Dear PGM Blog reader,

In this yearend blog article, we want to take the opportunity to review the year 2019 and try to give an outlook for the year 2020.

REVIEW OF THE YEAR 2019:

In 2019, global stock markets have posted their best year since the aftermath of the financial crisis a decade ago, as investors shrugged off trade tensions and warnings of slowing growth in major economies.

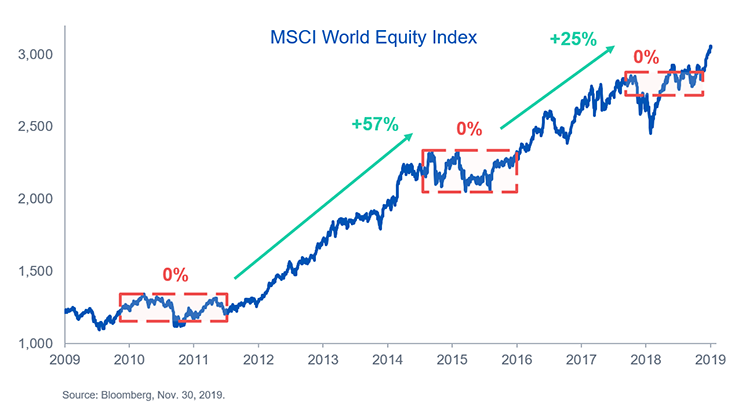

As can be seen from below chart, the MSCI World Index, which tracks stocks across the developed world, jumped by almost 24% during 2019, its strongest performance since 2009.

A surge in US technology giants and a strong recovery in eurozone and Asian stocks drove the rally.

Eurozone stocks also outperformed, with Germany’s Dax and France’s CAC both up 25%. Japan’s Nikkei gained 18%, helped by the prospect of new stimulus by Shinzo Abe’s government.

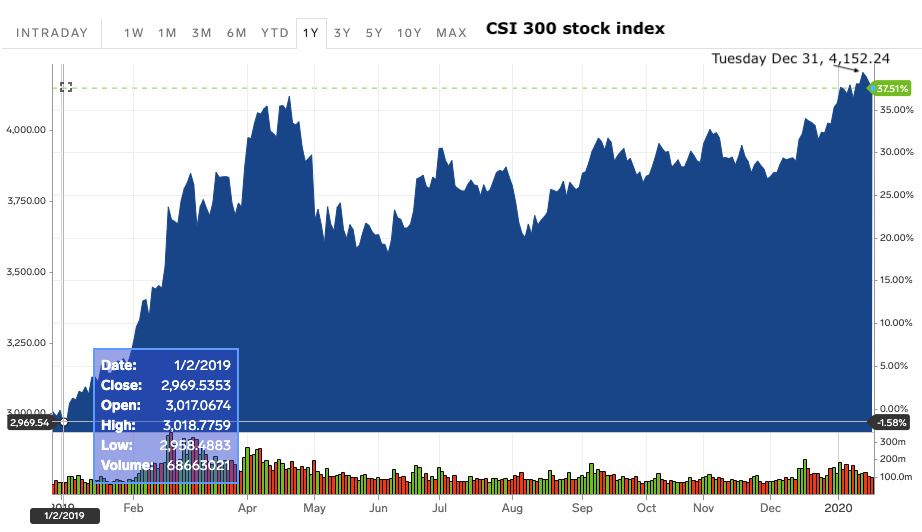

As can be seen from below chart, China’s CSI 300 stock index romped ahead by 36% during 2019, as Beijing cut borrowing costs and hiked spending on construction and infrastructure projects.

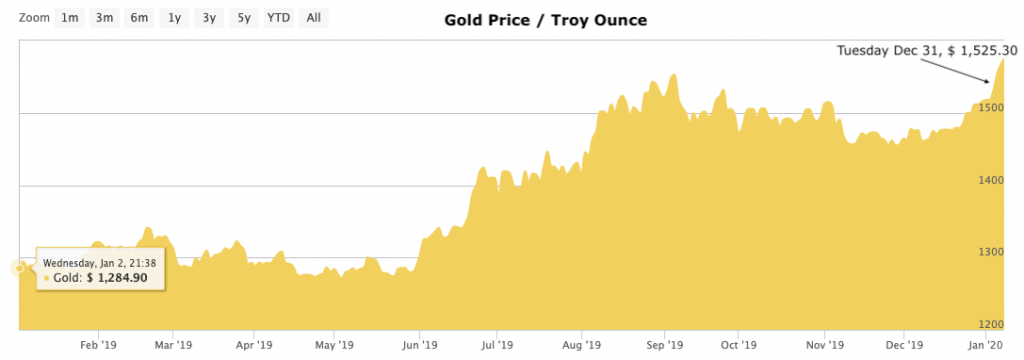

As can be seen from below chart, the price of gold jumped to US$1,525 per ounce, up nearly a fifth during the year. That’s its biggest annual rise in nearly a decade, as some nervous investors looked for a safe haven for their capital.

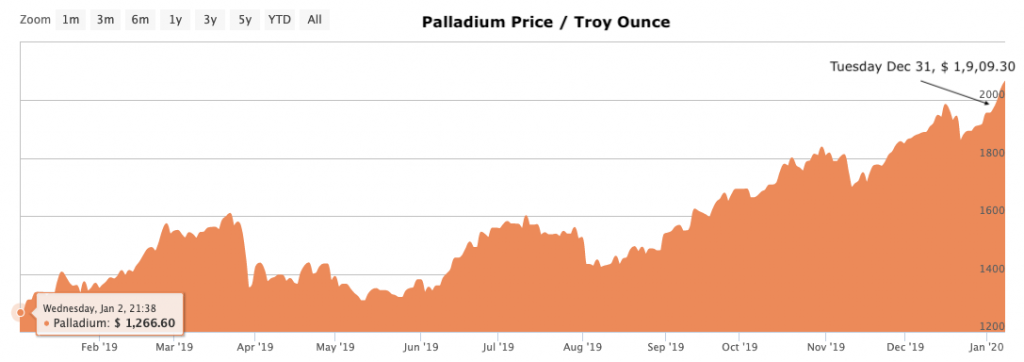

Palladium hit a series of record highs, as demand for the precious metal in automobile exhaust systems exceeded supply. As can be seen from below chart the Palladium increased with US$ 642.47 or 50.70 percent in 2019.

PGM TOP 10 BEST PERFORMING SECURITIES:

Here below we’ll give you a breakdown of the Top-10 best performing securities held in the accounts of our clients in 2019.

N0 10. –Rio Tinto Group-:

As can be seen from below, chart, shares of Rio Tinto Group, has appreciated in 2019 with 30.9 percent. On top of this, the stock of the company has dividend yield of approx. 4.16%.

No 9. –Nestle S.A.-:

As can be seen from below, chart, shares of Nestle S.A., has appreciated in 2019 with 31.0 percent. On top of this, the stock of the company has a dividend yield of approx. 2.34%.

No 8. –L’Oreal S.A.-:

As can be seen from below, chart, shares of L’Oreal, has appreciated in 2019 with 32.6 percent. On top of this, the stock of the company has a dividend yield of approx. 1.43%.

No 7. –Signify N.V.-:

As can be seen from below chart, shares of Signify N.V., in 2019, has appreciated with 32.9 percent. On top of this, the stock of the company has a dividend yield of approx. 4.48%.

No 6. –SFL Corporation-:

As can be seen from below chart, shares of SFL Corporation, in 2019, has appreciated with 32.5 percent. On top of this, the stock of the company has a dividend yield of approx. 9.6%.

No 5. –Ping An Insurance Group-:

As can be seen from below chart, shares of Ping An Insurance Group, in 2019, has appreciated with 37.5 percent. On top of this, the stock of the company has a dividend yield of approx. 2.13%.

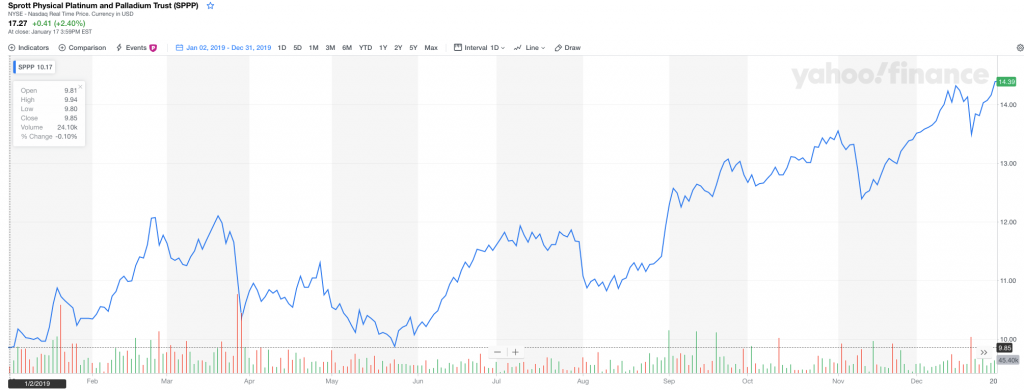

No 4. Sprott Physical Platinum and Palladium Trust

As can be seen from below, chart, shares of Sprott Physical Platinum and Palladium Trust, has appreciated in 2019 with 46.0 percent.

No 3. –Alibaba Group Holding Limited-:

As can be seen from below, chart, shares of Alibaba Group Holding, in 2019, has appreciated with 55.7 percent.

No 2. – LVMH Moet Hennessy – Louis Vuitton-:

As can be seen from below chart, shares of LVMH Moet Hennessy – Louis Vuitton, has appreciated in 2019 with 63.5 percent. On top of this, the stock of the company has dividend yield of approx. 1.44%.

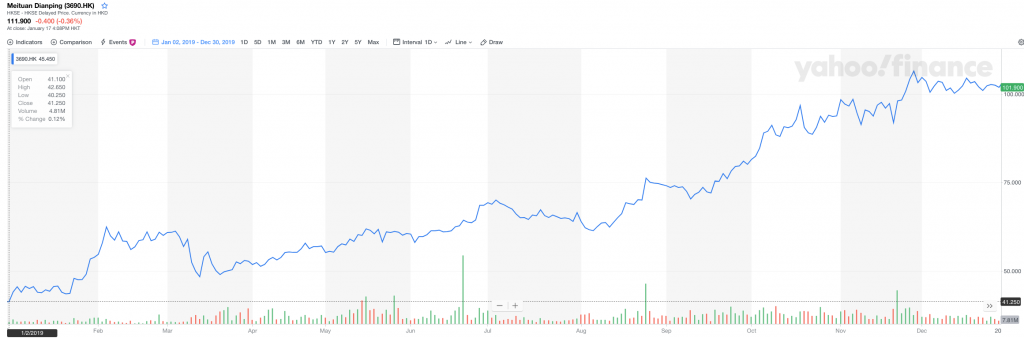

No 1. – Meituan Dianping -:

As can be seen from below chart, shares of Meituan Dianping, – our best performing security for 2019 – has appreciated in 2019 with 147 percent.

PGM CAPITAL COMMENTS & ANALYSIS:

Above listed top 10, of the best performing securities in our clients portfolio, proves, that our team, does its research globally in order to find the best companies; which based on their business model, brands, balance sheet and quality of its management, are or has the potential to become a leading company in their sector.

Global Market Outlook 2020

The year 2019, will go into history as a year dominated by U.S.- China trade tensions, fears of a hard Brexit and a global slowdown. Nevertheless, global markets closed 2019 on a high note, as concerns surrounding these geopolitical tail risks have eased

As can be seen from below technical MSCI World Equity Chart, the global equity markets have moved sideways for 22 months (January 2018 through to October 2019) and are now breaking out to the upside. Equities are moving up in anticipation of improvement in the macro-economic environment into 2020.

Based on this we foresee that growth in 2020 should pick-up modestly, aided by a détente in global trade frictions and stimulative central bank policies.

The Debt bomb:

Globally, debt – whether corporate debt, household debt, or national debt, whether in developed or developing economies – is at record-high levels.

Debt growth is particularly alarming in emerging markets, the World Bank says, which hold about $50 trillion in debt, making them particularly vulnerable to any shock.

Developing countries have already been through three debt crises – in the 1980s, the 1990s, and the 2000s – with hugely painful consequences.

A fourth might be on the way, the World Bank warned, with similarly nasty implications:

“The fourth wave looks more worrisome than the previous episodes in terms of the size, speed, and reach of debt accumulation”

In this era of change and subsequent turbulence, PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can remain solvent.

Yours sincerely,

Eric Panneflek