Dear PGM Capital Blog reader,

In this weekend’s blog article, we want to discuss some of the most important events that happened in the global capital markets, the world economy, and the world of money, in the week of May 04, 2020, as follows:

- Bank of England, sees H1 GDP contraction at nearly 30%.

- USA unemployment rate surged to 14.7%.

- Rebounding Oil prices.

BOE SEES H1 GDP CONTRACTION NEARLY 30%:

On Thursday, May 7, the the Bank of England maintained its bank rate at a record low of 0.1%.

The central bank noted that household consumption has declined by 30% and consumer confidence has deteriorated “markedly” amid the outbreak. It expects companies’ sales to be 45% lower than normal levels and business investment to halve in the second quarter.

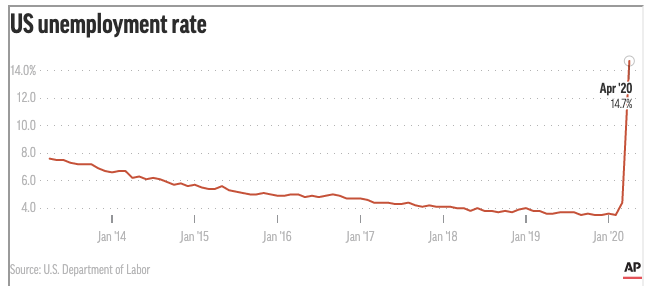

The BoE projects GDP to slump close to 30% in the first half of 2020 and 14% in 2020, of course, assuming public restrictions begin to lift in the third quarter. Growth of 15% is expected in 2021 and 3% in 2022.

USA UNEMPLOYEMENT RATE SURGED TO 14.7%:

On Friday, May 8, the Bureau of Labor Statistics released a statement, that the US economy lost 20.5 million jobs in April. This would be, by far, the most sudden and largest decline since the government began tracking the data in 1939.

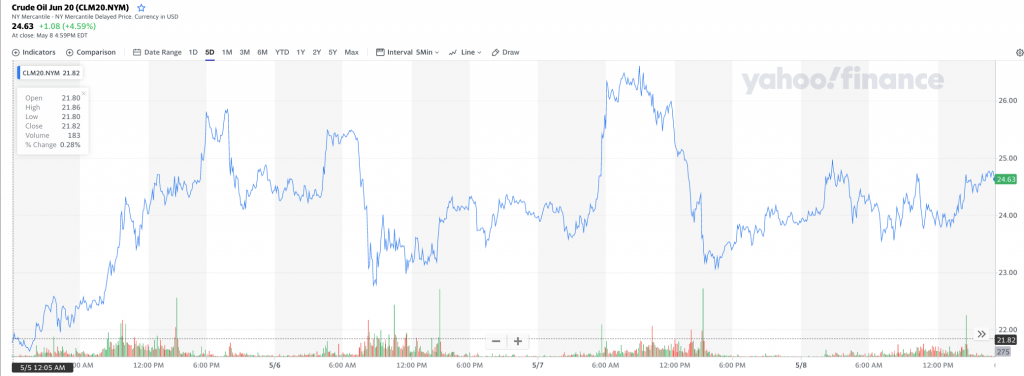

As can be seen from the below chart, the U.S. unemployment rate jumped to 14.7 percent in April (the highest level since the Great Depression) as many businesses shut down or severely curtailed operations to try to limit the spread of the deadly coronavirus.

Among the hardest hit sectors were the leisure and hospitality industries — which shed some 7.7 million jobs — though employment fell sharply across all major industries.

OIL PRICES REBOUNDING:

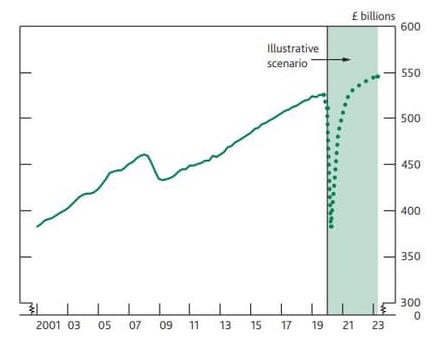

After months of sagging demand and wild swings in prices that at one point fell below zero, oil has now seen five straight days of gains – as can be seen from below chart – as economies slowly reopen and traders bet on a comeback.

Prices are responding to a slow uptick in demand: As some states and cities take cautious steps towards reopening, and as Europe and China return to work, thus, investors are optimistic that restrictions on travel and movement will continue to ease.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Projected H1 GDP decline in the UK:

The Bank of England has warned that the British economy could shrink by 14% this year – as can be seen from below chart – and unemployment more than double by spring as the coronavirus causes the deepest recession in modern history.

Andrew Bailey, the Bank’s governor said that growth could rapidly recover next year, with Britain bouncing back faster than from the 2008 global financial crisis. The Bank said growth could hit 15% for 2021 as a whole, with GDP recovering its pre-Covid peak by the second half of next year.

However, the scenario assumed no second wave of infections after the easing of lockdown measures over a four-month period from early June.

USA Unemployment rate:

The unemployment report indicated that the vast majority of those laid off in April – roughly 75% – consider their job loss temporary, a result of businesses that were forced to close suddenly but hope to reopen and recall staffers.

Whether most of those workers can return anytime soon, though, will be determined by how well policymakers, businesses, and the public deal with the health crisis. Economists worry it will take years to recover all the jobs lost.

The meltdown has occurred with startling speed. In February, unemployment was at a more than 50-year low of 3.5% and in just two months the unemployment rate has gone from the lowest rate in 50 years to the highest rate in almost 90 years.

Oil prices bouncing back:

According to some analysts, oil demand could rebound enough to exceed supply by the end of this month of May.

However, there are some 1.2 billion barrels in storage, that would need to be drawn as follows:

- The first oil in storage to go would be the millions of barrels in floating storage, which is the most expensive kind of storage. Most probably this will happen sometime in the third quarter of the year. The amount of oil removed from floating storage will be around 450 million barrels.

- In the fourth quarter of the year, oil stockpiles in onshore storage will begin to decline, by up to 400 million barrels.

Demand remains the key factor for oil prices, and demand will likely remain depressed throughout the year.

In mid-April, demand fell by about 30 million bpd from pre-crisis levels. Now, demand is about 19 million bpd below pre-crisis levels.

While this demand has started to improve, – according to oil analysts – it would still be down by 17 million bpd from pre-crisis demand this month and by 12 million barrels in June and July. By August, things will be looking up, with demand at 5-6 million bpd below pre-crisis levels.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Adviser and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek