Dear PGM Capital Blog readers,

On Tuesday, November 24, Wall Street tor through its latest milestone when the Dow Jones Industrial Average topped 30,000 for the first time.

INTRODUCTION:

The Dow Jones Industrial Average (DJIA), – also known as the DOW 30 or DOW – , is a stock market index that tracks 30 large, publicly-owned blue chip companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The value of the index is the sum of the stock prices of the companies included in the index, divided by a factor which is currently (as of September 2020) approximately 0.152. The factor is changes whenever a constituent company undergoes a stock split so that the value of the index remains unaffected by the stock split.

The index is often re-evaluated to replace companies that no longer meet the listing criteria in comparison, to those that do.

The table below alphabetically lists the companies included in the DJIA as of August 2020:

| Dow Jones Industrial Average Components | ||

|---|---|---|

| Company | Symbol | Year Added |

| 3M | MMM | 1976 |

| American Express | AXP | 1982 |

| Amgen | AMGN | 2020 |

| Apple Inc. | AAPL | 2015 |

| Boeing | BA | 1987 |

| Caterpillar | CAT | 1991 |

| Chevron | CVX | 2008 |

| Cisco Systems | CSCO | 2009 |

| The Coca-Cola Company | KO | 1987 |

| Dow Inc. | DOW | 2019 |

| Goldman Sachs | GS | 2013 |

| The Home Depot | HD | 1999 |

| Honeywell | HON | 2020 |

| IBM | IBM | 1979 |

| Intel | INTC | 1999 |

| Johnson & Johnson | JNJ | 1997 |

| JPMorgan Chase | JPM | 1991 |

| McDonald’s | MCD | 1985 |

| Merck & Co. | MRK | 1979 |

| Microsoft | MSFT | 1999 |

| NIKE | NKE | 2013 |

| Proctor & Gamble | PG | 1932 |

| Salesforce | CRM | 2020 |

| The Travelers Companies | TRV | 2009 |

| UnitedHealth Group | UNH | 2012 |

| Verizon | VZ | 2004 |

| Visa | V | 2013 |

| Walmart | WMT | 1997 |

| Walgreens Boots Alliance | WBA | 2018 |

| The Walt Disney Company | DIS | 1991 |

THE DOW-30,000 MILESTONE:

As can be seen from below chart, on Tuesday November 24, the DOW rose 454.97 points, or 1.5%, to close at 30,046.24 for the first time.

Investors were encouraged by progress in the development of coronavirus vaccines and the news that President-elect Joe Biden’s picks of Ms. Janet Yellen for treasury secretary as positive signs for the nation’s economic stability.

Janet Yellen, aged 74, aided the nation in recovery from the Great Recession. She was a professor before taking on top roles at the FED, eventually becoming the first woman to lead the central bank. If confirmed by the Senate, that she will become the first woman to helm the Treasury Department.

PGM CAPITAL ANALYSIS & COMMENTS:

While DOW 30,000, is merely an arbitrary number that does not mean things are much better than the DOW being at 29,999, its impact lies in the significance that the DOW has finally clawed back all its losses from the pandemic and is once again reaching new heights. It is up 61.5% since its close at 18,591.93 on March 23, as can be seen from the below chart.

It a little more than nine months for the DOW to surpass the record it had set in February before panic about the coronavirus triggered the market’s breathtaking sell-off.

What got the DOW this high:

The DOW’s rocket ride to 30,000 gained big boosts from the Federal Reserve, which slashed short-term interest rates back to roughly zero as can be seen from the below chart.

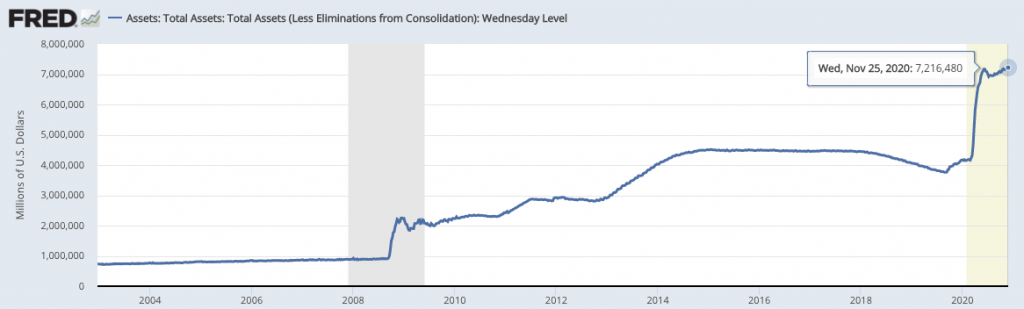

As can be seen from the below chart, the FED also came through with trillions of dollars of financial aid for the economy.

The above chart shows us that the FED has increased its balance sheet from 4.1 Trillion USD in March of this year, to 7.2 Trillion USD currently – an increase of 73.8 percent – might be the major trigger for rise of prices of financial assets and subsequently the DOW.

The above shown expansion of the FED’s balance sheet could potentially cause a hyperinflation cycle, when the velocity of money returns to normal once the COVID pandemic is over.

In the rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek