Dear PGM Blog reader,

In this new year’s blog article, we want to take the opportunity to review the year 2020 and provide potential outlook for the year 2021.

REVIEW OF THE YEAR 2020:

The year 2020 has been full of surprises that no one has ever wished for, nor anticipated.

Firstly, from June 2019 to May 2020, the bushfires that raged across Australia, burnt nearly 18.6 Million hectares and killed 1.25 billion animals. Reports from the New South Wales Bushfire Inquiry have stated the 2019-2021 bushfire as the worst australian fire season on record.

Yet, such a tragedy was soon followed by another, when the the world was caught unaware by the Coronavirus pandemic, that has infected approx. 84 million people as last stated on December 31st 2020.

Consequently, a third of the value of the S&P-500 benchmark had been erased in March as can be seen from the below chart.

As a result, the global tourism industry suffered dramatic losses, with countless cruise ships docked and passenger flights traveling at half-capacity.

From toilet paper hoarding to limits on gatherings, the pandemic’s immediate effects on our surrounding environment became clear as early as March. As daily life came to a standstill, commuter activity in major cities plummeted throughout the month.

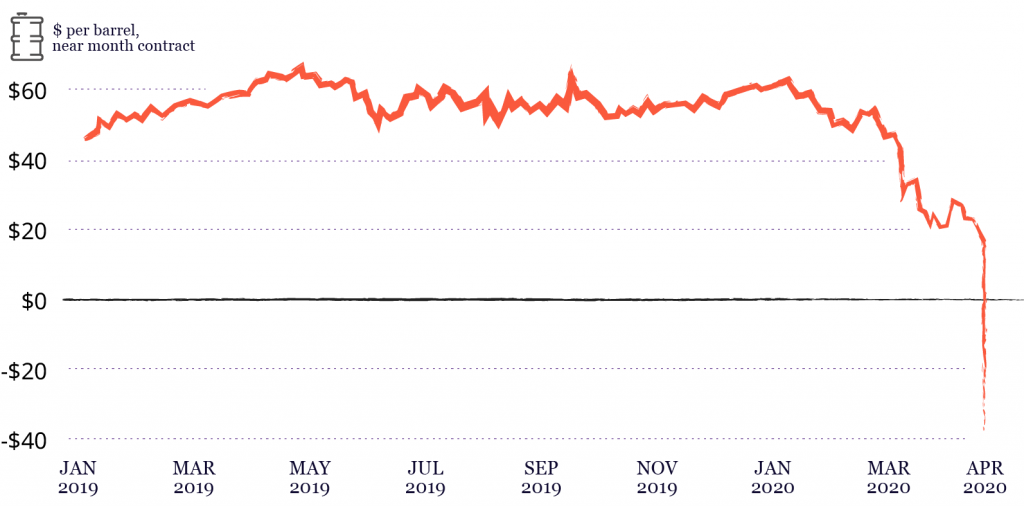

In another historic event, oil prices went negative for the first time in history. Futures contracts for WTI oil fell to a stunning -US$37.63 on April 20th, with producers actually paying traders to take the oil off their hands.

Based on the massive stimulus packages by Central Banks, which have pumped liquidity into the markets, almost all major capital markets around the world have close this very turbulent year at an all time high.

PGM TOP 10 BEST PERFORMING SECURITIES IN 2020:

Here below we will give a breakdown of the Top-10 best performing securities held in the accounts of our clients in 2020.

No 10. –LVMH Moët Hennessy-:

As can be seen from the below chart, shares of LVMH Moët Hennessy, have appreciated in 2020 with 23.34%. Additionally, the stock of the company has a dividend yield of approx. 1.00%.

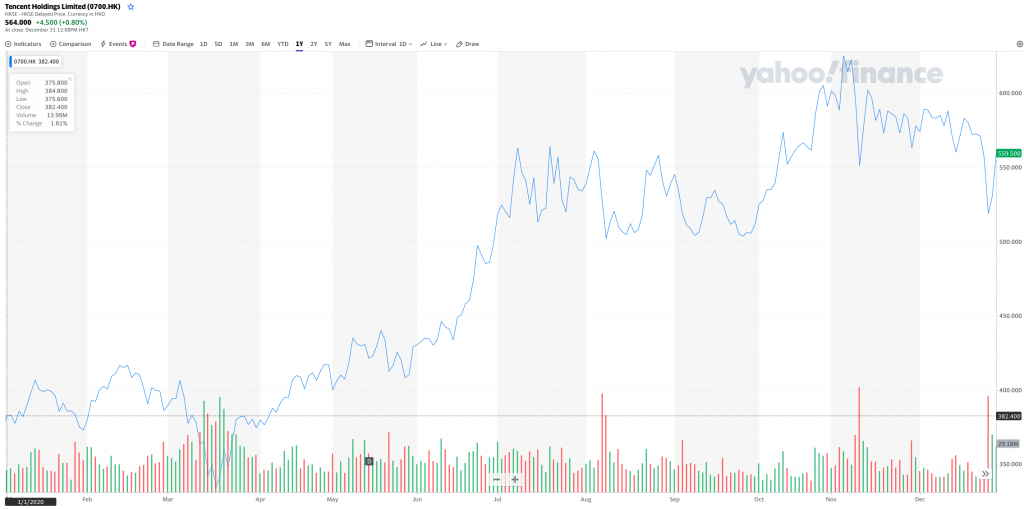

No 09. –Tencent Holding-:

As can be seen from the below chart, shares of Tencent Holding, have appreciated in 2020 with 47.6%. On top of this, the stock of the company has a dividend yield of approx. 1.21%.

No 08. –Beyond Meat, Inc.-:

As can be seen from the below chart, shares of Beyond Meat, Inc, have appreciated in 2020 with 66.18%.

No 07. –Geely Automobile Holdings Limited-:

As can be seen from the below chart, shares of Geely Automotive Holdings Ltd. have appreciated in 2020 with 68.14%. Additionally, the stock of the company has a dividend yield of approx. 1.21%.

No 06. –Baidu Inc.-:

As can be seen from the below chart, shares of Baidu Inc. have appreciated in 2020 with 71.07%.

No 05. –Marvell Technology Group Ltd.-:

As can be seen from the below chart, shares of Marvell Technology Group Ltd. have appreciated in 2020 with 85.18%.

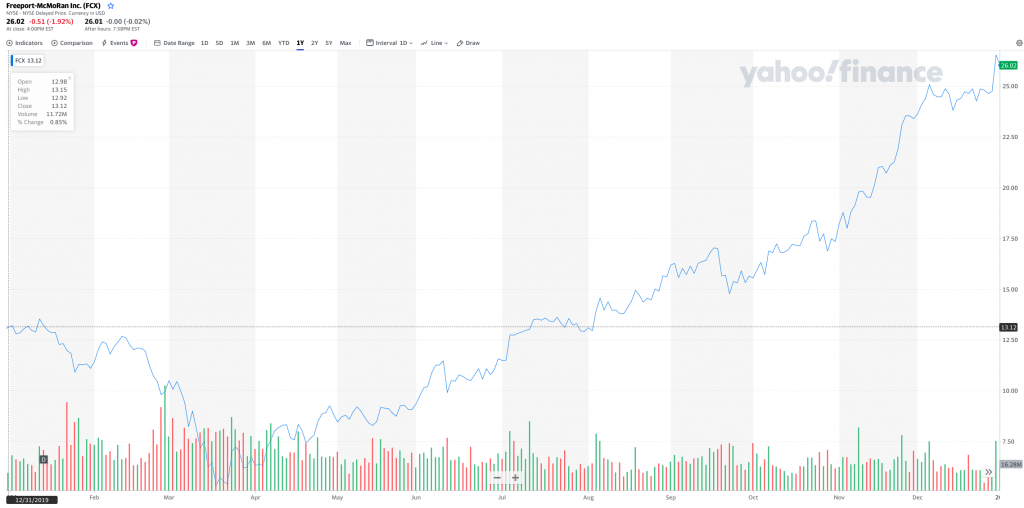

No 04. –Freeport-McMoRan Inc.-:

As can be seen from below chart, shares of Freeport-McMoRan Inc. have appreciated in 2020 with 98.23%. On top of this, the stock of the company has a dividend yield of approx. 3.48%.

No 03. –Meituan-:

As can be seen from below chart, shares of Meituan, have appreciated in 2020 with 182.27%.

No 02. –Xiaomi Corporation-:

As can be seen from below, chart, shares of Xioami Corporation, have appreciated in 2020 with 195.9%.

No 01. –NIO Inc-:

As can be seen from below chart, shares of Nio Inc, have appreciated in 2020 with 1,111.44%.

PGM CAPITAL COMMENTS & ANALYSIS:

After the turbulent ride that was 2020, many people are left wondering what 2021 will have in store.

In the first half of the year, vaccine distribution will surely take center stage. As well, economic recovery will be in focus as physical businesses resume more typical activity and regions slowly open up travel and tourism again.

Much like the financial crisis of 2008 was an inflection point for the economy, the COVID-19 pandemic has changed the course of human history. Chaos can breed opportunity, and although unemployment spiked to record highs globally, new business applications did as well.

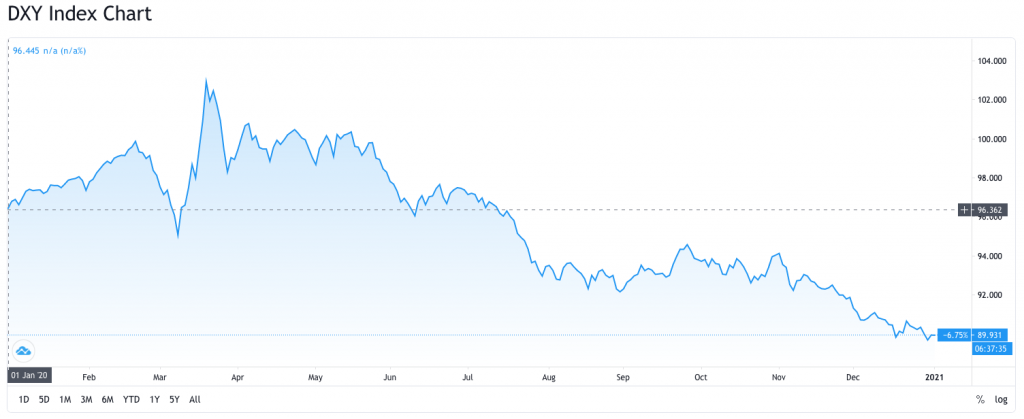

Declining USD:

As can be seen from the below 1-year chart from the USD-Index, the greenback has depreciated with 6.75% in the year 2020.

Based on the trade balance of the USA at the worst in 15 years, and increasing Debt to GDP ratio, the US-Dollar is vulnerable to a “significant depreciation” in the years ahead.

A depreciation of the US-Dollar with 6.75% in 2020, means that savers in the US-Dollars or currencies pegged to the USD, must have earned 6.7% on interest for them to maintain their purchasing power of January 1st, 2020.

The above implies that under the current market environment of near zero to negative interest rates, savers will be losers.

Or as Ray Dalio said:

PGM Top-10 Best Performing Securities:

The top 10 best performing securities in the client of PGM portfolio, shows that, over 50% of these are securities from Chinese companies, for which the rest are consumer and metallurgic companies.

With 60% of the top 10 best performing securities of PGM capital as technology related, there seems to be an indicated new normal has been set by the Covid-19 pandemic.

The above potentially indicates, that China has surpassed the USA as the world economic super power and that, based on the stimulus packages, the world might be on the brick of inflation cycle, starting 2021.

Disclosure:

We own shares of NIO, XIOAMI, Freeport-McMoRan, Baidu, and Tencent in our personal portfolio. It is also worth mentioning that the parent company of Geely – our No7 best performing security for 2020 -, in 2018, acquires 51.5% stake in SAXO BANK.

However, in the rapidly changing world and subsequent turbulence and chances of rise in inflation, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek