Dear PGM Capital blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you why Investing in Anheuser-Bush InBev at current price, can be lucrative for value investors.

INTRODUCTION:

Anheuser-Busch InBev SA/NV, a brewing company, engages in the production, distribution, and sale of beer, alcoholic beverages, and soft drinks.

The company offers a portfolio of approximately 500 beer brands, including: Budweiser, Corona, and Stella Artois; Beck’s, Castle, Castle Lite, Hoegaarden, and Leffe; and Aguila, Antarctica, Bud Light, Brahma, Cass, Cristal, Harbin, Jupiler, Michelob Ultra, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol.

It has operations in North America, Latin America West, Latin America North, Latin America South, Europe, Africa, and the Asia Pacific.

The company was formed following the acquisition of American brewer Anheuser-Busch by Belgian-Brazilian brewer InBev, which is a merger of AmBev and Interbrew. and is headquartered in Leuven, Belgium.

Anheuser-Busch InBev SA/NV is a publicly listed company, with its primary listing on the Euronext Brussels with symbol (ABI). It has secondary listings on Mexico City Stock Exchange, Johannesburg Stock Exchange and New York Stock Exchange.

FUNDAMENTAL ANALYSIS:

In this article we are going to estimate the intrinsic value of Anheuser-Busch InBev SA/NV by projecting its future cash flows and then discounting them to today’s value.

This is done using the Discounted Cash Flow (DCF) model.

What’s the estimated valuation?

We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company’s cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase.

In the first stage, we need to estimate the cash flows to the business over the next ten years. When possible we use analyst estimates, but if these are not available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

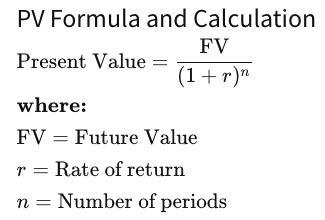

Generally we assume that a dollar today is more valuable than a dollar in the future; Thus the sum of these future cash flows is then discounted to today’s value:

In below calculation we will use as the rate of return “r”= 6.7%, which is based on a levered beta of 0.870.

Note: Beta is a measure of a stock’s volatility, compared to the market as a whole.

PV Formula and Calculation:

Present Value of the sum 10-year Cash Flow (PVCF)= US$116.9billion

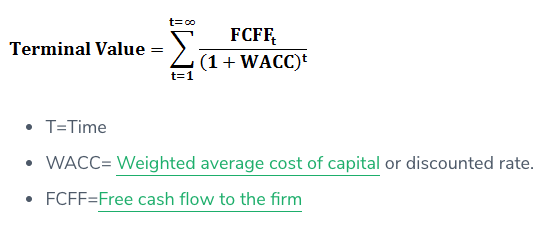

Terminal Value Calculation:

In finance, the terminal value (continuing value or horizon value) of a security is the present value at a future point in time of all future cash flows when we expect stable growth rate forever.

In this case, we have used the 10-year government bond rate (0.8%) to estimate future growth. In the same way as with the 10-year ‘growth’ period, we discount future cash flows to today’s value, using a cost of equity of 6.7%.

Terminal Value (TV) = FCF2029 × (1 + g) ÷ (r – g) = US$19b × (1 + 0.8%) ÷ (6.7% – 0.8%) = US$318billion

Present Value of Terminal Value (PVTV) = TV / (1 + r)10 = $US$318b ÷ ( 1 + 6.7%)10 = $166.20b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$283.10b.

To get the intrinsic value per share, we divide this by the total number of shares outstanding. This results in an intrinsic value estimate in the company’s reported currency of $144.48.

However, ABI’s primary listing is in Belgium, and 1 share of ABI in USD represents 0.886 ( USD/ EUR) share of NYSE:BUD, so the intrinsic value per share in EUR is €128.09. Relative to the current share price of €83.61, at the close of the market on Friday July 19, 2019.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Based on the above the company appears quite undervalued at a 35% discount to where the stock price trades currently.

Based on the above calculation, we have a STRONG BUY rating on the shares of the company at current price level.

Disclosure 1:

We own shares of Anheuser-Busch InBev SA/NV in our personal portfolio.

Disclosure 2:

Due to the very complex calculations outlined in this article we have start writing it early June and finished it on Friday, July 19, ahead of its earnings report of Thursday, July 25.

Q2-Financial Report:

On Thursday, July 25, the company reported its Q2/H1 financial report, showing that revenues of the company’s three global brands—Budweiser, Stella Artois, and Corona—grew 8% over the first half of the year.

It also reported its fastest beer sales growth in five years.

Based on the above shares of the company rose with approx. 5% on Thursday, to close the trading week on Friday, July 26 at YTD High of Euro 90.43 as can be seen from below chart.

Word of Caution:

Although the valuation of a company is important, it should not be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to “what assumptions need to be true for this stock to be under/overvalued?”

If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek