Dear PGM Capital Blog readers,

In our last blog article for the year 2020, this weekend’s blog edition will be a discussion of the possibility of a return of inflation in 2021.

INTRODUCTION:

Inflation is defined as an increase of an average price level of a basket of selected goods and services in an economy over some period of time.

The rise in the general level of prices, often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.

An increase in the supply of money is the root of inflation, in the sense that Inflation depends on money growth and the velocity of money, meaning that prices increase when the product of the money supply and its velocity grows faster than real GDP.

Inflation rate:

Inflation is the rate at which the the value of a currency is falling and consequently the general level of prices for goods and services is rising.

THE INCREASE OF MONEY SUPPLY:

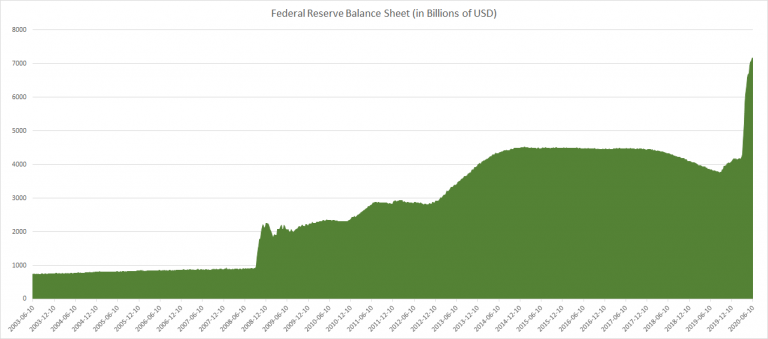

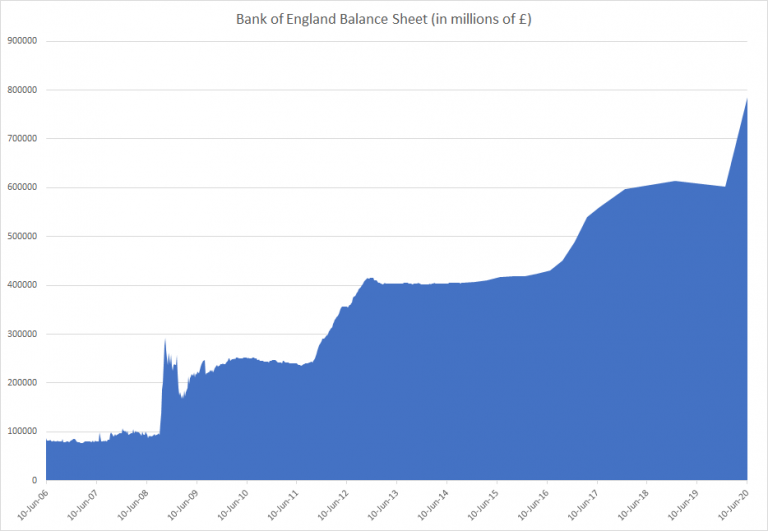

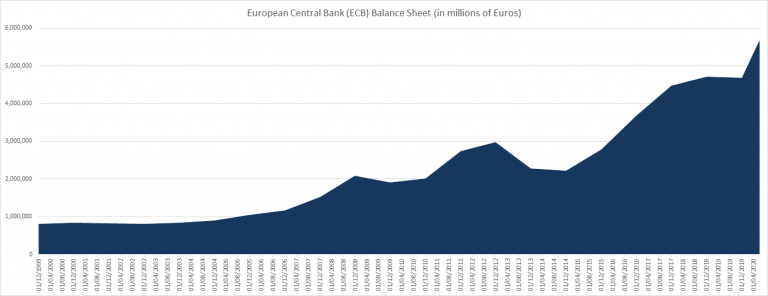

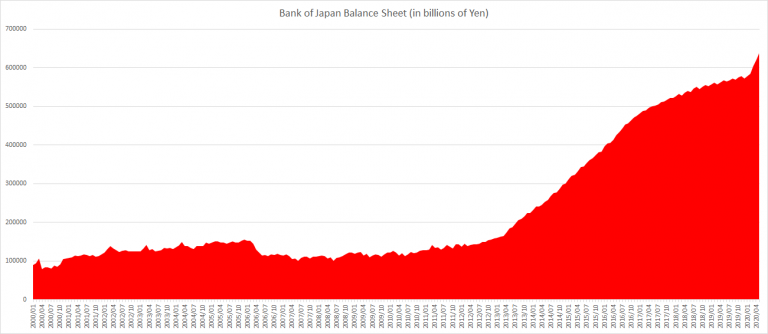

The below charts show the balance sheets of the Federal Reserve, the Bank of England, the European Central Bank, and the Bank of Japan at the end of Q2-2020, in response to the COVID-19 pandemic.

The above charts show, that Central Bank balance sheets have swelled in response to COVID-19, for which the one of Federal Reserve is leading by a approx. 3 mile trillions USD growth in 2020.

PGM CAPITAL ANALYSIS & COMMENTS:

It has been approximately 40 years since the world grappled with serious inflation; however, since the coronavirus pandemic, rampant spending by central banks and governments has led to expectations that change is afoot.

As can be seen from the below chart, Gold, the classic hedge against currency debasement, hovers around an all-time nominal high.

Capital markets which are a forward looking mechanism are also hovering around all time high.

Based on the above, some economists, turning to the history books, muse that inflation will follow.

The threat of widespread and persistent price rises matters now more than ever. Inflation exacerbates social divides, affecting those who are worst off the most.

As lockdowns ease, prices could jump. Businesses may want to make the most of pent-up demand as rules on social distancing are relaxed. Shocks to supply chains could bump up costs.

However, in the rapidly changing world and subsequent turbulence and chances of rise in inflation, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek