Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you, why Investing in “Industrial & Commercial Bank of China (ICBC), can be lucrative for value investors.

INTRODUCTION:

Industrial and Commercial Bank of China Limited (ICBC) (01398.HK), is a Chinese multinational banking company, which was established on 1 January 1984.

- On 28 October 2005, the Bank was wholly restructured to a joint-stock limited company.

- On 27 October 2006, the Bank was successfully listed on both Shanghai Stock Exchange and The Stock Exchange of Hong Kong Limited.

Through its continuous endeavor and stable development, the Bank has developed into the top large listed bank in the world, possessing an excellent customer base, a diversified business structure, strong innovation capabilities and market competitiveness and providing comprehensive financial products and services to 5,320 thousand corporate customers and 496 million personal customers

The Bank was named the “Best Emerging Markets Bank” by Euromoney, and ranked 1st place among the Top 1000 World Banks by the Banker and the Global 2000 listed by the US magazine Forbes for the third consecutive year.

INTERNATIONAL AND DIVERSIFIED OPERATIONS:

In 2015, the Bank’s global network layout paralleled channel building in a steady way. Riyadh Branch, Yangon Branch and ICBC (Mexico) were established.

The Bank acquired 60% shares of Standard Bank PLC, thus officially stepping into global commodities and money market trading business. In addition, the Bank also acquired shares of Tekstilbank, thereby becoming the first Chinese-funded bank that has established an operating institution in Turkey.

ICBC (Thai) and ICBC (Argentina) were successively authorized as the RMB clearing bank, thus increasing the number of the Bank’s overseas RMB clearing banks with authorization from PBC to six.

The Bank became the first Chinese-funded bank that is able to offer around-the-clock RMB clearing services in Asia, Europe, and the Americas.

As at the end of 2015, the Bank established 404 institutions in 42 countries and regions and indirectly covered 20 African countries as a shareholder of Standard Bank Group.

The Bank also established correspondent banking relationships with 1,611 overseas banking institutions in 147 countries and regions.

FINANCIAL HIGHLIGHT:

As at the end of 2015, total assets of the Bank amounted to RMB22,209,780 million, RMB1,599,827 million or 7.8% higher than that at the end of the previous year. Total liabilities of the Bank amounted to RMB20,409,261 million, RMB1,336,612 million or 7.0% higher than that at the end of the previous year.

In 2015, the Bank realized a net profit of RMB277,720 million, up 0.5%. Return on average total assets stood at 1.30%, and return on weighted average equity was 17.1%.

Core tier 1 capital adequacy ratio stood at 12.87%, tier 1 capital adequacy ratio 13.48%, and capital adequacy ratio 15.22%. Operating income amounted to RMB697,647 million, recording an increase of 5.9%. Specifically, net interest income was RMB507,867 million, growing by 2.9 %. Non-interest income reached RMB189,780 million, rising by 14.8%.

PGM CAPITAL ANALYSIS & COMMENTS:

Since going public in 2005, ICBC performed well in its business strategy and embraced process sophistication in its income structure, lending structure and investment structure.

ICBC’s emerging services as diversified as investment banking, credit card, wealth management, corporate annuity and electronic banking are standing at the front among the peers. Every year ICBC increases its profit contribution.

The bank sharpens its comprehensive service capabilities and international competitive edge by concentrating on the integration and internationalization and breaking new ground by looking outside its borders and integration of service.

Since Nov 2, 2009 – ICBC is the Largest Company by Negotiable Market Value of A-shares of the SSE Composite Index.

Based on the closing price of the shares of the company on Friday, October 6, 2017, the shares of the company have a P/E ratio of 7.45.

Dividend History:

Below table shows how the company has increased its dividend since fiscal year 2006

Below table shows how the company has increased its dividend per share since fiscal year 2006.

|

Fiscal Year

|

Dividend (RMB yuan)

|

Scrip issue(share)

|

Entitlement Date

|

Payment Date

|

|

2006

|

0.016(pre-tax)

|

0

|

2007-06-20

|

2007-06-28

|

|

2007

|

0.133(pre-tax)

|

0

|

2008-06-17

|

2008-06-26

|

|

2008

|

0.165(pre-tax)

|

0

|

2009-06-03

|

2009-06-30

|

|

2009

|

0.170(pre-tax)

|

0

|

2010-05-26

|

2010-06-25

|

|

2010

|

0.184(pre-tax)

|

0

|

2011-06-14

|

2011-07-08

|

|

2011

|

0.203(pre-tax)

|

0

|

2012-06-13

|

2012-07-12

|

|

2012

|

0.239(pre-tax)

|

0

|

2013-06-25

|

2013-07-19

|

|

2013

|

0.2617(pre-tax)

|

0

|

2014-06-19

|

2014-06-20

|

|

2014

|

0.2554(pre-tax)

|

0

|

2015-07-06

|

2015-07-07 (A Share)

2015-07-30 (H Share) |

|

2015

|

0.2333(pre-tax)

|

0

|

2016-07-07

|

2016-07-08 (A Share)

2016-08-17 (H Share) |

|

2016

|

0.2343(pre-tax)

|

0

|

2017-07-10

|

2017-07-11 (A Share)

2017-08-02 (H Share) |

Above table shows that in the period of 2006 and 2016, the company was able to increased its dividend with approx. fourteen hundred percent.Based on the closing price on Friday, October 6, 2017, the shares of the company has a dividend yield of 4.08%.

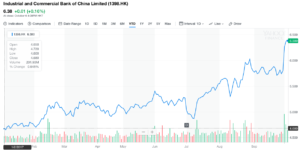

As can be seen from below chart, the share of the company has appreciated YTD with approx. 37 percent.

According with the Big Mac Index of July 2017, the Chinese Yuan is undervalued against the US-Dollar with 45 percent as can be seen from below chart.

Based on the company’s fundamentals and the fact that the Chines Yuan is currently 45 percent undervalued compared with the USD, we have a STRONG-BUY rating on the shares of the company.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek