Dear PGM Blog reader,

In this new year’s blog article, we want to take the opportunity to review the year 2021 and provide potential outlook for the year 2022.

REVIEW OF THE YEAR 2021:

Considering historically high inflation and supply chain disruptions, Global Capital markets have experienced high volatility in Q3- and Q4-2021. The past year was a wild year in many respects, despite this phenomenon, the USA and European markets ended in green.

On the other-hand the Chinese stocks have been negatively affected by financial news due to the stress between the USA and China since mid July of the past year.

The Covid market has really characterize the year 2021, in some ways more so than 2020, new Covid-19 variants have extended the duration of the pandemic and delayed a return to normal, with the consequence that the recovery has moved in “more a bumpy fashion than a linear one”

The Chinese Market:

China’s large-cap, the CSI 300 Index, fell roughly by 5% for the year 2021. Hong Kong, home of numerous Chinese tech and other giants, saw its Hang Seng Index dive almost 15% in the same period. The MSCI China Index ended the year 37% percentage points lower than comparable major indexes.

But the crushing year for Chinese markets had some analysts ready to buy the dip.

PGM TOP 10 BEST PERFORMING SECURITIES IN 2021:

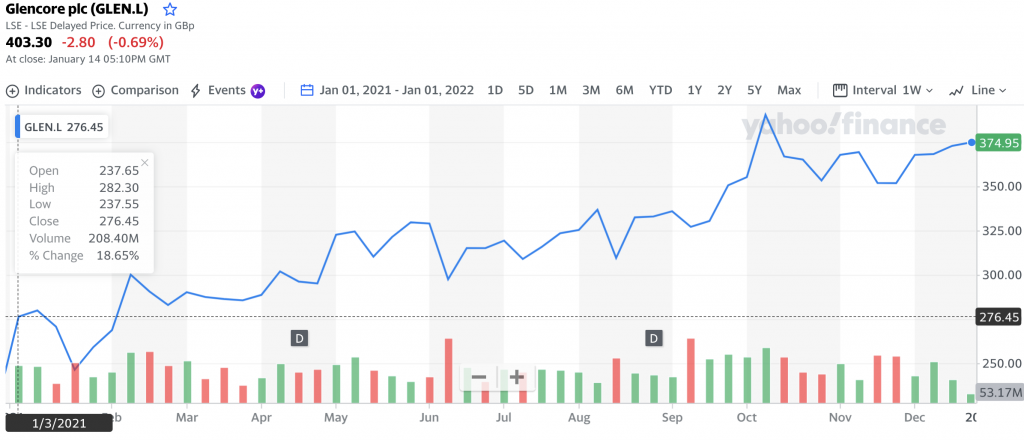

No 10. –Glencore plc-:

As can be seen from the below chart, shares of Glencore plc, have appreciated in 2021 with approx. 35.6%. Additionally, the stock of the company has a dividend yield of approx. 3.00%.

No 9. –Apple Inc-:

As can be seen from the below chart, shares of Apple Inc, have appreciated in 2021 with approx. 39.5%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

No 8. –LVMH Moët Hennessy-:

As can be seen from the below chart, shares of LVMH Moët Hennessy, have appreciated in 2021 with approx. 42%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

No 7. –Nutrien Ltd.-:

As can be seen from the below chart, shares of Nutrien, have appreciated in 2021 with approx. 50.7%. Additionally, the stock of the company has a dividend yield of approx. 4.00%.

No 6. –Freeport-McMoRan Inc.-:

As can be seen from the below chart, shares of Freeport McMoRan, have appreciated in 2021 with approx. 53.6%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

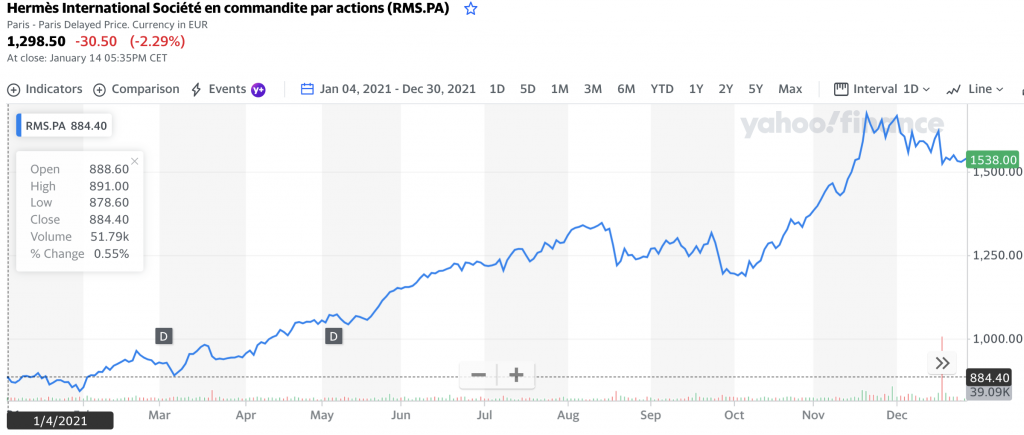

No 5. –Hermès International Société-:

As can be seen from the below chart, shares of Hermès International Société, have appreciated in 2021 with approx. 74%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

No 4. –ASML Holding N.V. -:

As can be seen from the below chart, shares of ASML Holding N.V., have appreciated in 2021 with approx. 75.6%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

No 3. –Moderna Inc -:

As can be seen from the below chart, shares of Moderna Inc, have appreciated in 2021 with approx. 127.3%.

No 2. –NVIDIA Corporation -:

As can be seen from the below chart, shares of NVIDIA Corporation, have appreciated in 2021 with approx. 135.9%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

No 1. –BioNTech SE -:

As can be seen from the below chart, shares of BioNTech SE, have appreciated in 2021 with approx. 182.3%.

PGM CAPITAL COMMENTS & ANALYSIS:

The top-10 of the best performing securities in the PGM-Index for the year 2021, shows the following:

- All the securities in the top-10 are either an hedge against inflation or securities of disruptive technologies companies.

- We expect this trend to continue in 2022.

- For the first time in the past 10 years due to the propaganda against China there are no, Chinese securities in the Top 10.

- Due to this we expect we expect a big bounce back of -mainly Chinese technological- securities in 2022.

- Two of the top-10 securities, are Luxury goods companies, LVMH and Hermes, this mainly to the high demand from East Asian Countries.

- Based on the increase of wealth per capita in Asia -mainly China- we expect this trend to continue in 2022

Outlook 2022:

The road map for 2022 suggests that the first six months of the year could be problematic, particularly when compared with 2021: Price pressures look as though they might ease, but inflation could remain uncomfortably high for the first few months of the year. This is a continuation of the stag-flationary narrative that persisted in the second half of last year, and the emergence of the Omicron variant could tip us further in that direction.

Prospects for the second half of 2022 look better, as inventory rebuilds and the unwinding of supply chain disruptions could fuel a more sustainable recovery. An improved growth picture and slower inflation should bring us back to a Goldilocks regime, which should be far better for market returns and general risk assets.

In 2022, cash will continue to be trash, while Inflation is Destroying your Savings Account.

Disclosure:

With the exception of Apple, LVMH, Moderna and Glencore, we own in our personal portfolio, the rest of the 2021, best performing securities in the PGM Index.

In this rapidly changing world and subsequent turbulence and chances of rise in inflation, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line.

Past Performance Is Not an Indication for Future Results.

Yours sincerely,

Ms. Pheadra Gijsbertha and Mr. Eric Panneflek

The PGM Capital Management Team