Dear PGM Capital’s Blog reader,

On Thursday, May 30, Bank of America – Merrill Lynch downgraded Teva Pharmaceutical (NYSE: TEVA) to underperform from Buy, and putting a price target on the stock to US$9 from US$19, causing yet another sell-off.

Based on this downgrade, the stock price of company lost approx. 21% of its value last week, to close the week at a price of USD 8.65 per share, as can be seen from below chart.

What investors want to know, regardless the downgrade of Bank of America – Merrill Lynch, does TEVA still have a brilliant future?

ABOUT TEVA PHARMACEUTICAL:

Teva Pharmaceutical Industries Ltd., is an Israeli multinational pharmaceutical company, which develops, manufactures, markets, and distributes generic medicines and a portfolio of specialty medicines worldwide.

It operates through two segments, Generic Medicines and Specialty Medicines.

- The Generic Medicines segment offers sterile products, hormones, narcotics, high-potency drugs, and cytotoxic substances in various dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments, and creams.

- The Specialty Medicines segment provides specialty medicines for use in central nervous system and respiratory indications.

It is the largest generic drug manufacturer in the world and one of the 15 largest pharmaceutical companies worldwide.

Teva Pharmaceutical Industries Limited was founded in 1901 and is headquartered in Petach Tikva, Israel.

Shares of the company trade on both the New York Stock Exchange (via ADR, with symbol TEVA) and the Tel Aviv Stock Exchange.

The company is a member of the Pharmaceutical Research and Manufacturers of America.

PGM CAPITAL’s ANALYSIS & COMMENTS:

The market evidently took notice of the drastic change of mind at Bank of America – Merrill Lynch, as the bank’s most recent price target for Teva had been among the highest out there: $24. So, a cut to $9 was quite drastic.

Shares of Teva have fallen 36.7% so far this year and a price target of US$ 9.00, will bring to company’s share price in its range of mid year 2000 as can be seen in below chart.

The basis, for the analyst to downgrade TEVA, is the fact that they predict a Free-Cash-Flow (FCF) for TEVA for 2021 to be 3.5 Billion US$.

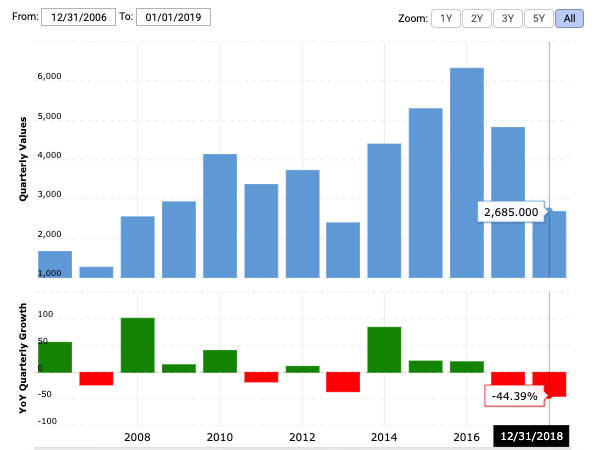

Below chart shows Teva Pharmaceutical Industries annual free cash flow history and growth rate from 2006 to 2018.

The projected FCF for the TEVA as predicted by BOFA-ML, for 2021, just 2 years from now, is 3.5 Billion US$. It is higher than that of 2018, but also approx. 35% of the company’s market-cap of the company at the close of the market on Friday, May 31, 2019, of 9.45 Billion US$.

So, how can a stock that, just two years from now, will make 35% of its market cap in FCF be downgraded?

The analist expressed concern about the ongoing lawsuits against the company. Teva is facing a mammoth opioid-related suit in an Ohio federal court, along with a lawsuit filed in early May alleging Teva and several other drugmakers conspired to artificially inflate prices and reduce competition.

Over the weekend, the company announced it had agreed to pay US$85 million to the state of Oklahoma to settle claims over its alleged role in the opioid crisis.

The complex nature of the lawsuits makes it difficult, if not impossible, to quantify potential damages or costs related to settlements.

Outlook:

We believe that with US$3 of FCF/share just two years from now and a sustainable debt situation Teva would inevitably trade much higher than the paltry US$10-11 implied by his current price target.

So, we could actually read his rating as a “near-term underperform, long-term outperform”.

We believe that below, quote from Warren Buffett, might be applicable for Teva Pharmaceutical at the current price.

Based also on the fact that the company is world biggest generic drug company, we believe that the current stock price is a good entry point.

Disclosure:

We own shares Teva Pharmaceutical in our personal portfolio.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek