Dear PGM Capital blog readers,

In this weekend blog edition, we want to discuss with you some great companies that have announced an increase of their dividend with more than 5 percent.

DIAGEO PLC:

On Thursday, July 27, Diageo Plc, (DGE.L), the maker of Johnnie Walker whisky and Smirnoff vodka reported its operating profit for its full year ending on June 30, 2017.

- Excluding one-time items, the company’s earning climbed 20% to GBP3.6 billion while per-share earnings before one-time items climbed to GBP1.09 from 89.4 pence.

- The Board recommended a final dividend increase of 5% bringing the full year dividend to 62.2 pence per share.

- The payment date is set for October 11, 2017, with an ex-dividend date of August 9, 2017.

HEINEKEN N.V.:

On Monday, July 31, 2017, Heineken, (HEIA.AS) the world’s second-largest beer maker, reported higher than expected earnings in the first half of 2017, with the strongest profit growth.

Highlights:

- H1 operating profit 1.81 billion euros vs the estimated 1.76 billion euros.

- Major markets Mexico, Vietnam strong

- Europe benefits from late Easter, early summer.

- The Board declared an interim dividend of Euro 0.54, an increase of 5% compared with last year interim dividend.

- The payment date is set for August 10, 2017, with an ex-dividend date of August 2, 2017.

CK Hutchison Holdings:

On Thursday August 3, 2017, CK Hutchison Holdings Ltd, (0001.HK) the ports-to-telecoms arm of Hong Kong’s billionaire businessman Li Ka-shing, posted a 7-percent rise in first-half net profit on, buoyed by strength in its telecoms business in Europe.

Highlights:

- H1-2017 profit reached HK$15.92 billion (US$2.04 billion), compared with HK$14.92 billion profit for the same period a year earlier, an increase of 6.7 percent.

- Total revenue rose 5 percent to HK$190.05 billion.

- The company declared an interim dividend of HK$0.78 per share, up 6 percent from the year-ago period.

- The payment date is set for September 14, 2017, with an ex-dividend date of September 4, 2017.

RIO TINTO:

On Wednesday, August 2, Global miner Rio Tinto (RIO.AX) reported that its H1-2017, profit more than doubled from a year earlier following a rebound in iron ore prices and announced an additional US$1 billion share buyback.

Highlights:

- Underlying earnings for the six months to June 30 rose to US$ 3.94 billion from US$1.56 billion a year earlier, an increase of 152 percent.

- Rio Tinto is to return $3 billion to shareholders: US$2 billion on the dividend side and US$1 billion of share buybacks. The US$2 billion of dividend is the highest interim dividend in the history of Rio Tinto.

- The company declared interim dividend of US$1.10 a share, equivalent to US$2 billion, up from 45 cents a share a year ago, an increase of the dividend payout of 144 percent.

- The payment date is set for September 21, 2017, with an ex-dividend date of August 9, 2017.

COMMONWEALTH BANK OF AUSTRALIA:

On Tuesday August 8, 2017, Commonwealth Bank of Australia (CBA.AX),Australia’s largest lender, reported a strong full year result.

Highlights:

- The bank’s cash net profit rose 4.6% to AUD 9.88 billion, with a 3.8% increase in operating income outpacing a 2.4% increase in operating expenses.

- Banking income grew 4.3% due to volume growth in home lending, business lending and deposits.

- Shareholders were rewarded with a final dividend per share of AUD2.30 a share, delivering a full year dividend of AUD4.29 a share.

- The payment date is set for September 29, 2017, with an ex-dividend date of August 16, 2017.

PGM CAPITAL ANALYSIS & COMMENTS:

The last 3 years we are urging our readers and investors to search globally for undervalued securities in the current overvalued USA market.

It is important under current market environment to act as a value investor and to seek for shares of companies, that based on fundamental analyses, are undervalued and which have the potential to maintain the leadership in their sector, increase their market share and dividend payout to their shareholder Year-Over-Year.

Diageo Plc:

Below chart shows the 10-year performance to stock of Diageo, in which we can see that it has appreciated from GBP 10.74 a share to GBP 25.03 a share an increase of approx. 133 percent.

In the same period the company’s dividend rose from 32.70 pence in 2007 to 85.2 pence, an increase of 160 percent.

Based on the company’s fundamentals, strong balance-sheet and its ability to increase its dividend Y-O-Y, we have a STRONG BUY rating on the stock of the company.

Heineken:

Heineken ranks as the world’s number two brewer, although the gap between its global leader AB InBev (NYSE: BUD) has widened after the latter’s near US$100 billion takeover of SABMiller late last year.

Below 5-year chart, shows how the shares of the company has more than doubled during the past five years, while its dividend increased from US$ 0.86 a share in 2012 to US$ 1.36 a share in 2017, which is an increase 58 percent of its dividend during the last five years.

Based on the company’s fundamental, we have a BUY rating on the shares of the company.

Commonwealth Bank of Australia:

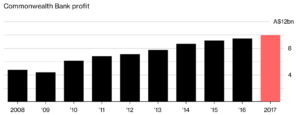

As can be seen from below chart the company is able to grow its profits Year-over-Year.

Below 5-year chart of the stock of the company, shows that its shares has rissen form AUD 57.04 a share on August 13, 2012 to AUD 80.50 on the close of trading on Friday August 11, 2017, which is an increase of approx. 42 percent.

Based on the Company’s fundamentals; an P/E ratio of 14,94 Strong Balance sheet, and a dividend yield of 7.24 percent, we upgrade the shares of the Company form BUY to STRONG BUY.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can stay solvent.

Yours sincerely,

Eric Panneflek