Dear PGM Capital blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you, – from an investors point of view – the possible consequences of an escalating trade war between the USA and China.

INTRODUCTION:

What is a Trade War:

A trade war happens when one country retaliates against another by raising import tariffs or placing other restrictions on the opposing country’s imports. A tariff is a tax or duty imposed on the goods imported into a nation.

Escalating Trade War USA-CHINA:

On Friday, August 23, the US-China trade war ratcheted up yet again, with Beijing unveiling a new round of retaliatory tariffs on about US$75 billion worth of US goods.

China will place additional tariffs of 5% or 10% on US imports starting on September 1st, according to a statement posted by China’s Finance Ministry.

The Ministry also announced plans to resume tariffs on US imports of automobiles and automobile parts. The tariffs would be 25% for vehicles and 5% on parts, which would take effect on December 15th. The new tariffs will target more than 5000 products, including soybeans, coffee, whiskey, seafood and crude oil.

On Friday afternoon, USA President Donald Trump responded swiftly, saying he was increasing rates on existing tariffs on Chinese goods. The US$250 billion of goods and products from China currently being taxed at 25% will be taxed at 30%, Trump said on Twitter. The remaining US$300 billion of goods and products that was to be taxed at 10% will now be taxed at 15%, Trump further wrote.

USA-CHINA TRADE FACTS:

According to the data released from the Office of USA Trade Representative (USTR), USA goods and services trade with China totaled an estimated US$737.1 billion in 2018.

Exports to China:

In 2018, China was the United States’ 3rd largest goods export market, for which U.S.A. goods exports to China in 2018 were US$120.3 billion, down 7.4% (US$9.6 billion) from 2017 but up 72.6% from 2008.

The top export categories in 2018 were: aircraft, machinery, optical and medical instruments, and vehicles.

Total exports of agricultural products to China totaled US$9.3 billion in 2018, the USA’s 4th largest agricultural export market.

Exports of services to China were an estimated US$58.9 billion in 2018, 2.2% (US$1.3 billion) more than 2017, and 272% greater than 2008 levels.

Imports from China

In 2018, China was the United States’ largest supplier of imports goods, for which goods imports from China totaled US$539.5 billion in 2018, up 6.7% (US$34.0 billion) from 2017, and up 59.7% from 2008.

The top import categories in 2018 were: machinery, furniture, bedding toys, plastics, and sports equipment.

Imports of services from China were an estimated US$18.4 billion in 2018, 5.5% (US$963 million) more than 2017, and 68.3% greater than 2008 levels.

Trade Balance:

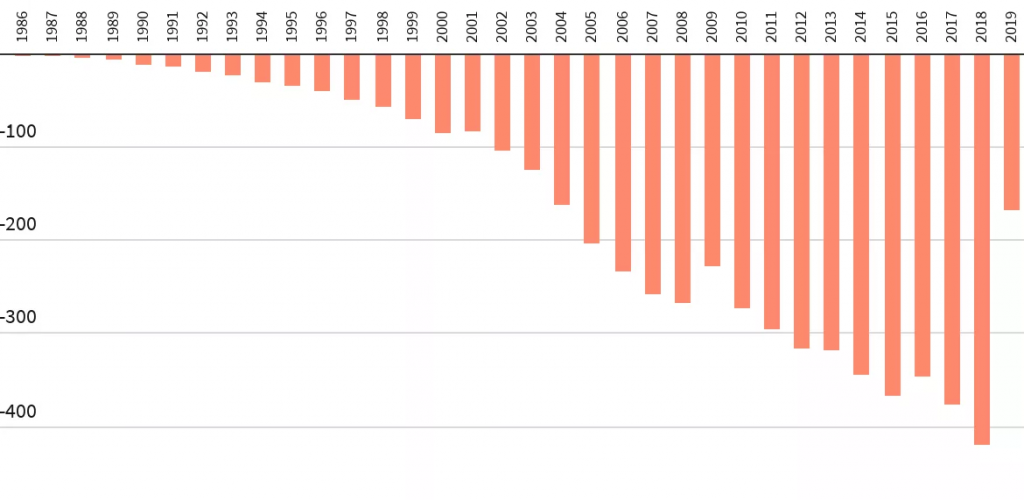

The U.S.A. had a goods trade deficit with China of US$419.2 billion in 2018, a 11.6% increase over 2017, but on the other hand a services trade surplus of S$41 billion 2018, up 0.8% from 2017.

Below chart shows the USA-China trade balance from 1995 up June 2019, from the USA census Bureau.

Investments:

U.S.A. foreign direct investment (FDI) in China was US$107.6 billion in 2017, a 10.6% increase from 2016, while China’s FDI in the U.S.A. was US$39.5 billion in 2017, down 2.3% from 2016.

PGM CAPITAL’s ANALYSIS & COMMENTS:

In a global economy, a trade war can become very damaging to the consumers and businesses of both nations, and the contagion can grow to affect many aspects of both economies as well as the rest of the world.

The Pros and Cons of Trade Wars:

The advantages and disadvantages of trade wars in particular and protectionism, in general, are the subjects of fierce and ongoing debate.

Critics argue that protectionism often hurts the people it is intended to protect long-term by choking off markets and slowing economic growth and cultural exchange.

Consumers may begin to have less choice in the marketplace. They may even face shortages if there is no ready domestic substitute for the imported goods that tariffs have impacted or eliminated. Having to pay more for raw materials hurts manufacturers’ profit margins.

As a result, trade wars can lead to price increases – with manufactured goods, in particular, becoming more expensive – sparking inflation in the local economy overall.

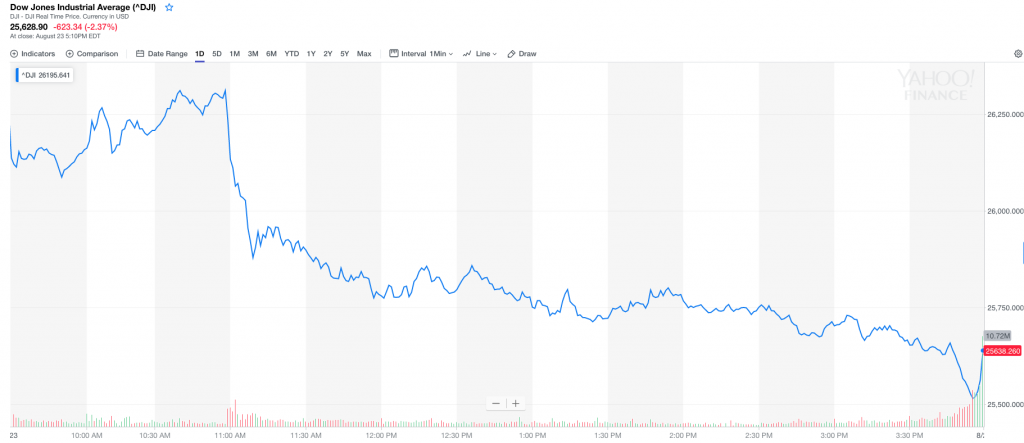

Based on the above. Wall Street stocks tanked Friday August 23, for which, the Dow Jones Industrial Average closed the trading week 623.34 points, or 2.37 percent, at 25,628.90, as can be seen from below chart.

Winning Trade Wars:

People say nobody wins trade wars, based on this OECD warns, that the U.S.A,-China trade war could cut global GDP by US$600 billion.

Chances are that this trade war, might developed into a currency war, in which countries seek to gain a trade advantage over other countries by causing the exchange rate of their currency to fall in relation to other currencies, which will lead to inflation.

Last but not least, here below we want to add some important points investors should consider in a trade war.

- Evolution always goes forward.

- Tariffs will act like a tax and will increase inflation in the country that impose them.

- The Buyer is always in control.

- A creditor always has the ultimate power over its debtor.

Yours sincerely,

Eric Panneflek