Dear PGM Capital blog readers,

In the afternoon of Monday, April 20, the price of West Texas Intermediate oil futures for delivery in May fell to negatives as low as $38.96 a barrel, to close on Friday, April 24, at US$ 17.18 a barrel, as can be seen from below chart.

INTRODUCTION:

The corona virus has severely reduced oil demand around the world due to large declines in airline, car, shipping, and trucking traffic as well as manufacturing production.

Oil is sold through futures contracts, meaning there is a gap between the contracted price and the spot price paid at its actual delivery date.

The contracts for May were set for Tuesday, April 21, and that pricing gap grew as more traders anticipated demand would not return until at least the fall, resulting in a historic sellout.

Monday April 20 price was the lowest at least, since records started being kept by BP in 1861.

WHY NEGATIVE US OIL PRICE?

Negative May oil futures price resulted from traders who do not wish to take physical oil delivery.

Many investors became frantic, due to negative May WTI oil futures prices. Oil futures traders, — who do not take physical oil delivery – are closing their positions, dumping those future positions on the market, regardless of the price.

However, it does not represent the overall oil market. It is just a matter of contract expiration and contract rollover.

PGM CAPITAL ANALYSIS & COMMENTS:

With low global demand and excess supply, excess crude oil needs somewhere to be stored.

As a consequence, the demand for renting oil tankers to store oil skyrockets, driving up tankers’ charter rates.

Royal Vopak:

Royal Vopak N.V., (VPK.AS), the world’s biggest independent oil storage company has all but run out of space for crude and refined products as a result of the fast-expanding glut that Covid-19 has created.

Rotterdam-based Royal Vopak N.V., said in an interview:

“The available capacity on the oil side is almost completely sold out for our terminals”

“For Vopak, worldwide available capacity that is not in maintenance is almost all gone and from what I hear elsewhere in the world we’re not the only ones.”

As can be seen from below chart the shares of the company has soared with 12.75 percent in the past 30 days.

Tankers as Storage:

The strain on storage is also starting to create some strange shipping movements as traders send tankers on odysseys to find the best places to stash supplies.

The amount of oil stored at sea has also increased to almost 250 million barrels and global floating storage is now accelerating at an unprecedented pace, an analyst said in a research note on Tuesday April 21.

The charter rates of very large crude carriers (VLCCs), which can store up to 2 million barrels of oil, have more than doubled, possibly being as much t as $350,000 per day.

Due to the tremendous demand for oil storage with limited tankers, the charter rates will keep going up.

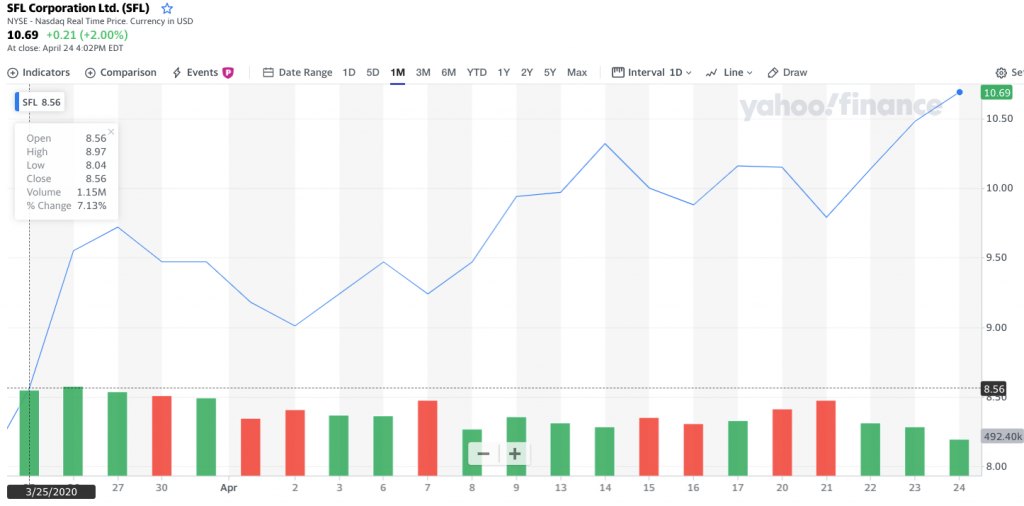

As a consequence of this shares of SFL Corporation Ltd. (NYSE: SFL), engages in the ownership, operation, and chartering out of vessels for oil transportation, soared with 24.88 percent in the last 30 days as can be seen from below chart.

Stress in the oil industry:

The S&P 500’s energy sector has lost more than 40% of its value this year, despite the dramatic rebound in the overall stock market over the past month.

Rystad Energy – an independent energy consulting firm -, predicts that more than US$70 billion of oil company debt will be reorganized in bankruptcy, followed by US$177 billion in 2021. This would only accounts for exploration and production companies, not the servicing industry that provides the tools and manpower to drillers.

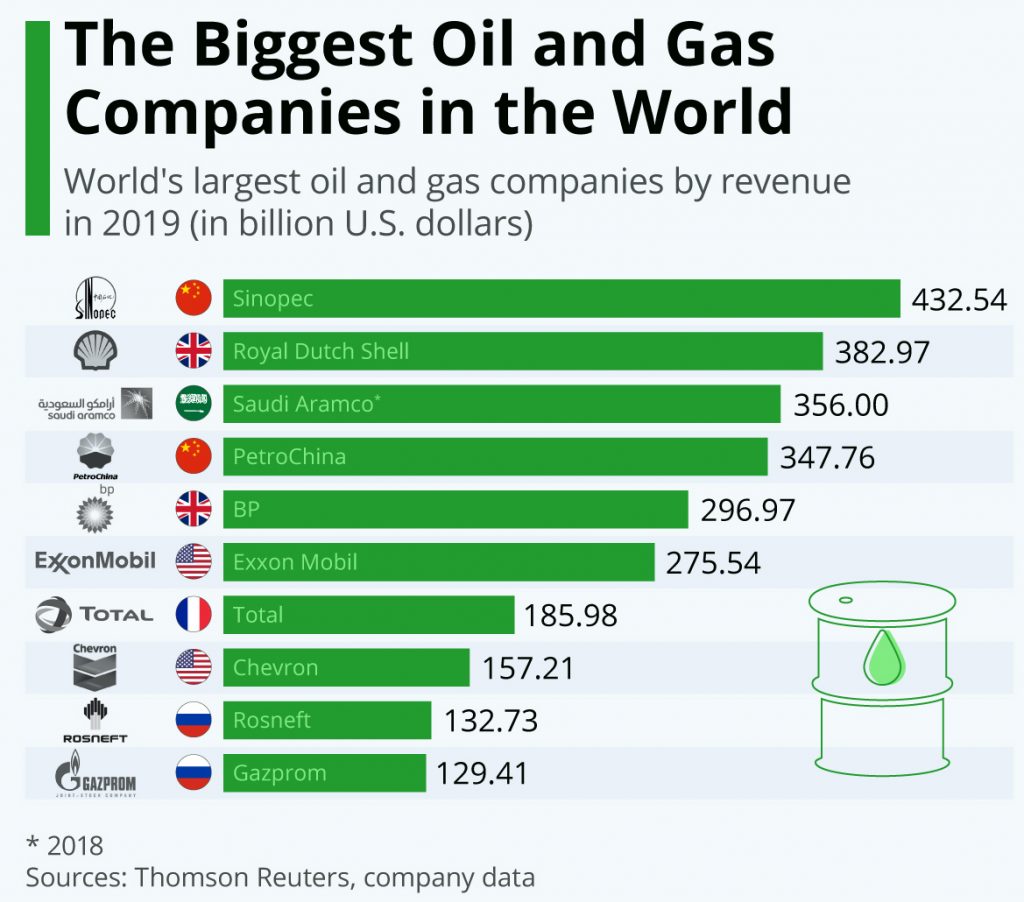

The nightmarish scenario could present lucrative buying opportunities for the industry’s biggest players. Struggling oil companies, either in bankruptcy or before it, will be forced to sell off prime acreage — at fire sale prices. The Biggest Oil and Gas Companies in the World could be tempted to make acquisitions.

Disclosure:

In our personal portfolio and the ones of our clients, we own shares of; SINOPEC, Royal Dutch Shell, BP, PetroChina and SFL Corporation.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Adviser and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek