Dear PGM Capital Blog readers,

In this weekend edition we want the elaborate on the consumption of Oil and whether or not we are approaching the end of the Age of Oil.

INTRODUCTION:

The Oil Age or the Petroleum Age, refers to the era in human history characterized by an increased use of petroleum in products and as fuel.

Although crude petroleum oil has been used for a variety of purposes for thousands of years, the Oil Age is considered to have started in the 1800s with the advance of drilling techniques, as well as the processing of products made use in internal combustion engines.

Since the beginning of the Industrial Revolution, fossil fuels have been used as sources of energy. Coal began to be widely used after 1800 and would continue to be the dominant source of energy into the twentieth century.

However, two events set the stage for the Age of Oil: The first was in 1846, when Abraham Gesner invented kerosene making coal and petroleum practical raw materials for lighting fuel. The second was in 1859, when Edwin Drake invented the first modern drilling process for deep oil wells.

ARE RENEWABLE READY TO TAKE OVER:

With little or no pollution, renewables like solar, wind and biofuels are viewed by many as a means to curtail the rising greenhouse emissions and replace oil as a sustainable alternative.

There is little doubt as to why China, US, Japan, UK and Germany, some of the world’s biggest energy gluttons have invested heavily in renewables.

However, according to a study conducted by Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance, the United Nations Environment Program (UNEP), the total global investments in renewables fell by 14% to $214 billion in 2013.

One of the major reasons of this fall was the backing out of some big oil firms. These companies significantly reduced their investments in renewables and decided to focus on their ‘core’ business; that is, oil and gas.

CHINA:

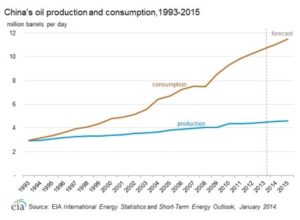

China, is currently the second biggest global consumer of oil and its oil consumption rate constitutes about one third the world’s total consumption rates and shows no signs of slowing.

In fact, EIA even predicts steady growth of China’s oil production reaching 4.6 million barrels per day in 2020 and 5.6 million barrels per day in 2040 as can be seen from below chart.

China has also invested heavily in building its strategic petroleum reserves and plans to expand them to 500 million barrels by 2020.

PGM CAPITAL ANALYSIS & COMMENTS:

The idea that the world has really just started to consume oil is one that is very difficult for some Westerners to accept.

It’s easy to see why: we have all the oil that we need and want. Americans consume over 2.6 gallons of oil products every day, and there are 255 million oil-based cars in the country.

A rising 83% of the world is undeveloped, and the transport demands for the poor are just now coming to light.

The developed, OECD nations use 50% of the world’s oil but are just 17% of the population. The rich consume 1.6 gallons of oil products a day, while the poor consume just 0.32 gallons.

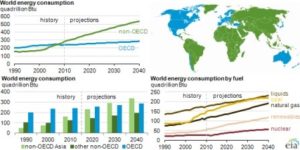

As can be seen from below chart, while on one hand the consumption of Oil in the industrialized world is growing slowly, on the other hand the consumption of Oil in the developing world is increasing exponentially.

After vehicles, the second emerging oil market to watch could be jet fuel. Boeing affirms that commercial aircraft in the world will double to over 40,000 by 2032, with Asia-Pacific becoming the focal point of aviation. Jet fuel demand in the region has more than doubled to over 2 million b/d since 2000.

Oil is Everything:

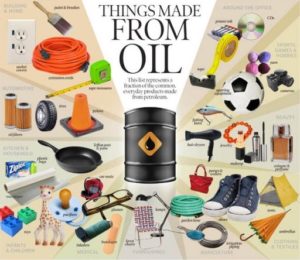

Oil is everywhere. It permeates our daily lives in ways we never think about. It’s in carpeting, furniture, computers and clothing.

Our food is oil intensive, the tractors in the field run on diesel and fertilizers, pesticides are all oil.

The roads we drive on, are made of asphalt which is Oil, the tires of our car are made from oil, lubricants are oil.

It’s in the most personal of products like Shampoo, toothpaste, shaving cream, lipstick soap, shoes, contact lenses, nail polish, deodorant, paint, petroleum jelly, inkt, syntactic rubber rubber, perfume, and vitamin capsules and so on.

Petrochemicals are the glue of our modern lives and even in glue, too.

And because of all that, petrochemicals are in our blood.

As we’ve seen in the past year, the price of oil can shoot up faster and higher than what seems reasonable.

Basic economics tells us that a price increase should lower demand, but oil is such an integral part of the global economy that regardless of price, people have to have it. It takes a pretty sizable price increase for people to scale back demand even a little.

As we’ve seen, that situation can raise the cost of nearly everything around you.

Crude oil, since its discovery has penetrated deep into our daily lives and we would be crippled when the reserves of crude oil are depleted.

After reading this article, you should agree with us, that Oil is here stay and when supply dwindles and demand doesn’t follow suit, the price will rise relentlessly higher.

Until next time

Eric Panneflek