Dear PGM Capital Blog reader,

In this weekend blog article, we want to look back on the month of January, which will go into history as the best January for the Global Capital Markets since 1987.

Stocks rose to close out their best January in three decades as strong earnings on the global front and a the USA Federal Reserve indicating it will pause rate hikes caused investors to rush back into the market following a vicious December sell-off.

USA MARKETS:

As can be seen from below charts, the S&P 500 jumped 7.87 percent in the month of January, its best January performance since 1987, and its biggest monthly gain since October 2015.

The Dow rose 7.17 percent in January, its largest one-month rise since 2015 and biggest January gain in 30 years, as can be seen from below chart.

EUROPEAN MARKETS:

European markets performance was triggered by blog buster earnings from the following European companies:

Royal Dutch Shell:

On Thursday, January 31, Anglo-Dutch, Royal Dutch Shell (RDSA.AS), reported its Q4-2018 and FY-2018, financial results.

Cash flow from operations, a crucial measure of the sustainability of spending, was US$22 billion in the fourth quarter, three times the level a year earlier. That figure benefited from a US$9.1 billion positive move in working capital, mainly due to the decline in crude prices and lower inventory levels.

Chief financial Officer Ms. Jessica Uhl, said organic free cash flow for the whole of 2018 was US$31 billion, surpassing its 2016 target to deliver US$25 billion to US$30 billion annually by 2020.

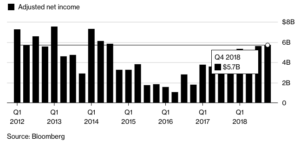

Adjusted net income of US$5.69 billion beat analysts’ estimates was the highest for the period in at least six years, matching an era when oil was closer to $100 a barrel, as can be seen from below chart.

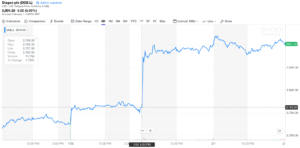

Based on the news, shares of the company jumped with approx. 3.8 percent as can be seen from below chart.

Roche:

On Tuesday, January 29, Swiss health care giant Roche (ROG.VX) reported a 7 percent rise in 2018 sales, highlighting strong demand for its new range of medicines.

Group sales climbed to 56.8 billion Swiss francs ($57.2 billion) with net income increasing by 24 percent, which included the benefits from the U.S. tax overhaul in early 2018. This beat an estimate in a Reuters poll which had predicted sales of 56.4 billion Swiss francs.

As can be seen from below chart, shares of company jumped with more than 2 percent on the news.

Diageo:

On Thursday January 31, Diageo (DGE.L), the world’s largest spirits company, reported its financial results for H2-2018.

The maker of Johnnie Walker Scotch and Smirnoff vodka, beat half-year earnings and sales forecasts on stronger demand from China and India and said it would buy back 660 million pounds (US$866 million).

- Net sales (£6.9 billion) was up 5.8% with organic growth partially offset by unfavorable exchange. Reported operating profit (£2.4 billion) was up 11.0%, driven by organic growth.

- Organic operating profit grew 12.3%, ahead of top line growth.

- Cash flow continued to be strong, with net cash from operating activities at £1.6 billion, up £356 million and free cash flow at £1.3 billion, up £317 million.

- The interim dividend increased 5% to 26.1 pence per share, payable on April 11, 2019, for shareholders on record of March 1, 2019.

- The ex-dividend date is set for February 28, 2019.

Based on the news the shares of the company jumped approx. 4.5 percent to close the week at an all-time high of GBP 29.015 per share, as can be seen from below chart.

CHINA:

Alibaba:

On Thursday January 31, Alibaba Group Holding Limited (NYSE: BABA) reported third-quarter fiscal 2019 earnings of US$1.77 per share, beating analysts estimate by 14 cents. Also, earnings increased 15% year over year.

- The company reported revenues of RMB117.27 billion (US$17.06 billion), up 41% from the year-ago quarter.

- Core Commerce: revenues in the quarter were RMB102.84 billion (US$14.96 billion), reflecting an increase of 40% on a year-over-year basis.

- China commerce retail business (69% of total revenues): revenues in the quarter were RMB81.06 billion (US$11.79 billion), reflecting an increase of 35% year over year.

- Cloud Computing: revenues in the quarter were RMB6.61 billion (US$962 million), up 84% from the year-ago quarter.

Based on the news the shares of the company jumped approx. 6.4 percent, as can be seen from below chart.

CANNABIS INDEX:

Cannabis stocks performed extremely well in the month of January, for which the North American Marijuana increased with 33.28 percent in the month, as can be seen in below chart, making it the best performing sector in the month.

PGM CAPITAL’s ANALYSIS & COMMENTS:

USA:

Similar to the European and Chinese markets, the performance of the markets on Thursday January 31 had a great contribution to the robust gains for the month of January 2019.

The gain Thursday was driven by better-than-expected earnings from a range of companies, including Facebook and General Electric.

Shares of Facebook surged 10.8 percent after the company’s quarterly results easily topped expectations. GE shares jumped 11.65 percent on stronger-than-forecast revenue. These results come during the busiest week of the corporate earnings season.

Europe:

London’s blue-chip stocks bagged gains for a third consecutive session on Thursday, January 31, as stellar earnings from Shell and Diageo helped cushion losses in banks and growing concerns over Europe’s economic health.

The FTSE 100 added 0.4 percent after earlier hitting its highest level in nearly three weeks. As can be seen from below chart, mainly thanks to the gains of Thursday, January 31, the FTSE-100, recorded a gain of 4.34 percent for the month of January 2019.

The German DAX-30, – the Börse of Europe biggest Economy – appreciated in the month of January 2019, with approx. 5.7 percent, as can be seen from below chart.

China:

Chinese equities, on the back of, beside others, Sinopec (0386.HK) and Tencent (0700.HK), bounced back, for which the Shanghai index appreciated with approx. 6.20 percent in the month of January, as can be seen from below chart.

PGM Component 50 Index:

As can be seen from below chart the PGM Component 50 Index, which comprises the Top 50 of all the securities in the portfolios under our management with their respective weight factors, on the back of the cannabis sector, did very well in January of this by appreciating with 10.01 percent.

Disclosure:

I / We are long shares of Diageo, Royal Dutch Shell, Sinopec, Tencent, Alibaba and several Cannabis Companies, but do not own Roche, GE or Facebook.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. A Past Performance Is Not Indicative Of Future Results. Shares of emerging markets and commodity based companies might experience a higher volatility than the ones of developed market big-caps.

Yours sincerely,

Eric Panneflek