economy and less on the stock market. It was also a time of lower debt, so the impact of higher interest rates had a smaller effect.

FED history also shows that if the FED rate hike by 50 basis points it is not likely to be its first move in a hiking cycle, but for the middle to end of a tightening cycle.

Another fact that might weigh on aggressive rate hike by the FED, is the current financial status of the USA.

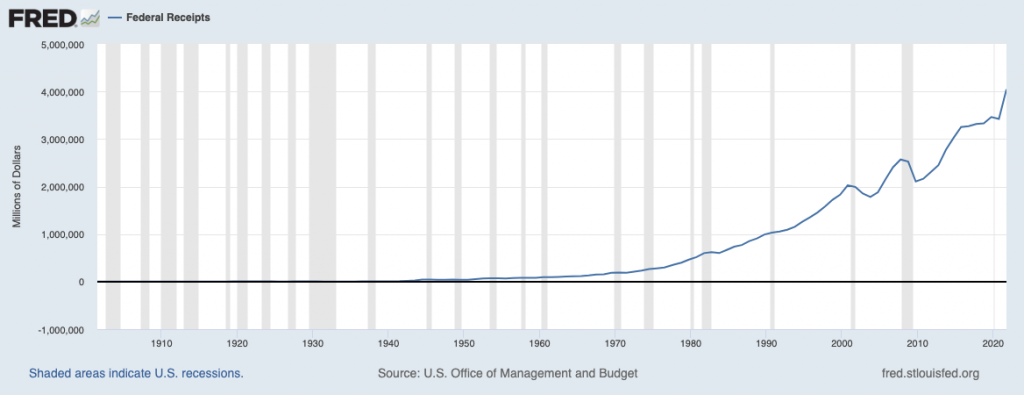

As can be seen from the below chart of the FED, for FY 2021 the USA Federal Revenue was approx. 4 Trillion US-Dollars

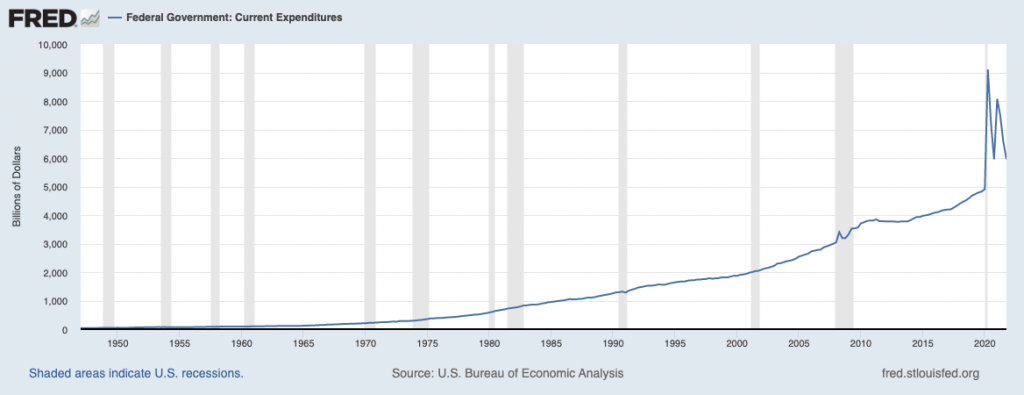

While the Federal expenditures were approx. 7 Trillion US-Dollars as can be seen from the below chart.

Based on the above the country will close FY 2021, with a deficit of 3 Trillion US-Dollars.

Some hawkish financial advisors and analysts are suggesting that the FED might increase rates this year up to 1.75 percent.

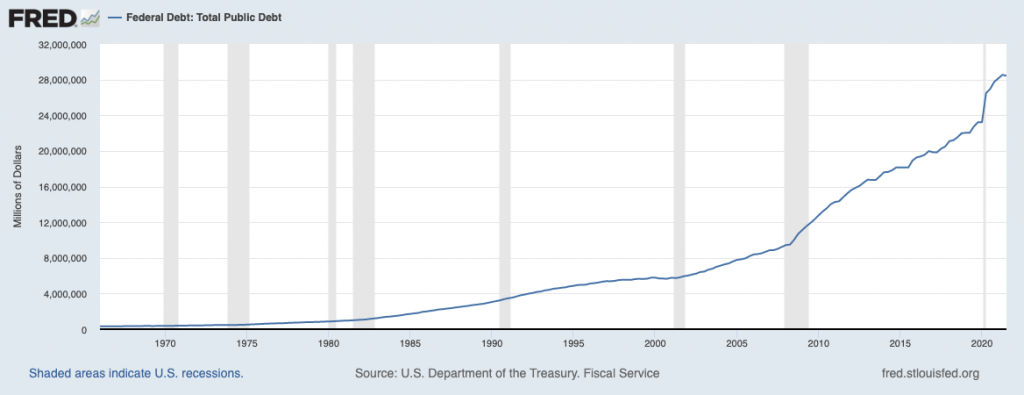

The below chart shows that currently the US has federal debt of approx. 28 Trillion US-Dollar.

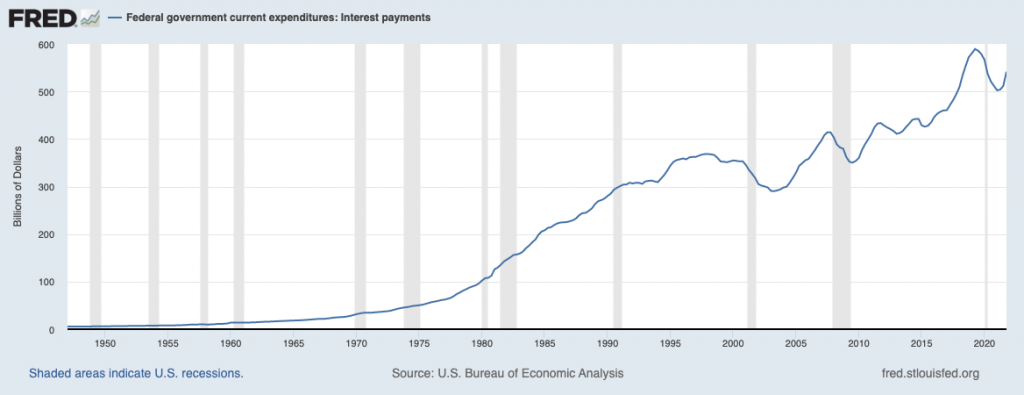

The interest payment on this debt currently at an interest rate of between 0.00 – 0.025% is approx. 540Billion US-Dollars as can be seen from the below chart.

The above implies that at an interest rate of 1.75 percent, the country’s interest payment will increase with 490 Billion US-Dollars per year, which will lead to a total interest payment of the country to approx. 1 Trillion USD per year.

A simple equation shows that 1 Trillion US-Dollar on Interest payment means 25% of total revenue of the country of 4 Trillion US-Dollars.

Conclusion:

Based on the above, we believe that the current interest fear and subsequent market rout is totally exaggerated, and that it has created an excellent buying opportunity for long term investors.

In this rapidly changing world, subsequent turbulence and chances of rise in inflation, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management Institution.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line.

Past Performance Is Not an Indication for Future Results.

Yours sincerely,

Eric Panneflek