Dear PGM Capital Blog reader,

In this weekend’s blog article, we want to take an in-depth look into the current wave of Mergers and Acquisitions (M&A), that are happening in the Energy sector.

INTRODUCTION:

The terms merger and acquisition mean slightly different things, though they are often used interchangeably.

Merger:

In the purest sense of the term, a merger happens when two firms, often of about the same size, agree to go forward as a single new company rather than remain separately owned and operated. This type of action is more precisely referred to as a “merger of equals.” Both companies’ stocks are surrendered and new company stock is issued in its place.

Acquisition:

When one company takes over another and clearly establishes itself as the new owner, the purchase is called an acquisition. From a legal point of view, the target company ceases to exist, the buyer absorbs the business and the buyer’s stock continues to be traded while the target company’s stock does not.

THE MERGER OF ENSCO & ROWAN:

On Thursday, April 11, UK-based Ensco (NYSE: ESV) has completed its merger with smaller rival Rowan (NYSE: RDC) to create the world’s largest offshore drilling firm by fleet size.

While Shares of Ensco Rowan are trading on the NYSE under the ESV ticker; the company will maintain its headquarters in London with a significant presence in Houston

Shares of the merged company have been consolidated through a 4:1 reverse split, resulting in ~197M shares outstanding; legacy ESV and RDC shareholders own a respective 55% and 45% of the combined company.

Ensco and Rowan shareholders will hold 55% and 45% of the new firm respectively.

The new firm has a total of 54 jackup rigs, 16 drill-ships, 12 semi-submersibles and two deepwater managed units.

CHEVRON ACQUISITION OF ANADARKO PETROLEUM:

On Friday, April 12, Chevron (NYSE: CVX), the second-largest US oil and gas company, has agreed to a 50billion USD deal to buy Anadarko Petroleum (NYSE: APC), one of the country’s leading independent producers.This will be considered the most significant move towards consolidation in the American industry since the decline in crude prices that began in 2014.

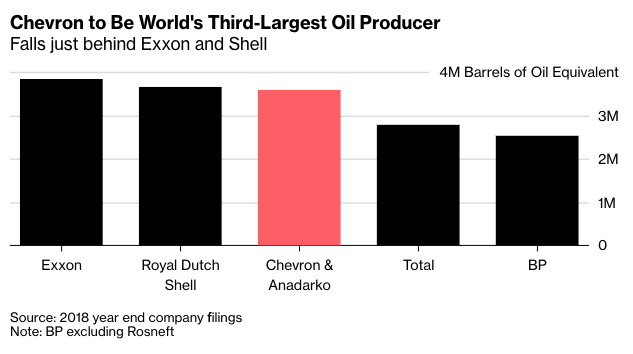

The takeover puts Chevron neck-and-neck with the oil and gas production of Exxon Mobil Corp. and Royal Dutch Shell Plc, both of which have dominated Big Oil over the past decade.

The deal is the biggest takeover in the oil and gas industry since Shell’s 47 billion pound ($61 billion) purchase of BG Group in 2015.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Mergers & Acquisitions:

The energy industry is teeming with M&A activity, as companies seek to improve operations.

Companies in the energy industry are focused on improving operational efficiencies and analytical capabilities. The issues are urgent for oil and gas companies, because of depressed prices meaning that profits are hard to come. They are also essential for renewable energy, which has been quite expensive in some cases, because the infrastructure is not in place.

The Ensco Rowan Merger:

The merged company is now the world largest offshore drilling contractor by fleet size by a big margin with 82 rigs in its fleet. For comparison, drilling giant Transocean (NYSE: RIG), which recently bought rival Ocean Rig, prior to the acquisition said the merged fleet would have 57 rigs.

Apart from the sheer size of the fleet, the driller will have one of the most diversified footprints geographically.

The Chevron takeover of Anadarko:

The US$ 65 per-share stock-and-cash deal announced Friday, April 12, that is sees Chevron doubling down on its expansion into the fast-expanding Permian Basin of West Texas and New Mexico, while also increasing its exposure to liquefied natural gas with Anadarko’s project in Mozambique.

The new company will sell US$15 billion to US$20 billion of assets from 2020 to 2022 to reduce debt and return cash to investors.

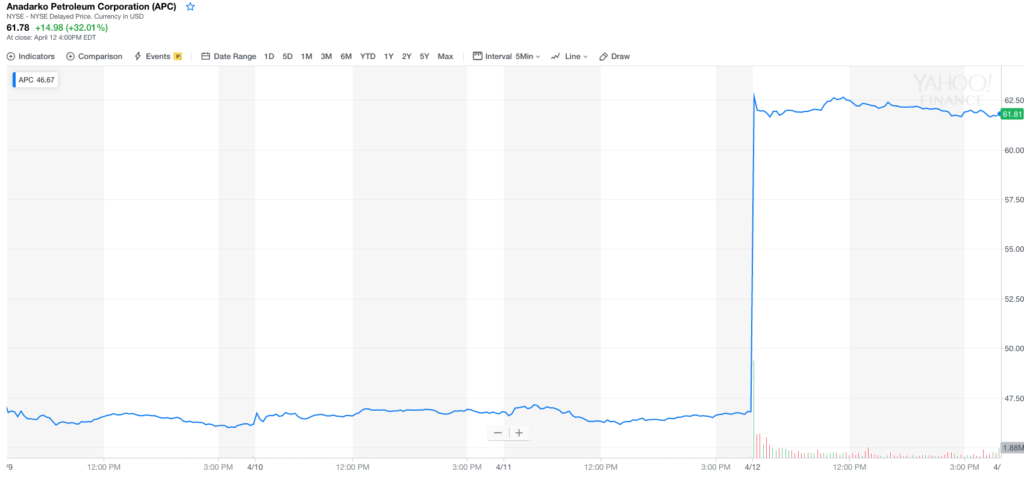

Based on the announcement of the deal Anadarko shares rose 32 percent to US$ 61.78 in New York, as can be seen from below 5-day chart.

On the other-hand Chevron shares fell 4.9 percent, the biggest drop since February last year.

Outlook for the Oil Sector:

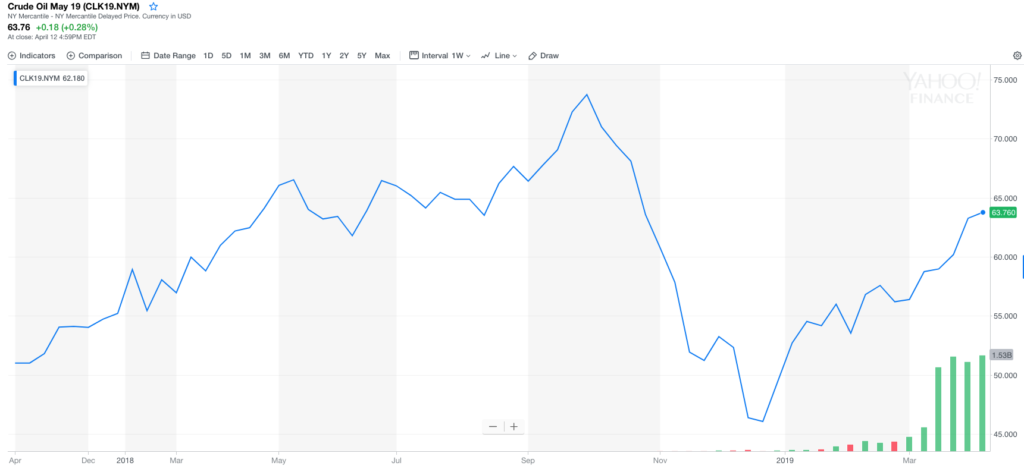

Oil prices are approaching breakout levels, and the final day of trading this week will offer clues about whether crude futures can keep rallying.

As can be seen from below chart, Brent prices increased more than 34%, to year-to-date, to close on Friday April 12 at US$ 71.55 a barrel.

Meanwhile, U.S. West Texas Intermediate crude approached US$ 64 a barrel on Friday, as can be seen from below chart.

The main catalyst for the bullish run is a sharp pullback in OPEC’s output at the start of a six-month production-cutting deal, which was bolstered by top exporter Saudi Arabia’s pledge to pump well below its quota.

We believe that both oil prices benchmarks are trading in a region that could portend a further rally.

Disclosure:

I / We are long shares of Ensco Rowan plc.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. A Past Performance Is Not Indicative Of Future Results. Shares of emerging markets and commodity based companies might experience a higher volatility than the ones of developed market big-caps.

Yours sincerely,

Eric Panneflek