Dear PGM Capital blog readers,

On Wednesday, September 11, U.S.A President Donald Trump called the Federal Reserve to push interest rates down into negative territory.

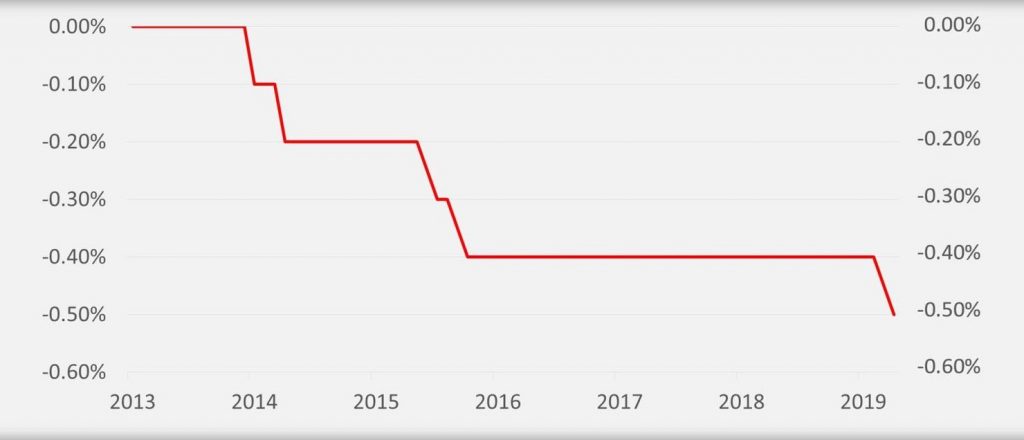

Thursday, September 12, the ECB cut interest rates further into negative territory, by cutting its deposit rate from minus 0.4 percent to a new record low of minus 0.5 percent as can be seen from below chart.

ECB chairman Mr. Draghi also stated, that the ECB would restart its quantitative easing (QE) program, buying € 20 billion of bonds every month from November until inflation expectations came “sufficiently close to, but below, 2 percent”, at which point interest rates could also start rising again.

In this article, we will elaborate on the consequences of negative interest rates for the global economy in general your investments in particular.

WHAT IS NEGATIVE INTEREST RATE POLICY:

Negative Interest Rate Policy (NIRP) is an unconventional monetary policy tool employed by a central bank whereby nominal target interest rates are set with a negative value, below the theoretical lower bound of zero percent.

It is in monetary policy used to mitigate a financial crisis.

A negative interest rate means that the central bank (and perhaps private banks) will charge negative interest. Instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank. This is intended to incentivize banks to lend money more freely and businesses and individuals to invest, lend, and spend money rather than pay a fee to keep it safe.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Interest Rates in the USA:

It seems like only yesterday that the Federal Reserve was steadily raising interest rates as the U.S. economy picked up steam after years of near-zero rates following the Great Recession of 2007-09.

But the Fed cut its key rate in July for the first time in a decade. Another such move is likely next week and there’s growing talk of pushing rates down to, or even below, zero.

Pros and Cons of Zero or Near Zero Interest Rates:

Negative interest rates can be considered a last-ditch effort to boost economic growth. Essentially, it’s put into place when all else (every other type of traditional policy) has proved ineffective and may have failed.

Pros:

Theoretically, targeting interest rates below zero will reduce the costs to borrow for companies and households, driving demand for loans and incentivizing investment and consumer spending.

On the other side, fewer households and businesses will be eager to either increase spending or take out loans if the economy is in recession.

Cons:

Low rates also squeeze the profit margins of banks, while Negative interest rates have a harrowing impact on cash.

Interest rates also affects how bonds are priced and valued. This would naturally affect retirement portfolios and how much retirees can withdraw on a monthly basis.

It might lead to large-scale capital flight and businesses could find it harder to fund their operations.

It will lead to inflation.

The banking system would be severely handicapped as banks become unable to earn an acceptable spread on loans. If loans become unprofitable, then the supply of credit will dry up and cause great harm to the economy at large.

We are currently living in challenging economic times, for which BREXIT, a looming trade war, to mention a few.

PGM Capital as your trusted, financial and investment advisor is at your service to consult and guide you in these turbulent times.

Yours sincerely,

Eric Panneflek