Dear PGM Capital blog readers,

In this belated weekend’s blog article, we want to elaborate the peaking of change of era in 2022, and the effect it will have on your investments.

INTRODUCTION:

Change of the Era means altering the trends of the times, transforming the culture, environment and way of life.

In this decade, the world will transform into a new global community with a new economy where power relations that are familiar to us today are radically overturned.

In his book “CHANGE OF ERA – OUR WORLD IN TRANSITION” Jan Rotmans PhD, Professor of transition management at Erasmus University Rotterdam, says:

Change of Era draws a portrait of this transition in various contexts: education, healthcare, energy and finance.

Because people today are no longer the singular focus in these sectors, they have begun to devise and implement their own alternatives. Together these are giving shape to a bottom-up movement that is essential for the transition towards a society and economy better attuned to people’s lives.

With its tangible and at times shocking portrayal of the violent clash between the established order and the forthcoming new order, this book shows us what lies ahead.

THE RISE OF ASIA:

Economists, political scientists, and emerging market pundits have been talking for decades about the coming of the Asian Age, which will supposedly mark an inflection point when the continent becomes the new centre of the world.

Asia is already home to more than half the world’s population. According to UN data, 21 of the world’s 30 largest cities, are in Asia.

Somewhere in this year -2020- , Asia will also become home to half of the world’s middle class, defined as those living in households with daily per capita incomes of between US$10 and US$100 at 2005 purchasing power parity (PPP).

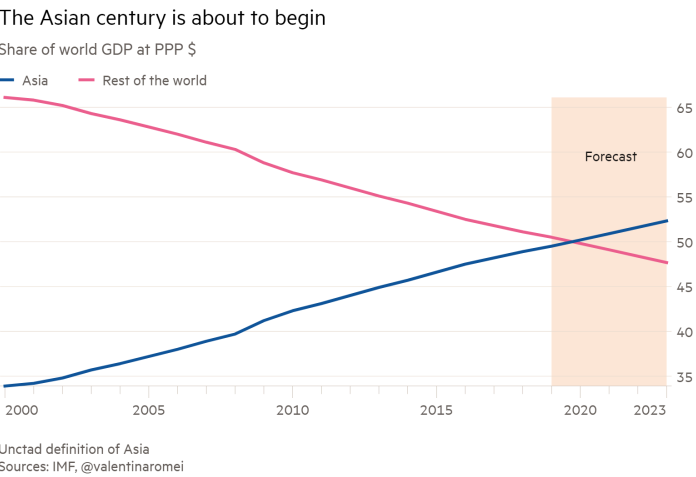

According to UN trade and development body UNCTAD, Asian economies will be larger than the rest of the world combined in 2020, as can be seen from below chart.

In just a couple of generations, a “winning mix of integration with the global economy via trade and foreign direct investment, high savings rates, large investments in human and physical capital, and sound macroeconomic policies” contributed to Asia’s economic leap forward, according to the IMF’s latest regional outlook.

Over the past five decades, hundreds of millions of people in Asia have been lifted out of poverty and many Asian economies have graduated to middle-income or advanced economic status, according to World Bank definitions.

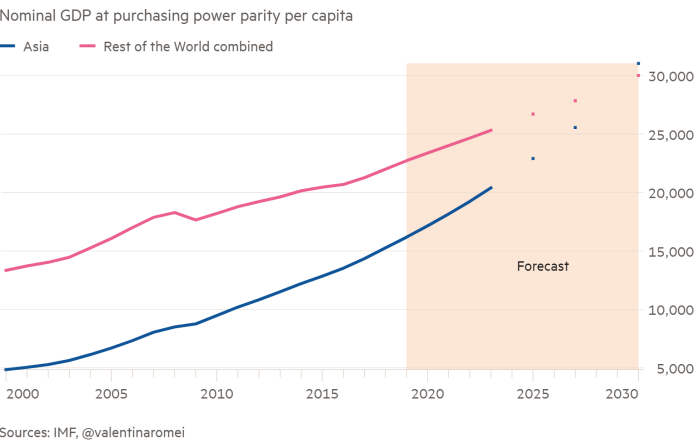

As can be seen from below chart the gap in GDP per capita (PPP) between ASIA and the rest of the world is narrowing.

CASH IS TRASH:

Ray Dalio, the billionaire founder of the hedge fund Bridgewater Associates, the investment-management firm which looks after some US$160 billion, said during an interview on the sidelines of the World Economic Forum in Davos, Switzerland, that investors should be buying this market, rather than seeking safety in cash.

“Cash is trash”

FOOD PRICES:

Rising incomes in Asia and ethanol subsidies have put an end to a long era of falling food prices.

Americans today pay an average of 19.1 percent more on grocery items than they did 10 years ago. Over the same time, the inflation rate was just 16.3 percent.

Several key factors generally affect food prices in the long run. High oil prices increase the cost of shipping; droughts and floods cause shortages of certain crops; and a growing appetite for more expensive food from an increasingly affluent world population drives up overall demand – and prices – of food.

The prices of the following 20 grocery items increased by at least 21 percent over the last 10 years:

20. Rice, pasta, cornmeal – 10-year price increase: 21.7 percent

19. Other fats and oils including peanut butter – 10-year price increase: 21.5 percent.

18. Bread – 10-year price increase: 22.4 percent

17. Canned fruits – 10-year price increase: 22.5 percent

16. Pet food – 10-year price increase: 23.0 percent

15. Bacon, breakfast sausage, and related products – 10-year price increase: 24.5 percent

14. Frozen fish and seafood – 10-year price increase: 24.7 percent

13. Sauces and gravies – 10-year price increase: 25.6 percent

12. Fats and oils – 10-year price increase: 25.6 percent

11. Canned vegetables – 10-year price increase: 25.7 percent

10. Fresh biscuits, rolls, muffins – 10-year price increase: 27.2 percent

9. Cakes, cupcakes, and cookies – 10-year price increase: 27.6 percent

8. Frankfurters – 10-year price increase: 27.6 percent

7. Salt and other seasonings and spices – 10-year price increase: 31.5 percent

6. Oranges, including tangerines – 10-year price increase: 37.6 percent

5. Prescription drugs – 10-year price increase: 39.1 percent

4. Beef and veal – 10-year price increase: 42.4 percent

3. Shelf stable fish and seafood – 10-year price increase: 42.5 percent

2. Margarine – 10-year price increase: 50.2 percent

1. Tobacco and smoking products – 10-year price increase: 88.7 percent

PGM CAPITAL COMMENTS & ANALYSIS:

In our comments chapter of this blog article we will be very short.

First we completely agree with Mr. Ray Dalio, that Cash is Trash; with the consequence that if you don’t want to hold cash today, you should avoid a promissory note that gives you cash in the future against an interest rate (near zero or negative) that is much lower than food price increase in the same period.

Secondly, Hedging against the effects of the current change of era with its high and increasing food prices, by investing in food and medicine producing companies, which are dividend aristocrat, with a credit rating above BBB.

In this era of change and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can remain solvent.

Yours sincerely,

Eric Panneflek