Dear PGM Capital’s Blog reader,

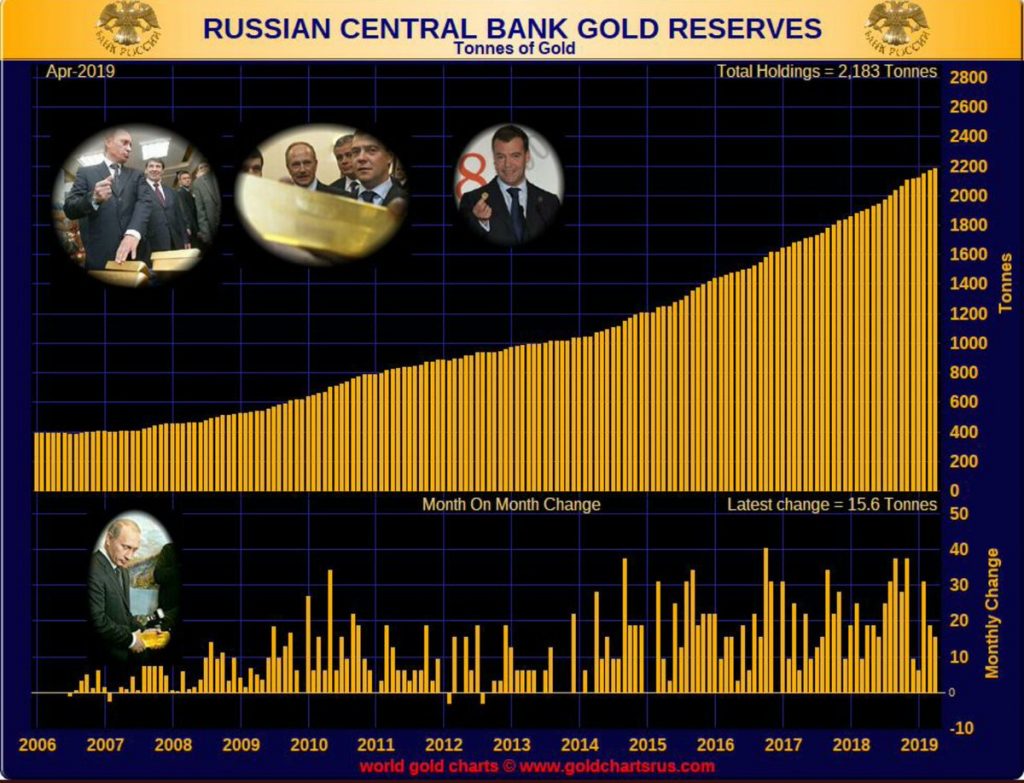

Russia once again added to its growing gold reserves in April, buying another 15.55 tons (metric ton) of the yellow metal, bringing its total gold reserves to 2,183.46 tons. As the world’s fifth largest national holder of gold, this puts it within spitting distance of the World’s No.s 3 and 4, Italy and France which respectively report their gold holdings at 2,451.8 tonnes and 2,436,0 tonnes.

INTRODUCTION:

With Russian’s recent addition, to its growing gold reserves in April, according to a press release from the Central Bank of Russia, it now holds 2,183.46 tons of gold.

Russia has expanded its gold holdings by 71.53 tons through the first four months of 2019. Russian gold reserves increased 274.3 tons in 2018, marking the fourth consecutive year of plus-200 ton growth.

Meanwhile, the Russians sold off nearly all of its US Treasury holdings. According to Bank of America analysts, the amount of US dollars in Russian reserves fell from 46% to 22% in 2018.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Why is Russia Selling US Treasuries & Buying Gold:

Russia has been the largest annual accumulator of gold for some years now, at least as far as figures reported to the IMF go.

Russia, however, seems to have been following a conscious policy of replacing most of its U.S. dollar-related holdings in its forex mix given the imposition of mostly Crimea-related U.S. economic sanctions.

With U.S. under the Trump Administration seeming increasingly willing to impose economic weapons against countries which it deems to be unfriendly, it would not be too surprising if some other countries were to follow the Russian lead.

In an appearance on RT, Peter Schiff said he thinks the Russians are preparing for an impending dollar crisis.

According to the World Gold Council, last year central banks added the most gold to their reserve totals since President Nixon cut the U.S. dollar’s ties to gold in 1971. So far this year central bank gold acquisitions still remain elevated, with Russia continuing to lead the pack, although at perhaps a slightly lower rate than last year.

Gold thus far retains a prominent role in global finance with few central banks.

The apparent acceptance of the yellow metal’s global economic role should stand it in good stead in the months and years to come Particularly since global new mined supply is at the very least plateauing. Many expect new mined supply to start turning down in the near future (peak gold) given the dearth of major new discoveries and continuing consolidations among the gold majors with older mines approaching the ends of their lives not able to be replaced by new projects already in the pipeline.

Disclosure:

I/We are Long Gold, Silver and other precious metals investors.

A Word of Caution:

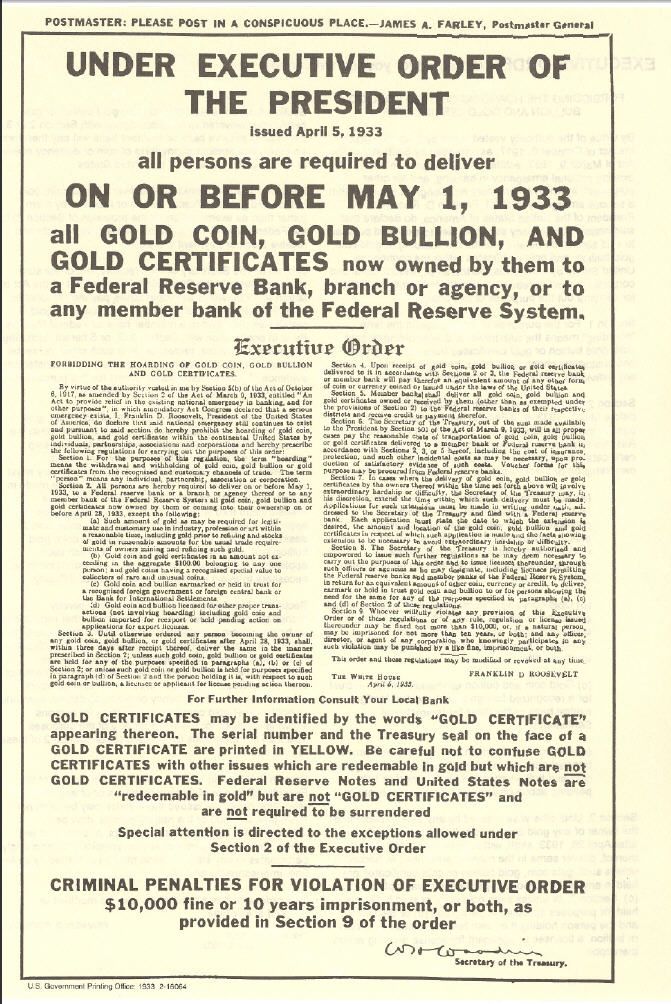

Gold is a politically sensitive asset, which is also trading as futures on secondary markets. With the consequence that policy makers and central bank are able to short it in order to suppress its price. On the other government might also confiscate gold holdings of its people via an executive order, like USA president – Franklin D. Roosevelt -, did in 1933, via executive oder 6102.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind prices don’t move in a straight line. Past Performance Is Not Indicative Of Future Results. Precious metals and stocks of their producers, experience a higher volatility than the ones of developed market big-caps.

Yours sincerely,

Eric Panneflek