Dear PGM Capital blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you why Investing in CNOOC Ltd at current price, can be lucrative for growth investors.

INTRODUCTION:

CNOOC Limited is China’s largest producer of offshore crude oil and natural gas. It is a major subsidiary of China National Offshore Oil Corporation.

The company operates through Exploration and Production, and Trading Business segments.

The company also holds interests in various oil and gas assets in Asia, Africa, North America, South America, Oceania, and Europe. As of December 31, 2018, it had net proved reserves of approximately 4.96 billion barrels-of-oil equivalent.

The company was incorporated in 1999 and is based in Central, Hong Kong.

Shares of the company trades on the Hong Kong Stock Exchange under the symbol 00883 and it also has a secondary listing on the New York and Toronto Stock Exchange.

FUNDAMENTAL ANALYSIS:

Return On Equity Calculation:

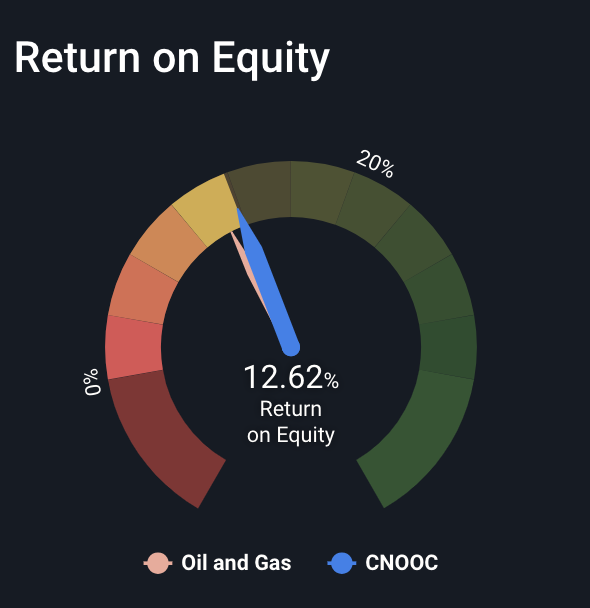

Let us first analyze the Return on Equity (ROE) of CNOOC Limited.

Return on Equity = Net Profit ÷ Shareholders’ Equity

Based on the trailing twelve months to December 2018 results of the company net profit was 52.688 Billion CN¥ and its Equity 417.365 Billion CN¥ => ROE = (CN¥52.688b ÷ CN¥417.365)*100% = 12.62%.

As you can see in the graphic below that CNOOC has an ROE that is fairly close to the average for the Oil and Gas industry (11%).

That’s not overly surprising. ROE tells us about the quality of the business, but it does not give us much of an idea if the share price is cheap.

Intrinsic Value Calculation:

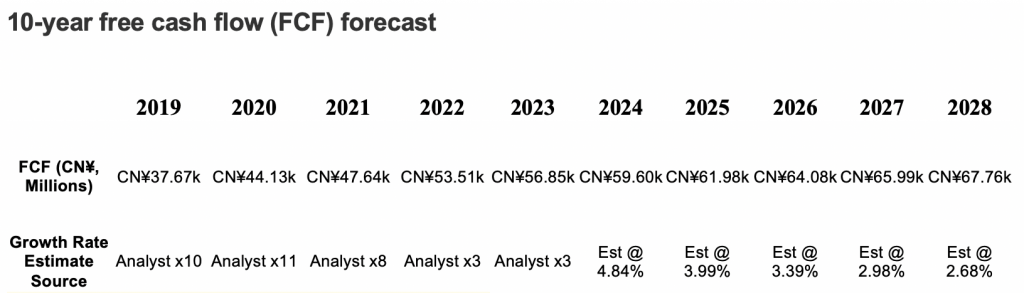

Secondly, we are going to estimate the intrinsic value of CNOOC Ltd., by estimating the company’s future cash flow and discounting them to their present value.

A Discounted Cash Flow (DCF) is all about the idea that a dollar in the future is less valuable than a dollar today, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

Present Value of 10-year Cash Flow (PVCF)= CN¥342.81billion

The second stage is also known as Terminal Value, this is the business’s cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country’s GDP growth.

In this case we have used the 10-year government bond rate (2%) to estimate future growth. In the same way as with the 10-year ‘growth’ period, we discount future cash flows to today’s value, using a cost of equity of 9.1%.

Terminal Value (TV) = FCF2029 × (1 + g) ÷ (r – g) = CN¥68b × (1 + 2%) ÷ (9.1% – 2%) = CN¥978b

Present Value of Terminal Value (PVTV) = TV / (1 + r)10 = CN¥CN¥978b ÷ ( 1 + 9.1%)10 = CN¥410.56b

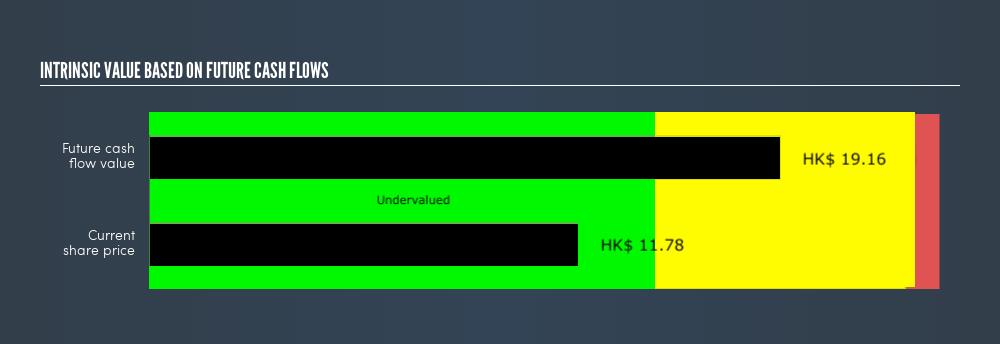

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥753.37b. The last step is to then divide the equity value by the number of shares outstanding. This results in an intrinsic value estimate in the company’s reported currency of CN¥16.87. However, 883’s primary listing is in Hong Kong, and 1 share of CNOOC in CNY represents 1.136 ( CNY/ HKD), so the intrinsic value per share in HKD is HK$19.16.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Compared with the company’s share closing price of HK$11.78, of Friday, August 9, the company appears undervalued at a 38.5% discount to where the stock price trades currently.

Financial Condition:

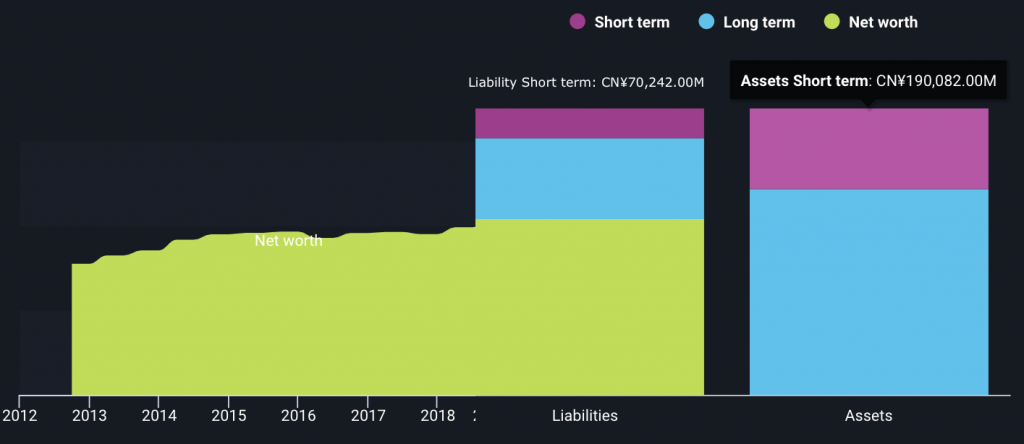

Based on the company’s FY 2018, financial report the company has a Quick ratio of 2.6, which is excellent.

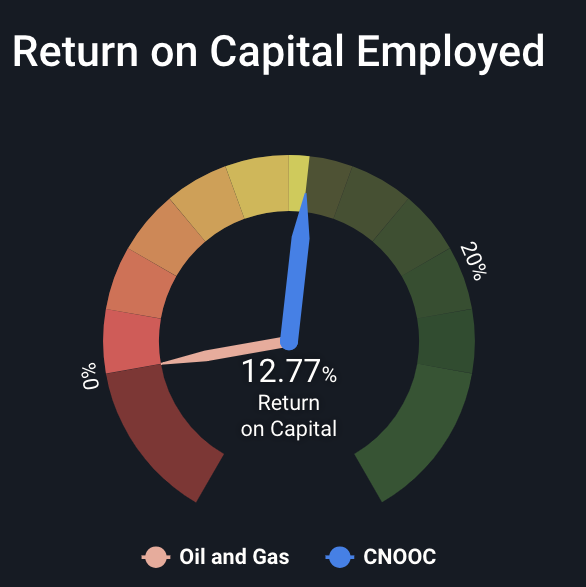

Return on Capital Employed:

As can be seen from below chart, with a return on Capital of 12.77, CNOOC Ltd, with a wide margin outperforms its peers.

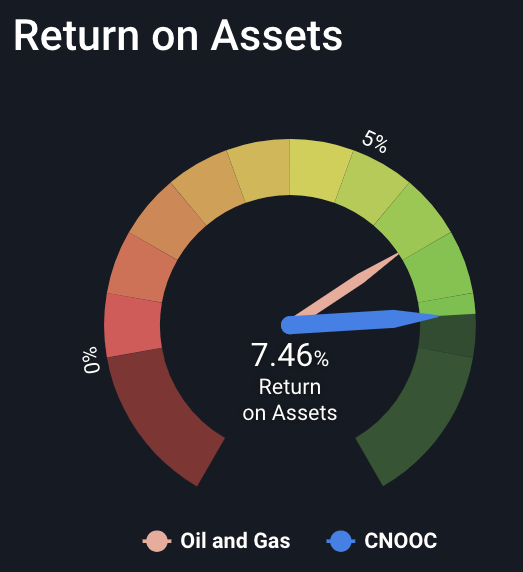

Return on Assets:

As can be seen from below chart, with a return on Assets of 7.46, CNOOC Ltd, outperforms its peers.

CNOOC’s Debt And Its 12.62% ROE:

Although CNOOC does use debt, its debt to equity ratio of 0.33 is still low. The combination of modest debt and a very respectable ROE suggests this is a business worth watching.

Based on the above calculation and a dividend yield of 5.88%, we maintain our STRONG BUY rating on the shares of the company at current price level.

Disclosure 1:

We own shares of CNOOC Ltd., in our personal portfolio.

Disclosure 2:

Due to the very complex calculations outlined in this article, we have started writing it early July and finished it on Saturday, August 10.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek