Dear PGM Capital Blog readers,

On January 16, of this year, a new report showed that the billionaire Microsoft co-founder, Bill Gates, has become the largest owner of farmland in the United States.

In this blog article, we will try to find the reasons why savvy investors have been plowing millions of dollars into farmland.

INTRODUCTION:

Agriculture is the science and art of cultivating plants and livestock, being the key development in the rise of sedentary human civilization.

The history of agriculture began thousands of years ago, where farming of domesticated species created food surpluses that enabled people to live in cities.

The major agricultural products can be broadly grouped into the following; foods, fibers, fuels and raw materials (such as rubber).

Food classes include cereals (grains), vegetables, fruits, oils, meat, milk, fungi and eggs.

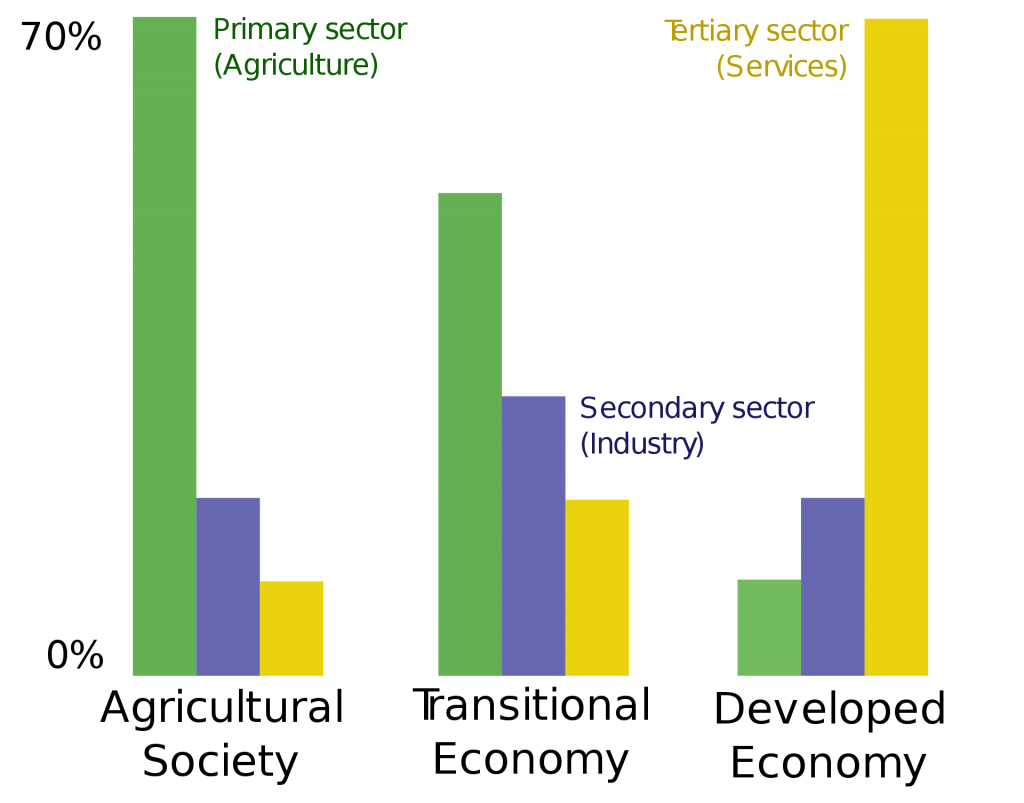

As can be seen from below chart, approx. 70% of people employed in the least developed countries, work in the agriculture sector or primary sector. With less than 2% in the most highly developed countries work in the primary sector, most of the employed people work in the service sector also called the tertiary sector.

Most agricultural commodities require great areas of land, for which only the largest countries have in abundance. In fact, four of the world’s dominant food-producing countries – China, India, the U.S., and Brazil – also rank in the top ten countries in the world for total geographic land area.

The U.S. has long been a superpower in food markets, and it is still the world’s largest food exporter – followed by the Netherlands in the second place.

Archer-Daniels Midland:

The Archer-Daniels-Midland Company (NYSE: ADM), is an American multinational food processing and commodities trading corporation founded in 1902 and headquartered in Chicago, Illinois.

The company – which is considered one of the world’s largest food commodities producers – operates through three segments: Agriculture Services and Oilseeds, Carbohydrate Solutions, and Nutrition. It procures, stores, cleans, and transports agricultural raw materials, such as oilseeds, corn, wheat, milo, oats, rice, and barley.

Deere & Company:

Deere & Company (NYSE: DE), together with its subsidiaries, manufactures, agricultural, construction, and forestry machinery, diesel engines, drivetrains (axles, transmissions, gearboxes) used in heavy equipment, and lawn care equipment and distributes various equipment worldwide.

The company – which is considered one of the world’s largest agriculture and farming equipment makers, was founded in 1837 and headquartered in Moline, Illinois.

PGM CAPITAL COMMENTS & ANALYSIS:

The world stands on the brink of a food crisis worse than any seen for at least 50 years, the UN has warned as it urged governments to act swiftly to avoid disaster.

According to the UN secretary general, – António Guterres – , unless immediate action is taken, it is increasingly clear that there is an impending global food emergency that could have long-term impacts on hundreds of millions of children and adults.

Land & Water Crisis:

The amount of land transformed by humans varies from 39% to 50%, for which land degradation, the long-term decline in ecosystem function and productivity, is estimated to be occurring on 24% of land worldwide, with cropland overrepresented.

Agriculture accounts for 70% of withdrawals of freshwater resources, and is drawing water from aquifers, and underground water sources at an unsustainable rate.

In addition to these, increasing pressure is being placed on water resources and land by industry and urban areas, meaning that water and fertile land scarcity is increasing and agriculture is facing the challenge of producing more food for the world’s growing population with reduced water resources and available land.

Aging farmers Crisis:

Much of the food we eat is the result of work by a huge number of farmers, growers and agricultural workers, but in many parts of the world, we simply pluck packets of food off supermarket shelves without giving this provenance a second thought.

The world’s farming population is growing older, in combination with the fact that young people increasingly chose city life, we have to ask ourselves:

Who is going to grow our food in the future?

Shares of Archer-Daniels Midland and Deere at all-time High:

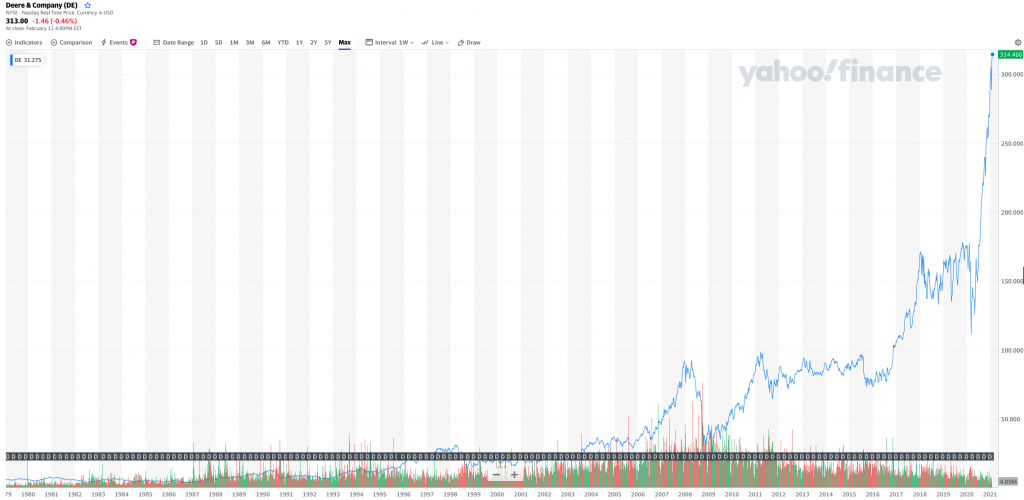

As can be seen from below 40-year charts of Archer-Daniel Midland and Deere, the both are currently trading at an all-time high, for which their stock prices accelerated, since the announcement that Bill Gates is now the USA largest owner of farmland.

It is also worth mentioning, that in the past 40-years, the company has increased its quarterly dividend every year, for which reason it also qualifies as a dividend aristocrat.

Based on the information provided in this article, we can conclude that in the near future the world will face shortage in agriculture and food commodities, and subsequent price rises that could lead to an increase in people facing food poverty.

Disclosure:

We own shares of Archer-Daniel Midland in our personal portfolio.

In the rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek