Dear PGM Capital Blog reader,

In this weekend’s blog article, we want to discuss the consequences of the current trend of near zero to negative interest rates in the developed economies.

THE FED CUT INTEREST RATES FOR THE THIRD TIME IN 2019

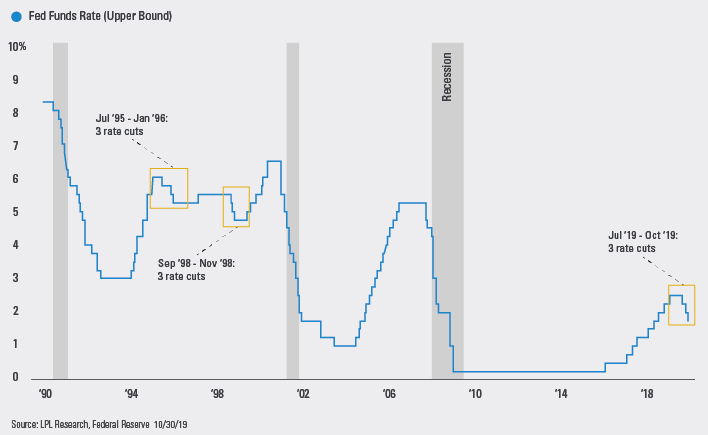

On Wednesday, October 30, the USA Central Bank, “The FED” for the third time in three months lowered its key interest rate by a quarter percentage point, to a range of 1.5% to 1.75%, as can be seen from below chart.

While the central bank was on a steady march to raise rates just a year ago, it has spent the past several months trying to insulate the American economy against the treats of USA president Trump hot-and-cold trade war, paired with a tenuous global outlook.

While the central bank was on a steady march to raise rates just a year ago, it has spent the past three months trying to insulate the American economy against those threats, which has put the Fed on the defensive.

CHRISTINE LAGARDE THE NEW ECB CHAIRWOMAN

On Friday, November 1, 2019, the baton of the ECB was passed on from Mr. Mario Draghi, to Ms. Christine Lagarde. She has officially taken charge of the European Central Bank presidency, succeeding Italian Mario Draghi, the monetary body announced.

Lagarde, the first woman to become president of the body since its launch in 1998, has experienced a career progression marked by the crises she lived through as head of the French ministry of economic affairs (2007-2011), and then as head of the International Monetary Fund from 2011 until 2019.

She was elected to head the ECB by the European Council on October 18 2019 for a mandate of eight years.

European Central Bank head Christine Lagarde is defending the bank’s record low rates and other stimulus measures with the economy facing trouble from trade wars and Brexit.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Cheap Money:

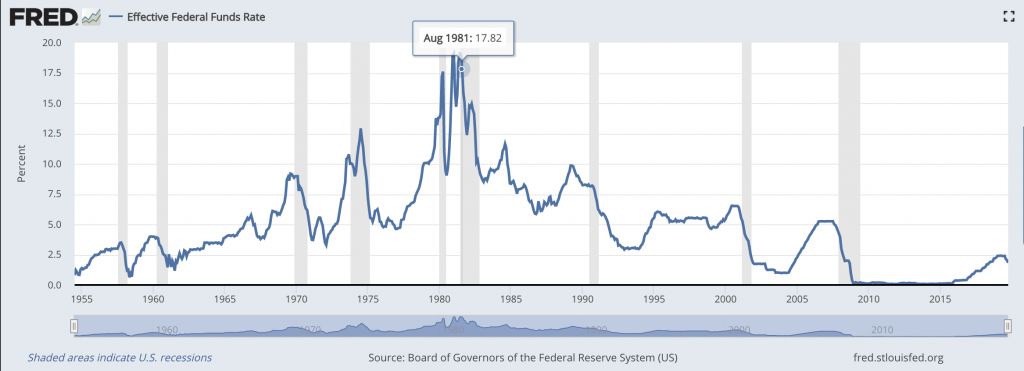

By lowering the interest rates in the USA, the FED confirmed that, future interest rates high and lows, – since its peak in 1981- will be lower than the respective previous Highs and Lows, as can be seen from below chart from the FED of St. Louis.

In our opinion, the addiction to cheap money is the problem, not the solution. Zero or negative interest rates will do “tremendous damage” to the respective economies in the long run.

U.S. President Donald Trump has consistently called for low interest rates, tweeting on September that the FED should cut interest rates to zero or even set negative interest rates. He then appeared to praise Germany for its negative rates on government bonds.

European banks have struggled for years in a persistently low interest rate environment, first hitting zero in 2012 before turning negative in 2014. The European Central Bank pushed its rate further below zero in September, and other countries such as Denmark, Sweden and Japan have also done so.

Demographic transition and Low Interest Rates

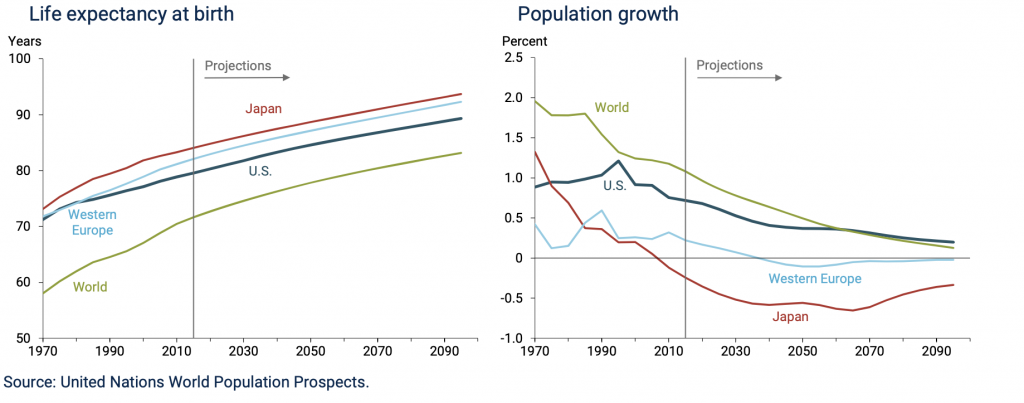

Interest rates have been trending down for more than two decades. One possible explanation is the dramatic worldwide demographic transition, with people living longer and population growth rates declining, as can be seen from below charts.

The above charts show a remarkable population aging over the past few decades. The projections indicate that these changes will persist and deepen for some time in the future.

On top of this, the median retirement age has changed little, leading to longer retirement period

But how could these trends in demographics affect interest rates?

Natural Interest Rate

Changing demographics can affect the “natural” rate of interest. This rate, also known as r* (r-star), is the inflation-adjusted interest rate that is consistent with the full use of economic resources and steady inflation

near Central Bank’s target level.

Is 75 the new 65

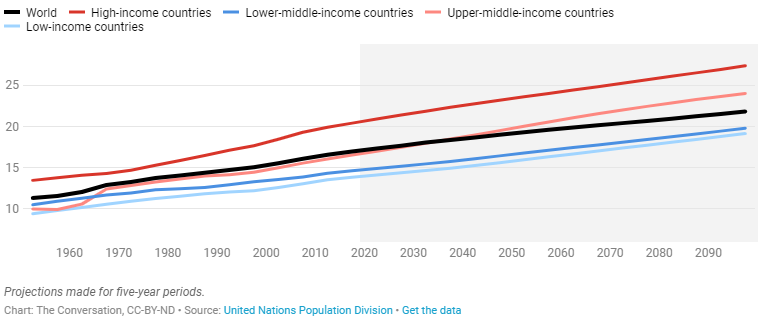

In 1950, men and women at age 65 could expect to live about 11 years more on average.

Today, that number has gone up to 17, with the United Nations forecasts predicting that it will increase by about five more years by the end of the century, as can be seen from below chart.

As people continue to live longer, governments will need to rethink similar policies around health care, employment and more. Eventually, as conditions change, we worry that policies based on fixed chronological ages will become dysfunctional.

The above combined with the prospect of near zero to negative interest rates for a prolonged period, will have a disastrous effect on pensions and retirees living on fixed income.

Based on the above analysis suggests that another decade of work may be required to pay for life after work.

Implications? A whole new ballgame for ‘retirement planning’ – it’s possible that we must now plan for a longer life that will demand the physical, mental and attitudinal capacities to remain vital to work well into what most have defined as later life.

Going back to school to refresh, renew or even retrain for an entirely new profession,

will fast become the new norm.

Above all, surviving and thriving will be the prize for those who are able to be flexible and willing to adapt to new workplace demands, technology and knowledge.

In this era of continuous change and change of era with high volatility, investors having a financial advisor, with vast experience, knowledge and performance track record, will be a Critical Success Factor.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek