In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money, in the week of September 24, 2018, as follows:

- Aurora Cannabis reported Q4-2018 and Full FY-2018, Financial Results.

- The FED increased interest rates.

AURORA CANNABIS SWINGED TO PROFIT:

Aurora Cannabis Inc. (ACB.TO) released its fiscal 2018 and Q4-2018 (ended June 30, 2018) results after the close of the market on Monday, September 24.

Fiscal Year 2018 Results:

For the fiscal year ending of 2018, Aurora reported total revenue of CAD 55 million versus fiscal 2017’s total revenue of CAD 18.07 million. The net income for the year was CAD 69 million versus the previous year’s loss of CAD 12 million. Aurora also reported a gross profit of CAD 43 million for the year versus last year’s gross profit of CAD 16 million.

Q4-2018 Results:

For the fourth quarter of 2018, the company reported that its revenue increased 223% to CAD 19.1 million from last year’s CAD 5.9 million for the same time period.

Fourth quarter net income increased to CAD79 million, versus a net loss of CAD20 million for the previous year. It was 16% better than the previous quarter’s revenue of CAD 16.1 million. Gross margins improved to 74% from the third quarter’s gross margin of 59%.

Below table shows the results of the company in Q4-2018, Q3-2017 and Q4-2017.

THE FED INCREASED RATES FOR THIRD TIME IN 2018:

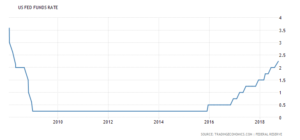

Following a two-day meeting, Jeremy Powell, – chairman of the Federal Reserve’s Open Market Committee -, announced on Wednesday September 26, the central bank was increasing interest rates for the third time this year.

This unanimous decision, which had been widely anticipated, increased rates by 25 basis points, to a range of 2% to 2.25%. It was the eighth time the committee has raised rates since late 2015.

Below is a 10-year chart showing the 8 fed fund rate hikes, since the FED started increasing interest rates in December of 2015.

PGM CAPITAL’s COMMENTS & ANALYSIS:

Aurora:

Aurora reported a good quarter, despite some areas of concerns that marred an otherwise strong quarter. It is also important to note that this quarter and the 2018 fiscal year ended on June 30, 2018, which means that the MedReleaf acquisition is not included because it closed in July. The CanniMed acquisition closed on May 1, 2018, meaning that this quarter only includes 2/3 of CanniMed as well.

The company was able to harvest 83% more cannabis than last quarter and sold 20% more, leading to a healthy buildup in inventory. It is earnestly anticipating the legalization in October.

The average price of the product sold was CAD 9.20 per gram, an increase of 15% versus the third quarter and 23% higher than last year’s fiscal fourth quarter.

The increase was attributed to the amount of cannabis oils sold. The total amount of cannabis sold in the quarter including oils were 1,617 kilograms (kg), a 19% increase sequentially and a 114% increase year-over-year.

U.S.A. Listing:

Aurora confirmed the intends to list its securities on a senior U.S Stock Exchange, although it didn’t specify which exchange. The company said that it would file a Form 40-F Registration Statement with the Securities and Exchange Commission.

Regarding the listing of the company’s shares on a senior USA-Exchange, Aurora Chief Executive Terry Booth said:

“Listing our shares on a senior U.S. exchange reflects the level of corporate and business maturity and our high-paced execution. This listing provides access to a broader investor audience who gain the opportunity to participate in our continued success.”

We believe that the company’s financial report of Monday September 24th, marks a milestone in terms of disclosure and shareholder communication for cannabis firms with Aurora leading the pack in this matter. While other firms have been secretive or scaling back their disclosure, we believe that Aurora has just made it clear that they are ready to behave like an adult in the corporate world.

Based on the above we maintain our STRONG BUY rating on the shares of the company.

Disclosure:

I/We are long share holders of Aurora Cannabis.

FED Rate Hike:

The Fed had kept its target rate anchored near zero from December 2008 until this hiking cycle began as it sought to bring the economy out of the financial crisis slump.

The committee still indicated another rate hike before the end of 2018 and likely three more in 2019. There’s one more increase factored in for 2020, bringing the median range to 3.4 percent where it is expected to stay through 2021 before settling to 3 percent over the longer run, an increase from June’s projection of 2.9 percent.

U.S.A. National Debt:

A hike in interest rates boosts the borrowing costs for the U.S. government and fuel an increase in the national debt. A report from 2015 by the Congressional Budget Office and Dean Baker, a director at the Center for Economic and Policy Research in Washington, estimates that the U.S. government may end up paying $2.9 trillion more over the next decade due to increases in the interest rate, than it would have if the rates had stayed near zero.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that; share prices don’t move in a straight line. A Past Performance Is Not Indicative Of Future Results. Technology stocks and stocks of startups and maturing companies, experience a higher volatility than the ones of developed market big-caps.

Yours sincerely,

Eric Panneflek