Dear PGM Capital Blog reader,

In this weekend blog article, we want to elaborate on the financial reports of the two biggest Canadian Cannabis Producers, – Aurora Cannabis (ACB.TO) and Canopy Growth (WEED.TO) -, which reported their earnings in the week on February 11, 2019.

INTRODUCTION:

Canada is the second country in the world to legalize the drug for both medical and recreational use on October 17, 2018, trailing Uruguay and the first country among the G-7 nations.

In the week of February 11, Aurora Cannabis and Canopy growth, were the two major, Canadian Cannabis producers, which reported their first quarter that overlaps with Canadian recreational cannabis legalization, beginning October. 17th, 2018.

AURORA CANNABIS EARNINGS REPORT:

On Monday, February11, 2019, after the bell,Aurora Cannabis (ACB.TO), reported its earnings for the December 31st quarter.

Aurora Cannabis is the third major Canadian cannabis producer to report post-recreational earnings, after HEXO (HEXO.TO) and Aphria (APHA.TO). As with each of those three companies, Aurora saw tremendous growth in the post-legalization quarter despite the somewhat rocky start to Canadian legalization of cannabis.

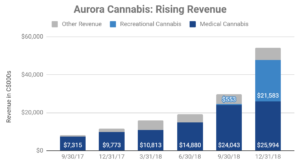

Aurora forecast CAD 50-55 million in revenue, and they hit that target with revenue of CAD 54.2 million, up 83% sequentially and up 363% year over year as can be seen from below chart.

As can be seen from above chart, nearly all of Aurora’s growth this quarter is attributable to the launch of recreational cannabis in Canada, which led to CAD 553,000 in revenue last quarter and CAD 22 million in revenue this quarter.

While Aurora’s medical cannabis results suffered marginally due to excise taxes and low unit revenue, Aurora posted very strong medical cannabis sales.

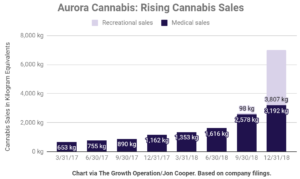

As can be seen from below chart, during the quarter the ended on December 31, 2018, Aurora sold 3,807 kg, of recreational cannabis, which is 48% more than the medical cannabis they sold last quarter.

Above chart shows, that, Aurora sold 162% more cannabis in the quarter ending December 3, than the one ending September 30, 2018.

CANOPY GROWTH EARNINGS REPORT:

On Thursday, February 14, in the evening, Canopy Growth (WEED.TO) reported its earnings for the December 31st quarter as follows:

|

Operational and Financial Highlights |

|||

|

Q3 2019 |

Q3 2018 |

% Change |

|

|

Net revenue (millions) |

$83.0 |

$21.7 |

282% |

|

Kilograms and kilogram equivalents sold |

10,102 |

2,330 |

334% |

|

Average Selling Price per gram – Recreational |

$6.96 |

– |

NM |

|

Average Selling Price per gram – Canadian Medical |

$9.77 |

$8.21 |

19% |

|

Average Selling Price per gram – International Medical |

$13.28 |

$12.61 |

5% |

|

Average Selling Price per gram |

$7.33 |

$8.30 |

-12% |

|

Inventory & Biological Assets (millions) |

$216 |

$108 |

100% |

|

Kilograms harvested (kilograms) |

7,556 |

7,961 |

-5% |

|

Cash, cash equivalents and marketable securities (millions) |

$4,915 |

$429 |

1,046% |

|

NM = Not Meaningful |

|||

|

Revenue Highlights |

|||

|

Q3 2019 |

Q3 2018 |

% Change |

|

|

Canadian Recreational Cannabis Gross Revenue – Business to Business |

$60.1 |

– |

NM |

|

Canadian Recreational Cannabis Gross Revenue – Business to Consumer |

$11.5 |

– |

NM |

|

Canadian Recreational Cannabis Revenue – Subtotal |

$71.6 |

– |

NM |

|

Canadian Medical Cannabis Gross Revenue |

$15.9 |

$19.3 |

-18% |

|

International Medical Cannabis Gross Revenue |

$2.7 |

$1.0 |

170% |

|

Medical Revenue – Subtotal |

$18.6 |

$20.3 |

-8% |

|

Other Revenue |

$7.5 |

$1.4 |

436% |

|

Total Gross Revenue |

$97.7 |

$21.7 |

350% |

|

Less Excise Taxes |

$14.7 |

– |

NM |

|

Net Revenue |

$83.0 |

$21.7 |

282% |

|

NM = Not Meaningful |

|||

|

Product Sales Highlights |

|||

|

Product Sales (Kilograms & kilogram equivalents) |

Q3 2019 |

Q3 2018 |

% Change |

|

Canadian Recreational Cannabis – Business to Business |

7,381 |

0 |

NM |

|

Canadian Recreational Cannabis – Business to Consumer |

906 |

0 |

NM |

|

Canadian Medical Cannabis |

1,611 |

2,254 |

-29% |

|

International Medical Cannabis |

204 |

76 |

168% |

|

Total |

10,102 |

2,330 |

334% |

|

NM = Not Meaningful |

|||

PGM CAPITAL’s ANALYSIS & COMMENTS:

Aurora:

The company’s results reflect the launch of legal marijuana sales in Canada, the first industrialized nation to allow recreational-pot sales nationwide. Aurora claimed a large market share for Canada in the launch quarter, with $21.6 million of its revenue coming from its home country.

Based on the company’s current confirmed production results, Aurora reiterated its previous guidance. Aurora expects to have approximately 25,000 kgs available for sale in Q4 (April to June 2019). The company also reiterated its prior outlook of achieving sustained EBITDA positive results from the second calendar quarter of this year (fiscal Q4).

Below video, of the presentation of Aurora’s financial report presentation of February 11, provide additional details, guidance and outlook, of the company.

From below chart we can see that the shares of the company, have appreciated with approx. 31.2 percent Year-To-Date.

Canopy Growth:

In the transition from a “medical marijuana” business to a business producing clinically proven cannabinoid therapies, the Company experienced a decline in its Canadian medical market demand in the quarter. The decline may be attributed to the initial adjustment to the available legal recreational market which patients can also access. Additionally, medical revenues reflected a migration to a tighter medical product range as well as elevating and re-focusing Spectrum Cannabis to a more pure medical/pharma focused brand proposition.

International medical revenues in the three months ended December 31, 2018, consisting primarily of sales in Germany, increased by 170 percent over the same quarter in the prior year to $2.7 million.

From below chart we can see that the shares of the company, have appreciated with approx. 59.9 percent Year-To-Date.

Based on the above we maintain our STRONG BUY rating on Aurora Cannabis as well as Canopy Growth.

Discloser:

I / We are long shares of Aurora Cannabis as well as Canopy Growth.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. A Past Performance Is Not Indicative Of Future Results. Shares of emerging technologies and growth companies might experience a higher volatility than the ones of developed market big-caps ones.

Yours sincerely,

Eric Panneflek