Dear PGM Capital’s Blog reader,

Gold prices have rissen sharply this week surpassing the key US$1,400 an ounce level, on Thursday, June 20, on dovish signals from major central banks and rising tensions in the Middle East.

INTRODUCTION:

ECB:

On Tuesday, June 18, when ECB president Mario Draghi held a conference in Sintra, Portugal, he stated that the ECB was not resigned in its quest to perk up the economy and said that:

“in the absence of improvement… additional stimulus will be required.”

He also said:

“Further cuts in policy rates… remain part of our tools,”

Draghi noted it was also possible to re-start a bond-buying stimulus program that had been halted only in December.

Europe’s top central banker even held out the prospect of cutting interest rates, though they are already at record lows.

FED:

At the end of a two-day FOMC meeting, marked by concerns about slowing growth and rising trade tensions, the US central bank said it would

“act as appropriate to sustain the expansion” and would “closely monitor the implications of incoming information for the economic outlook”.

The Federal Reserve held interest rates steady but shifted towards a more dovish stance and pointed to possible interest rate cuts in the future, citing rising “uncertainties” about the economic outlook.

GOLD PRICE JUMPED ON DOVISH FED:

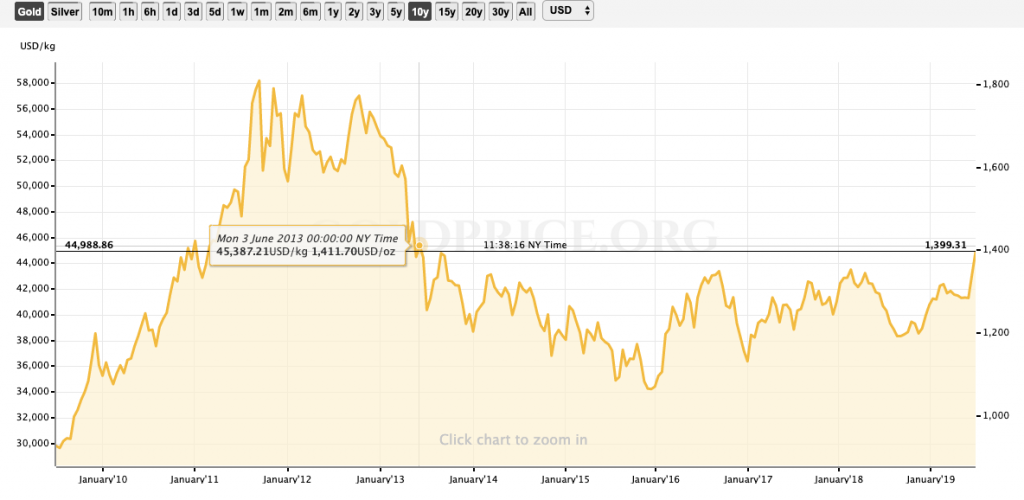

As can be seen from below chart, Gold prices surged to their highest in more than six years in the week of June 17, after the US Federal Reserve signalled interest rate cuts beginning as early as July.

They said that they are ready to battle growing global and domestic economic risks as it took stock of rising trade tensions and growing concerns about weak inflation.

Lower interest rates decrease the opportunity cost of holding non-yielding bullion and weigh on the dollar, making gold cheaper for investors holding other currencies.

As can be seen from below chart, the price of gold appreciated with US$ 64.9 an ounce, closing the week just below the psychological level of US$ 1,400.00 an ounce.

PGM CAPITAL’s ANALYSIS & COMMENTS:

A move towards lower interest rates at the Fed would represent a remarkable U-turn in policy for the US central bank compared with 2018, when Mr Powell oversaw a series of gradual increases in the fed funds rate to bring it up to its current level of 2.25-2.5 per cent. By March, however, most Fed officials were no longer expecting interest rate rises, and the Fed effectively switched to a neutral posture, saying it would adopt a “patient” approach to interest rate changes in either direction.

But with trade tensions rising, economic data pointing to a slowdown, and investors buying up US government debt in anticipation of a possible easing, Mr Powell and other Fed officials began seriously considering interest rate cuts — which would be their first downward shift since September 2007.

Meanwhile, China’s commerce ministry said on Thursday top Chinese and U.S. officials would resume trade talks in accordance with the wishes of their leaders, but China hopes the United States will create the necessary conditions for dialogue.

The European Central Bank and the Australian central bank have also signalled this week more policy stimulus was needed.

The (gold’s) move higher looks constructive for a further test toward US$1,400 an ounce, as participants focus upon the Fed’s dovish skew, with potential targets extending toward US$1,450 should near-term support around US$1,375 remain intact.

A word of Caution:

There is growing awareness in the community that central banks have misused their money creating capacity for political ends.

Unless Western governments and central banks change their policies, people may start shifting their trust from fiat money back to gold.

Based on this, Gold is considered a politically sensitive asset.

A key concern is that today’s policymakers could abuse their legislative powers to outlaw physical ownership of gold, especially in Europe and the U.S., as a way of extending the control and reach of monetary policy.

There are precedents for this, including President Franklin Roosevelt’s executive order in 1933 to outlaw gold currency ownership by individuals. The step would be a logical, if totalitarian, outcome of current monetary policies.

It is just one small step from abolishing cash to outlawing gold ownership.

Disclosure:

We own Gold as well as other precious metals in our personal portfolio.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek