Dear PGM Capital Blog reader,

Today is September 30th, and the month of September is almost over and most of you have seen a lot of volatility in your portfolio this month.

Due to this in today’s blog article, we’ll elaborate the September effect for the capital markets.

INTRODUCTION

The Stock Market:

Stock market investors hate to see summer end, and it’s not because they fear shorter days or the back-to-school rush.

August is typically a weak month for stock market performance, and September is the only month that, on average, is worse for equity-market prices.

Statistically, September has always been a bad month for stocks since 1950. Stocks have always been known to decline in September.

The S&P 500 has fallen in September 55% of the time since World War II. Since 1928, the S&P 500 has on average lost about 1% in September, making it by far the worst month for stocks.

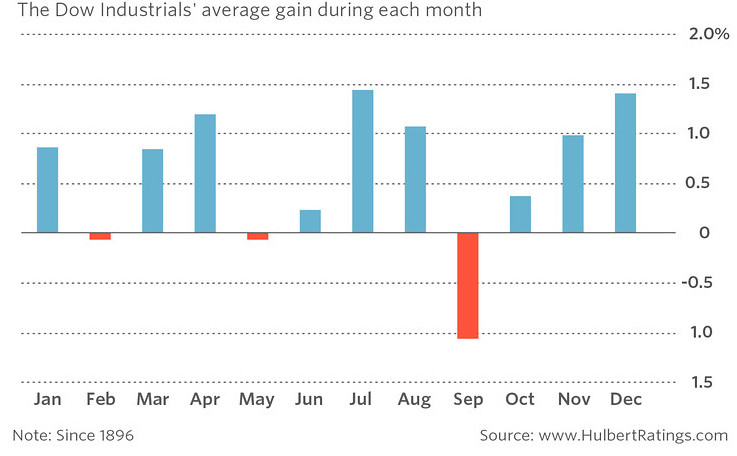

For the past 50 years, September has historically marked the worst month of the year for the Dow, with stocks down on an average of 1%, as can be seen from below chart.

Gold:

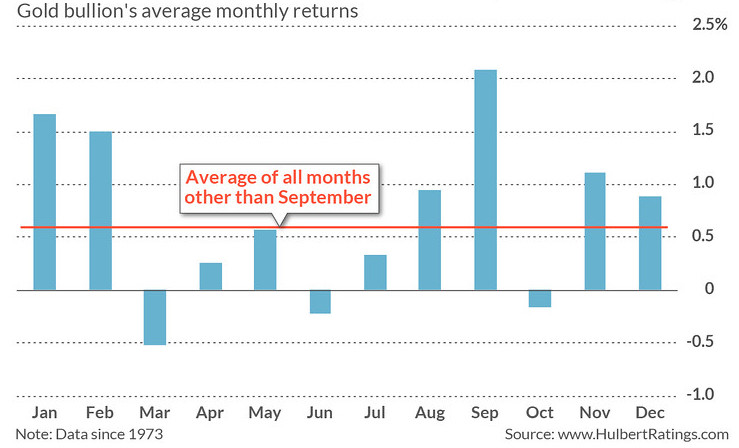

While September may be the worst month of the calendar for stocks, it is the best month for gold.

Since it began trading freely in the U.S. in the early 1970s, gold bullion has produced an average gain of 2.1% in September. The comparable monthly average for all non-September months is 0.6%, as can be seen from below chart.

PGM CAPITAL’s ANALYSIS & COMMENTS:

We are not a fan of “seasonality” for use with tactical decision, but when/if it is considered along with other issues such as investor complacency and an overvalued stock market it can become more interesting.

Seasonality is a characteristic in the data experiences regular changes that seem to recur every calendar year. Any change or pattern in a time series that recurs or repeats over a one-year period can be said to be “seasonal”.

The Stock market:

As can be seen from below chart, after a turbulent month of August, the USA Dow Jones index held up to Friday, September 27. The Dow Jones Index is up for the month, surprisingly not up keeping the tradition of seasonal bad performance for the month of September.

Gold:

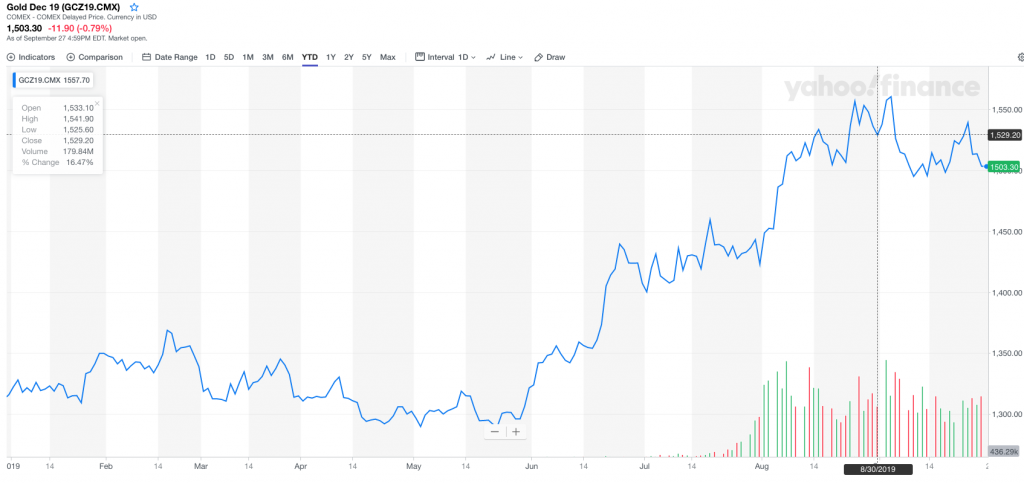

The price of Gold although it performed very well YTD, has also broken with the its traditional seasonal bull run for September. Although it had peaked on September 4, its closing price of Friday September 27, is below its closing price of August 30, as can be seen from below chart.

With increasing geopolitical tension, trade war, BREXIT, and recession fears, we believe that central banks will continue to lower interest rates, which will have a positive effect on Stocks as well as the Price of Gold.

Breaking News:

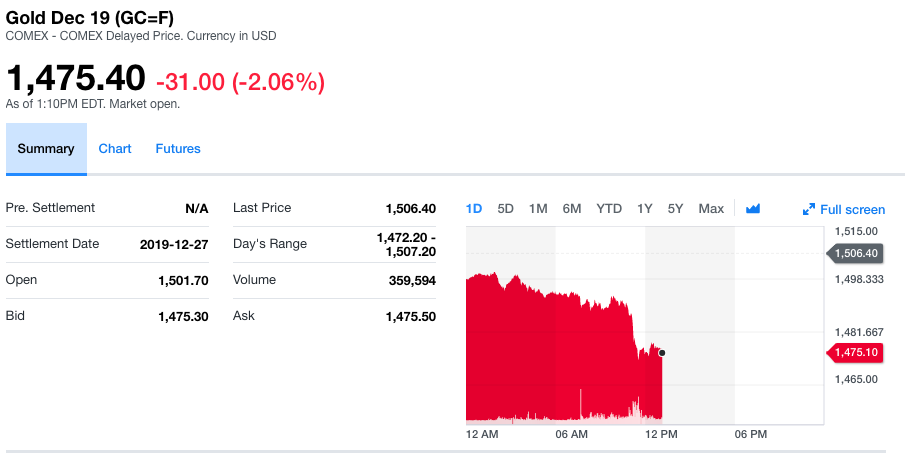

Before posting this article, today September 30, we want to update you on the price of gold as well as the value of the Dow Jones Industrial.

Gold futures for September 30, 2019 at 13:10 EST

DOW Jones Industrial for September 30, 2019 at 13:20 EST

If the above trend continues until close of the markets, today in New York, we can conclude, that although volatility has increased in the markets, the traditional September seasonal effect for stocks and gold didn’t occur this year.

According to Sir Alan Greenspan, we are currently living in the age of turbulence.

In this era of continuous change and high volatility, investors must be able to control their emotions and have a financial advisor, with vast experience, knowledge and performance track record, as captain of their nest egg.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek