Dear PGM Capital Blog readers,

As can be seen from below chat, the US-Dollar Index, on Friday July 21, sank to its lowest level since June 22, 2016, a fresh 13-month low, after two more Republican defections on Monday, July 17 in the night, doomed the proposed GOP healthcare plan in the Senate.

THE US-DOLLAR INDEX:

The US-Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners currencies.

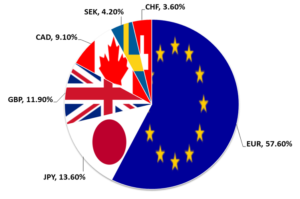

The Dollar Index is a weighted geometric mean of the dollar’s value relative to other select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight

USDX goes up when the U.S. dollar gains “strength” (value) when compared to other currencies in the basket and visa versa.

USDX is updated whenever U.S. Dollar markets are open, which is from Sunday evening New York City local time (early Monday morning Asia time) for 24 hours a day to late Friday afternoon New York City local time.

THE EURO SURGED TO 2.5-YEAR HIGH:

The sliding dollar sent the Euro surging as high as 1.626, against the USD, its highest level since January of 2015, as can be seen from below chart.

PGM CAPITAL ANALYSIS & COMMENTS:

The USD-Index Basket needs to be updated:

The make up of the “USD-Index basket” has been altered only once, when several European currencies were subsumed by the Euro at the start of 1999.

Due to this we believe that the make up of the “basket” is overdue for revision as China, Mexico, South Korea and Brazil are major trading partners presently, which currently are not a part of the index whereas Sweden and Switzerland are continuing as part of the index.

Outlook for the USDX and the US-Dollar:

As can be seen from below chart, Year-To-Date the US dollar index already has fallen more than 10%.

Remember just three months ago when President Trump was worried that the US-Dollar was too strong in a quote he said on Wednesday, April 12th:

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me.”

We believe that the worsening outlook for the US-Dollar represents something much deeper and that the significant USD slump of YTD, reflects a major underlying USD scepticism in the market, that the Trump trade is over, and that all hopes of a major growth boost from Washington has been abandoned some time ago.

The outlook of a moderate economic growth of the country has raised the possibility that the Federal Reserve will delay the next round of interest rate increases, also contributed to the dollar vulnerability.

Foreign-exchange options markets show that traders are the least bullish they’ve been on the dollar since May 2016.

In its place other currencies have flourished, most notably the Mexican peso, to which the dollar has lost more than 15% of its value this year.

Below table shows the performance of the USD-Dollar YTD against some other major world currencies:

| US dollar versus | YTD performance (%) |

|---|---|

| Mexican peso | -15.3 |

| Australian dollar | -9.2 |

| Euro | -9.0 |

| Swedish krona | -9.0 |

| Korean won | -6.9 |

| Norwegian krone | -6.4 |

| Swiss franc | -6.3 |

| Canadian dollar | -6.2 |

| New Zealand dollar | -5.8 |

| Singapore dollar | -5.5 |

| Indian rupee | -5.3 |

| British pound | -5.2 |

| Japanese yen | -4.1 |

| Russian ruble | -2.9 |

| Chinese renminbi | -2.8 |

| Brazilian real | -2.2 |

| South African rand | 0.0 |

| Turkish lira | 0.4 |

| Hong Kong dollar | 0.6 |

For the short term the US-Dollar might be oversold and due to this we might expect it to do a dead cat bounce.

Declining US-Dollar, combined with rising interest rates globally reminds us to the period of 1977 – 1982, in which a declining US-Dollar combined with rising interest rates has triggered the 1981-82 recession which was at that time the worst economic downturn in the world since the Great Depression.

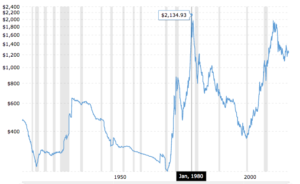

During 1981-82, recession, inflation rose in the USA to 13.5 percent, in order to tamed inflation the USA FED Chairman of that time Mr. Paul Volcker raised interest rates to 21.5 percent. As a consequence of this Gold the ultimate safe haven reached US$ 850.00 per Troy Ounce, which corrected for inflation in today’s US-Dollars, is US$ 2,134.93 per Troy Ounce, as can be seen from below chart.

We believe that with the current status of the World Debt, rising interest rates will balloon interest payments of those indebted countries, for which the USA, with a current public debt of approx. 20 Trillion US-Dollar – approx. 106 percent of GDP -, sits in the front seat.

Based on this we believe that all ingredients for a worse recession than the one of 1981-82 and the one 2007-2009 are baked in the cake.

Until Next week

Eric Panneflek