Dear PGM Capital Blog readers,

On Thursday, September 3rd, the rally – for tech stocks and other high-flying sectors that have benefited from momentum-driven waves of buying – came to an ugly end.

INTRODUCTION:

On Thursday, September 3rd, the ghosts of the dot.com bust of 2000 to 2002, were on every trading screen on Wall-street.

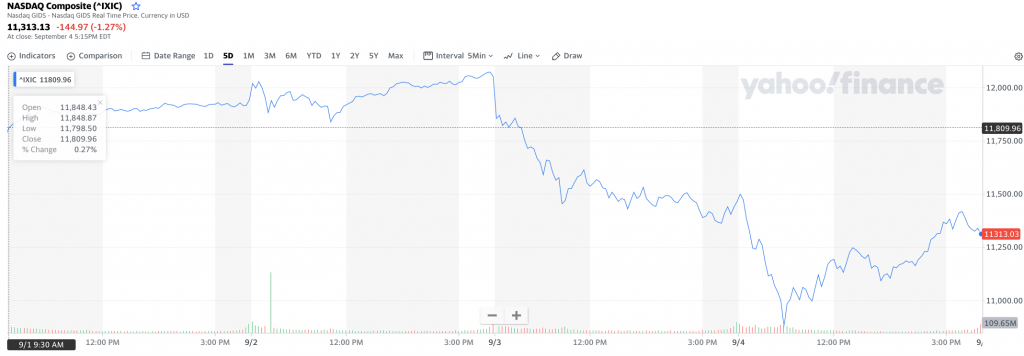

The Nasdaq Composite index, which fell 5% on Thursday and was down a further 5% in morning trading on Friday, pared back the losses to 1.3% for the day and closed the trading week at 11,313.58.03 points, as can be seen from below chart.

The carnage in many of the underlying stocks was far worse. Notably, 50 stocks in the tech-heavy Nasdaq dropped 9 percent or more yesterday, including some of this year’s high-fliers.

THE NASDAQ WHALE:

Investors watching the vertigo-inducing rise – and this week’s fall – of technology stocks are buzzing about a single trade, a giant but shadowy bet on Silicon Valley being big enough to pull the market up with it.

According to an article in the Financial Times, of Friday, September 4, 2020, Japan’s SoftBank the “Nasdaq whale” has bought billions of dollars’ worth of US equity derivatives in a series of trades that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday and Friday.

In total, SoftBank injected roughly US$4 billion building up stakes in Amazon.com Inc, Netflix Inc, Tesla Inc, Microsoft Corp, and Alphabet Inc , according to regulatory filings.

SoftBank bought a roughly equal amount of call options tied to the shares it bought, according to the Wall Street Journal, which generated an exposure of about US$50 billion, according to the WSJ report.

PGM CAPITAL ANALYSIS & COMMENTS:

Unlike in 2000, the largest tech firms today are highly profitable and their valuations, while punchy, don’t look so obviously unsustainable

So while this correction may well have further to run, and we continue to think that tech stocks will fare less well than most other sectors as the economic recovery continues, we don’t expect that a collapse in tech stocks will drag the entire market down for an extended period in the way that it did in 2000-02.

What is ahead for the markets:

September is a notoriously weak month for investors and October also has the hallmarks of a rough patch for Wall Street, with the November 3rd, USA presidential election looming.

Bullish investors see the promise of lower interest rates for years to come and further injections of money by the Central Banks into various parts of the financial system, along with perhaps another fiscal stimulus from the government, as buttressing the market and offering a floor against future dramatic losses.

Optimists see the slump that the equity market experienced last week as a bump in the road to greater gains.

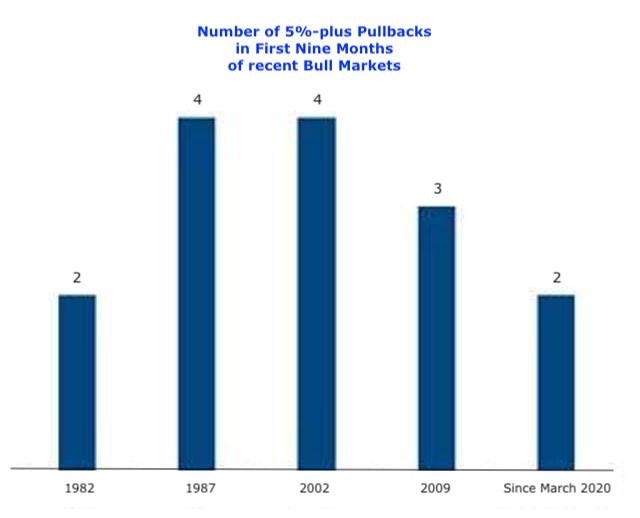

Since the current bull market kicked off in March of this year, there have only been two pullbacks of more than 5%. As can be seen from below chart, recent bull markets have tended to have between two to four pullbacks over the first nine months.

The above might implicate that, investors may view last week’s retreat as a natural corrective phase that removes some of the euphoric froth from equity valuations that had far exceeded the metrics that pragmatic investors use to assess an asset’s value compared against its peers.

A bounce off Friday’s lows in New York, aided by moves into financials, can be viewed as constructive for the broader market.

In these challenging times with uncertainties and high volatilities, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek