Dear PGM Capital blog readers,

In this belated weekend’s blog article, we want to discuss with you the possible affect of the Coronavirus outbreak may have on your investments.

INTRODUCTION:

Coronaviruses (CoV) are a large family of viruses that cause illness ranging from the common cold to more severe diseases such as Middle East Respiratory Syndrome (MERS-CoV) and Severe Acute Respiratory Syndrome (SARS-CoV). A novel coronavirus (nCoV) is a new strand that has not been previously identified in humans.

Coronaviruses are zoonotic, meaning they are transmitted between animals and people.

WILL THE CORONAVIRUS BECOME A “BLACKS SWAN” EVENT?

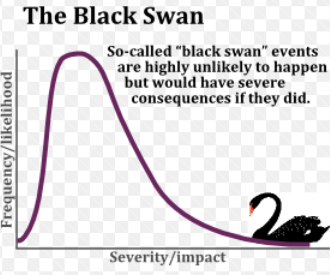

What is a Black Swan Event?

A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences.

With the impact of trade wars, Brexit and various geopolitical issues, the global economy has been going through hard times and the possibilities of recession and economic slowdown are on the global agenda.

One of the concerns is the fear of a “Black Swan” scenario coming true; thus further deteriorating the global economy, which has already been on fragile ground for some time. The recent outbreak of the novel coronavirus that emerged in Wuhan, China brought forward the possibility of such a scenario, increasing concerns about the global economy.

In order to fully comprehend the probable impacts, one of the most recent cases to look at would be the 2003 SARS outbreak. Due to the impact of SARS, the Chinese economy is estimated to have lost at least 2 percentage points in real GDP growth in the second quarter of 2003.

PGM CAPITAL COMMENTS & ANALYSIS:

The scare of the Coronavirus will affect the movement of people negatively, with the consequence that it will degrees the demand for Crude Oil and distillates temporary. This will have as a consequence that share price of Oil Companies, including the ones of the Oil supermajors will decrease, temporary, which can be seen as an excellent entry point for long term investors in the securities of the oil sector.

Based on the above, the shares of Royal Dutch Shell, with a P/E ratio of 9.87, a AA- credit rating, currently has dividend yield of 7.47%, for which we have upgraded the stock to STRONG BUY.

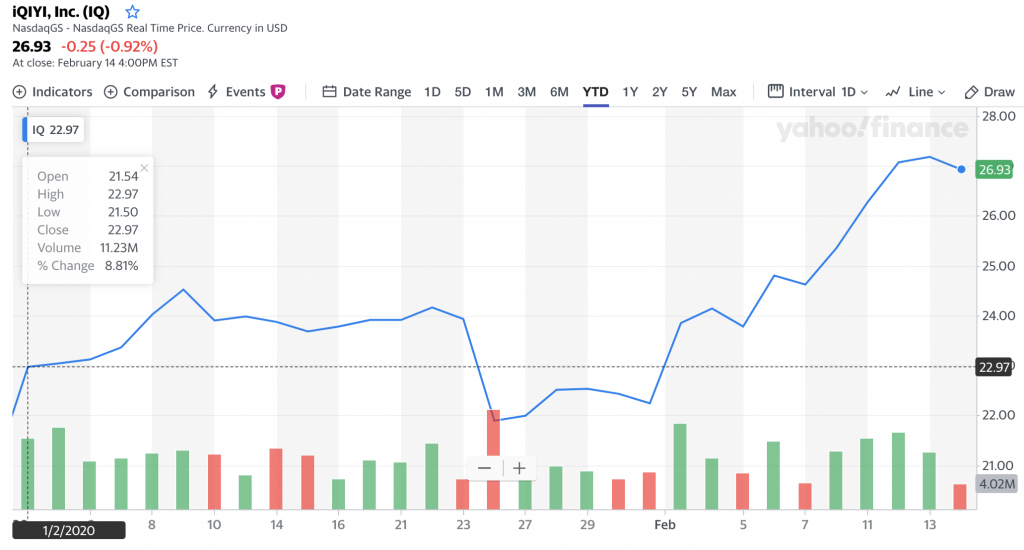

On the other hand, the fact that people – mainly in Asia – are staying home, the demand for only shopping and entertainment has increased dramatically. Due to this, share price of Chinese Online entertainment services iQIYI, Inc. has appreciated with approx. 17.3 YTD, percent as can be seen from below chart.

History has proven, that when people experience the convenience of home entertainment and shopping, it might a become a new habit, when the event that has triggered it has eased.

To make a long story short, the currently Coronavirus is creating an excellent entry point for the Oil supermajor shares, and will boost even further in the long term the usage of online entertainment and shopping.

Disclosure:

We own shares of Royal Dutch Shell as well as iQIYI in our personal portfolio.

In this rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that the market can remain irrational longer, than you can remain solvent.

Yours sincerely,

Eric Panneflek