Dear PGM Capital’s Blog reader,

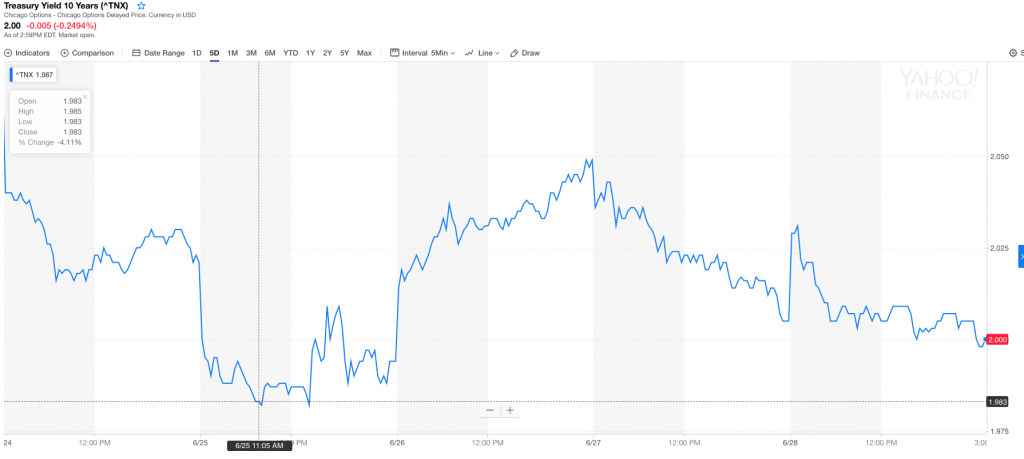

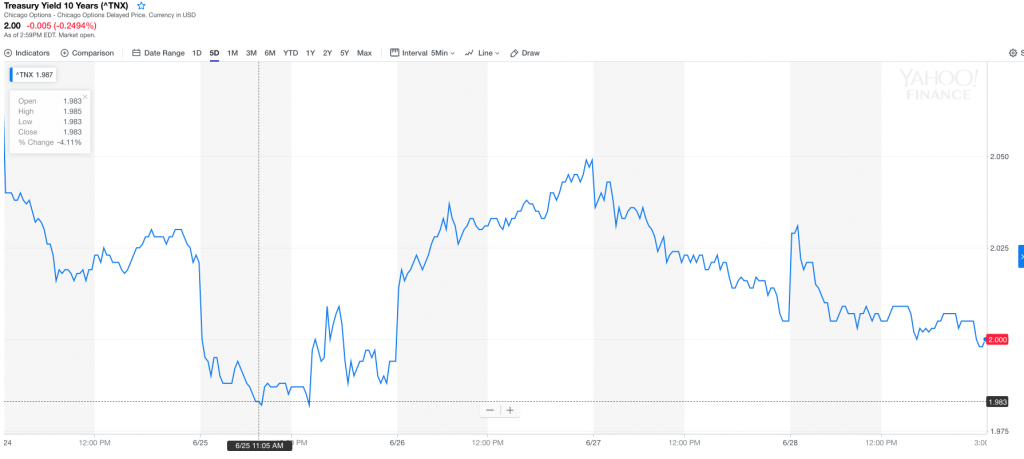

The yield of the US 10-year Treasury has declined below 2% on several recent trading days, in the week of June 24, to close on Friday, June 28, at 2 percent as can be seen from below 5-day chart.

INTRODUCTION:

A United States Treasury security is a government debt instrument issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Treasury securities are often referred to simply as Treasurys.

Although the United States is a sovereign power and may default on its debt, its strong record of repayment has given Treasury securities a reputation as one of the world’s lowest-risk investments.

The 10-year Treasury note has become the security most frequently quoted when discussing the performance of the U.S. government bond market and is used to convey the market’s take on longer-term macroeconomic expectations. Below chart shows the yield of the 10-year treasury note in the periode of April 1953 – May 2019.

YIELD 10-YEAR NOTE BELOW 2%:

The dip below 2% on the 10-year happened again on Tuesday, June 25, in the morning after a disappointing consumer confidence reading, as investors looked for safety with the much weaker-than-expected data hitting its lowest level since June 2017, as can be seen from below chart.

That has happened five times in the past decade and has been key to S&P 500 performance.

According to history, a move under the key psychological level of 2% on the 10-year treasury note is a big deal, and bodes well for stocks.

INVERTED YIELD CURVE:

An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This type of yield curve is the rarest of the three main curve types and is considered to be a predictor of economic recession.

On Friday, March 22, the U.S. 10-year Treasury note dipped below the yield on the 3-month paper, for the first time since mid-2007.

As can be seen from below 1-year chart which shows the yield of 10-Year Treasury Minus 3-Month Treasury, since May 9 the yield curve in the USA is inverted.

PGM CAPITAL’s ANALYSIS & COMMENTS:

U.S.-China trade tensions, global growth concerns, and falling inflation expectations have prompted demand for haven assets such as U.S. Treasurys.

Subdued inflation is supportive for bonds because it means less risk to the purchasing power of a bond’s fixed interest and principal payments.

The rally in government bonds is broad-based, with yields on 10-year debt in Germany, Japan, Holland, Switzerland, and Denmark among those that are in negative territory.

Investors who buy new bonds at such levels are effectively paying borrowers to hold their money.

The bond market often is viewed as less flighty than the stock market and perhaps a more reliable indicator of where the economy is headed.

The two are sending mixed signals. While Treasury yields keep falling, stocks keep rallying.

Outlook:

We believe that yields are going to be lower for longer; inflation is going to be lower for longer; and growth is going to be lower for longer,

Over the past decade, the US 10-year note has dropped below 2% on five other occasions (with a minimum of 3 months between episodes). Three months after these crosses, major global Indexes have traded higher 100% of the time.

While we believe that the bond markets appear to be signaling an economic slowdown in the USA, equities suggest growth will continue in a low inflation Goldilocks scenario.

Both stories make sense if we conclude bond markets are focused on a pre-emptive Fed strike to forestall the risk of a recession, while equities are telling us that the Fed will be successful.

Low interest rates also negatively affect people who live off the interest income from their savings, so they cut back their spending. When a large group of people, such as baby boomer retirees, reduce their spending, overall economic activity slows.

Also a liquidity trap happens when interest rates are so low that they don’t serve the normal function of spurring the economy to growth. Instead, they reduce the flow of money to the Main Street economy because it goes into investments in assets that don’t produce employment, such as the stock market and paying down loans.

This means money doesn’t flow through the economic system. When that happens, unemployment rises as companies lay off expensive workers and hire contractors and temporary or part-time workers at lower prices. When wages decline, people can’t pay for things and prices on goods and services are forced down, leading to more unemployment and lower wages. This is the danger of deflation, which is difficult to stop as the economy spirals down.

There is an old saying on Wall Street that the market is driven by just two emotions: fear and greed.

We have predicted for years that the years 2019 – 2021, might be very challenging, for retirees, and income investors.

Just as the market can become overwhelmed with greed, the same can happen with fear.

In challenging times, an ahead of the curve knowledge and mindset, combined with knowledgeable, trustworthy and experienced investment advisor, can make all the difference.

We of PGM Capital, are at your service in these challenging times, because we believe that;

Yours sincerely,

Eric Panneflek