Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you, why investing in Pepsico Inc, can be lucrative for value investors.

INTRODUCTION:

PepsiCo, Inc. (NYSE: PEP), is an American multinational food, snack, and beverage corporation headquartered in Harrison, New York, and has interests in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products.

The company was formed in 1965 with the merger of the Pepsi-Cola Company and Frito-Lay, Inc. PepsiCo has since expanded from its namesake product Pepsi to a broader range of food and beverage brands, the largest of which included an acquisition of Tropicana Products in 1998 and the Quaker Oats Company in 2001, which added the Gatorade brand to its portfolio.

Q1-2019 FINANCIAL RESULTS:

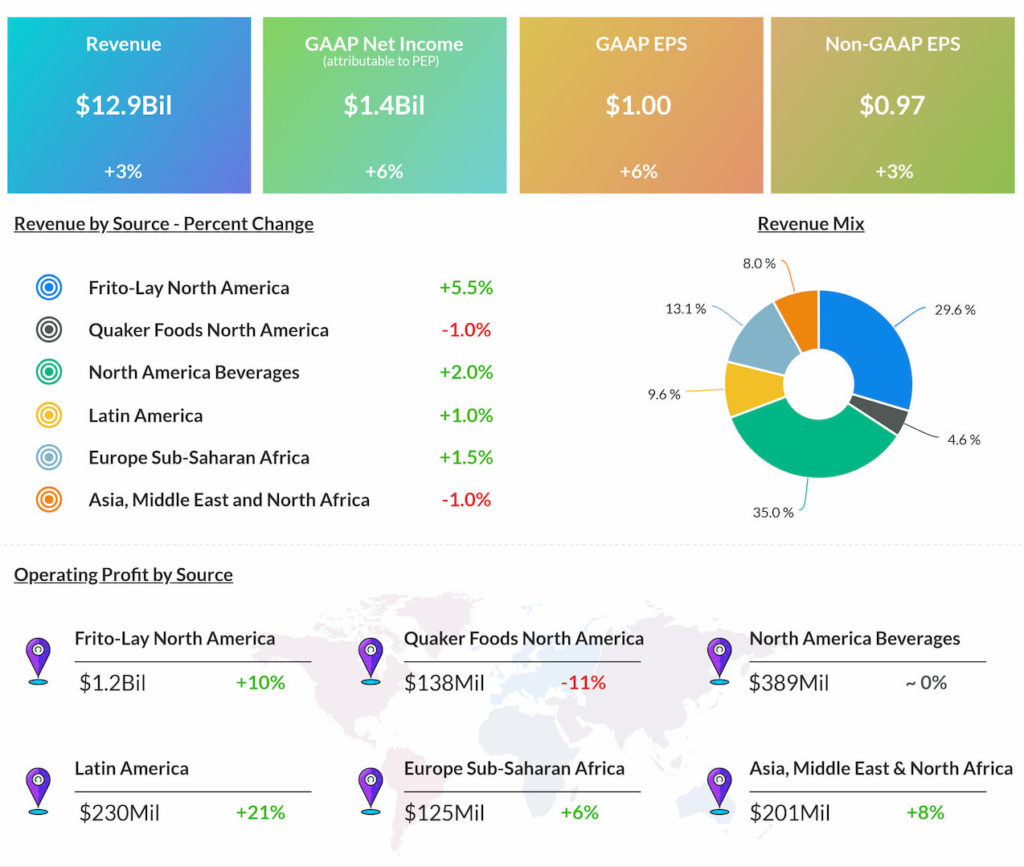

On Wednesday, April 17, before the opening bell, Pepsico Inc, released its Q1-2019, earnings report with the following highlights:

- Net revenue inched 3% higher to US$12.9 billion.

- Operating profit jumping 11% to US$2 billion.

- Net attributable income rose 6% to US$1.4 billion or US$1 per diluted share in the quarter.

Highlight of Q1-2019 Financial Results:

As can be seen from above figure, revenues from Frito-Lay North America grew 5.5% to US$3.8 billion, while that from Quaker Foods North America slipped 1% to just US$594 million.

PepsiCo Beverages North America revenue grew 2% to US$4.5 billion. Revenue from Latin America inched 1% up to reach US$1.2 billion, revenue from Europe Sub-Saharan Africa rose 1.5% to US$1.7 billion, while that from Asia, Middle East and North Africa slipped 1% to US$1 billion.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Outlook:

Following strong results, PepsiCo reiterated guidance for 2019. It plans to continue investing in capabilities that will position it for growth in the future.

For 2019, the company anticipates organic revenue growth of 4%, with nearly 1% decline in core constant-currency EPS.

Free cash flow is estimated to be around US$5 billion. Operating cash flow is expected to be nearly $9 billion, with net capital spending of US$4.5 billion.

The company plans to return US$8 billion to shareholders through dividends worth US$5 billion and share repurchases worth US$3 billion.

Pepsico Shares Jumped to All-time High:

Based on its blockbuster results, the shares of the company rose as much as 2.1% on April 17, to close the short trading week on Thursday April 18 at its highest point ever, of US$ 127.09 per share. as can be seen from below chart.

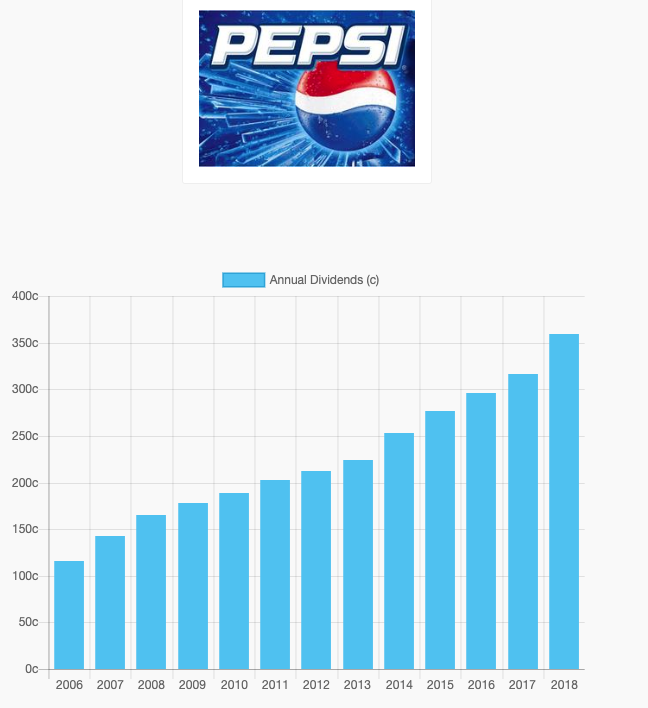

As can be seen from below chart, the company increased its yearly dividend from US$ 1.65 per share in 2008 to US$ 3.5875 per share in 2018, an increase of approx. 118 percent in ten years.

Based on the company’s fundamentals, P/E ratio, strong balance sheet and its ability to increase its dividend YOY, we have a BUY rating on the shares of Pepsico Inc.

Disclosure:

We don’t own shares Pepsico Inc in our personal portfolio.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line, that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek