Dear PGM Capital’s Blog reader,

On Friday, June 9, the USA labor department reported that, surprisingly for the month of May, just 75,000 jobs were created in the country, which shows that the resilient job market is now being hit by the same weakness cropping up in other parts of the economy.

Based on this, most investors are asking themselves the following question.

Are the May Non Farm Payroll figures an outlier or the first signs of a looming recession?

INTRODUCTION:

With USA presidential election in November 2020, it’s now likely that the Fed will move to cut rates this year, possibly as early as July, in order to avoid a recession in the USA in 2020.

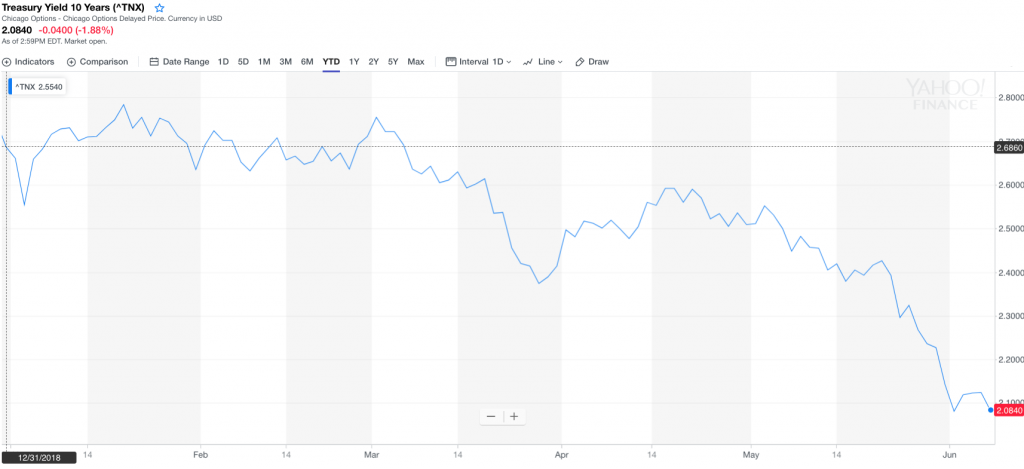

As can be seen from below YTD-chart of the yield of the USA 10 years Treasury note, continued to fall sharply and fell on Friday, June 7, with 4 basis points to close the trading week at 2.085%, its lowest level since September 2017.

The benchmark maturity declined 5.4 basis points in the week of June 3rd.

Bond prices and yields move in opposite directions, which you may find confusing if you’re new to bond investing. When bond yields go up, prices go down, and when bond yields go down, prices go up.

In other words, an upward change in the 10-year Treasury bond’s yield from 2.2 percent to 2.6 percent is a sign of negative market conditions, because the bond’s interest rate moves up when the market trends down.

Conversely, a downward move in the bond’s interest rate from 2.6 percent down to 2.2 percent actually indicates positive market performance.

A decline of the yield of the 10 years treasure might be an indicator that proactively investor are buying bonds in anticipation for interest rate cuts by the FED this year.

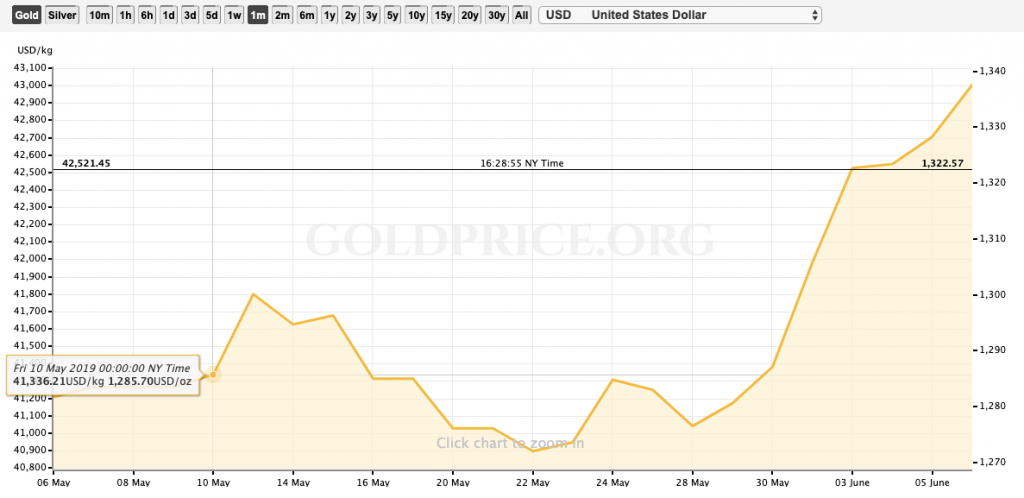

As can be seen from below chart, the gold price is rising sharply, since Friday, May 10, when USA president Mr. Donald Trump, made good on its threat to raise tariffs on US$200 billion worth of Chinese exports from 10% to 25% earlier, marking a sharp escalation in tension between the world’s two largest economies.

Gold is a hedge against inflation but also a protection against tale risk, by buying gold investors proactively are hedging against the risk of a recession and increasing inflation due to the reduction of key interest rates.

PGM CAPITAL’s ANALYSIS & COMMENTS:

The weak June jobs report confirms the concern about the U.S. economy that has rippled through the economy over the past week, and the Federal Reserve may decide the best way to counteract that is an interest-rate cut at its meeting later this month.

Game Over:

The grand central bank experiment of the past 10 years, of stimulation economic growth via, monetary easing, has ended in utter and complete failure.

The games of cheap money and constant intervention that have brought you record global debt to the tune of US$250 trillion and record wealth inequality are about to embark on a new round of peddling blue meth again.

Australia has already cut interest rates, and so has India. The European Central Bank (ECB) is talking about it, and markets are already pricing in multiple Federal Reserve cuts and investors are counting on a rate cut at the end of the FOMC meeting of coming June 18 – 19.

The new global rate-cutting cycle begins anew before the last one ever ended. Brace yourselves as no one, absolutely no one, can know how this will turn out.

We are afraid that the structural bears who have predicted that central bankers would never be able to normalize the construct they created and has produced the world’s greatest debt explosion ever were 100% correct and that world is heading to a stagflation period worst than the one of mid 1970.

During the stagflation of mid seventies, we have experienced a hyper inflation cycle, which brought the price of Gold, Oil and food to record high.

We believe that the fact the stock price of major food producers are hitting all time high daily since the beginning of this year is a clear warning that something very ugly is cocking.

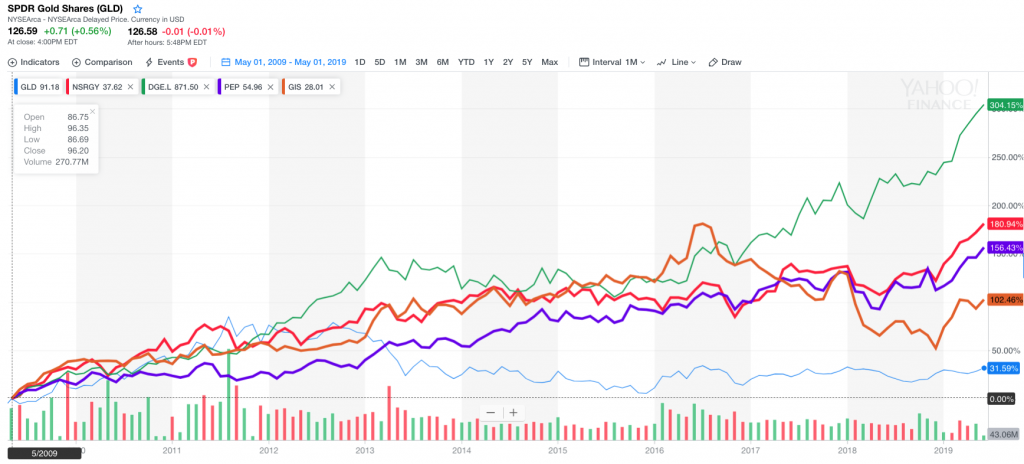

Below 10-year chart compares the stock price of major food producers, Nestlé, Unilever, Pepsico, Diageo with the price of gold.

Above chart clearly shows, that above mentioned food producers, all have outperformed Gold between 500 and 1000 percent in the past ten years, this above the fact that during the last 10 years they have increased their dividend pay out with at least 100 percent.

Based on this we believe that investing in world’s major food producer will be a excellent hedge against the coming stagflation cycle.

Disclosure:

We own Gold as well as shares of Nestlé, Diageo and Unilever in our personal portfolio.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek