Dear PGM Capital Blog readers,

In this belated weekend’s blog article, we want to take the opportunity to discuss with you, the possibilities that the coronavirus pandemic, might be trigger for the acceleration of the BIG Shift of Wealth from the West to the East.

INTRODUCTION:

How fast can a virus change our life. One day, it feels normal. The next day we’re “sheltering in place” in our homes…distancing ourselves from neighbors when we go for a walk.

We’re still in the middle of this crisis, so the future isn’t fully clear. Will this go on for a few months, or are we going to have health and economic disruption for years?

Well regardless of how soon this is over, it’s clear to me we are in the middle of The Big Reset, a new way of thinking about work, life, business, and economic leadership.

This big reset might trigger shift of the economic leadership in the coming 5 years.

The following Critical Succes Factors for people, corporations, and countries to profit from the coming big reset are:

- High savings- and low debt to GDP ratio.

- Ahead of the curve education and subsequent HDI ranking

- High penetration of high quality internet connection.

- E-enabled.

- Good and transparent leadership.

- Flat, lean, mean and no-nonsense organization.

THE BIG SHIFT OF GLOBAL ECONOMIC POWER:

The rising emerging economies from the East are often compared with major advanced economies, or the so-called G6: the United States, Japan and the four core European nations: Germany, UK, France and Italy.

In the year 2000, China’s economy was barely one tenth to that of the US, whereas, Japan’s GDP was still as large as the three largest European economies put together: Germany, the UK, and France.

By the early 2010s, the world economy looked very different. The US economy was still more than twice as big as that of China but Japan’s growth had been penalized by stagnation.

If China stays on course, the size of its economy shall surpass that of the US by the late 2020s. Despite growth deceleration, which is normal after intensive industrialisation, China has strong growth potential until the 2030s, while US’ growth is slowing due to maturing economy and ageing demographics.

By 2050, Chinese economy could be almost 50 percent bigger than the one of the USA.

THE CORONA VIRUS AS A CATALYST TO THE BIG SHIFT:

Without wanting to give a political opinion, one characteristic of the current crisis has been a marked lack of U.S. leadership.

The United States has not rallied the world in a collective effort to confront either the virus or its economic effects. Nor has the United States rallied the world to follow its lead in addressing the problem at home.

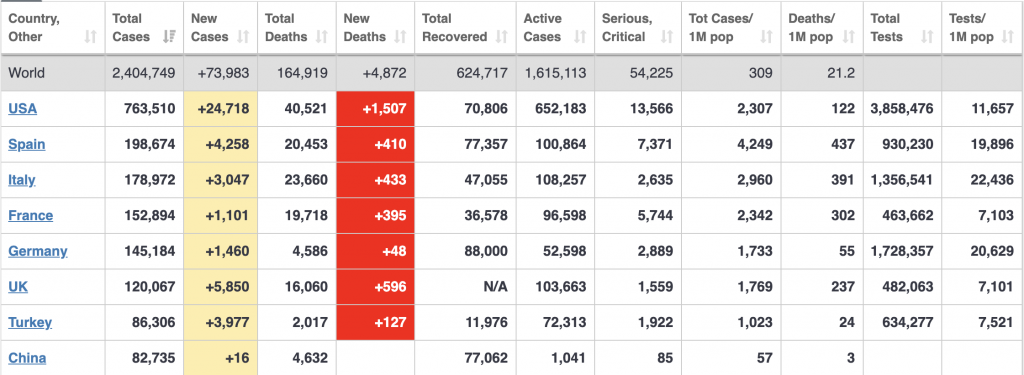

Below table dated April 19, 2020, gives an overview of development of the COVID-2019 in the West, – in particularly in the USA – Compared with China.

Other countries are looking after themselves as best they can or turning to those past the peak of infection, such as China, for assistance.

But if the world that follows this crisis will be one in which the United States dominates less and less, this trend is hardly new. It has been apparent for at least a decade.

To some degree, this is a result of what Fareed Zakaria described in his book the “Post American World” as “the rise of the rest” (and of China in particular), which brought a decline in the United States’ relative advantage even though its absolute economic and military strength continued to grow.

PGM CAPITAL ANALYSIS & COMMENTS:

Below information, tables and charts will give an impression on how, slowly without being noticed by the crowd the big shift of Wealth from the West to East is evolving.

Top 10 Biggest Public Companies by the end of 2019:

According with above table of the Forbes ranking for 2019, 5 of the top 10 companies are Chinese and only 4 of them are from the USA.

Fortune-500, Top 10 of Worlds largest companies by Revenue:

This ranking shows that the top 10 of the companies with the biggest revenue in 2019 is again dominated by China, with 3 companies and that the USA is only represented with only 2 companies.

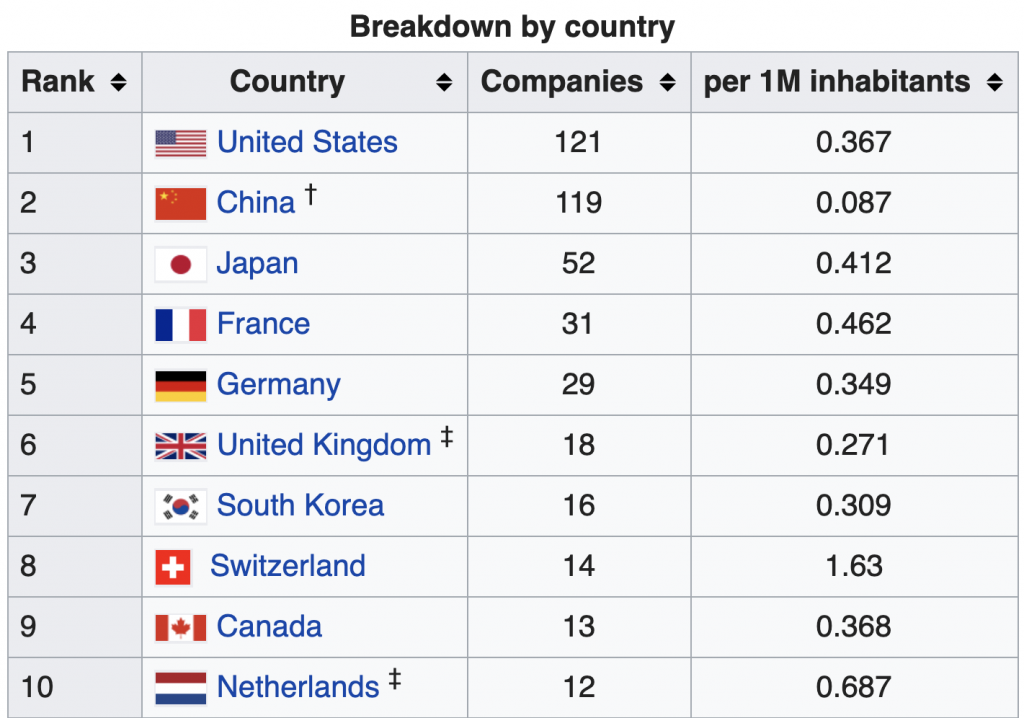

If we dig deeper into this figure and break down the amount of companies per country in Fortune-500 2019 ranking, we get the following result:

† The Global 500 lists Taiwan separately. If its 10 companies were combined with the 119 in China (and Hong Kong), then Greater China would have 129 companies and rank first.

‡ The Global 500 includes Unilever & Royal Dutch Shell under the heading “Britain/Netherlands”, as the company is counted in the tally for both countries.

Disclosure:

In our personal portfolio and the ones of our clients, we are not only diversifying out of cash in favor of consumer companies with a global market, but also Chinese companies.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Adviser and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek