Dear PGM Capital Blog readers,

As can be seen from below chat, the US-Dollar Index, on Friday September 8, sank to 91.32 points, its lowest level since Friday, January 02, 2015, a fresh 32-month low.

INTRODUCTION:

The US-Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners currencies.

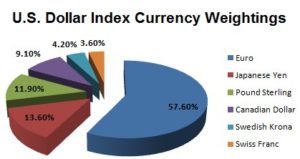

The Dollar Index is a weighted geometric mean of the dollar’s value relative to other select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight

USDX goes up when the U.S. dollar gains “strength” (value) when compared to other currencies in the basket and visa versa.

USDX is updated whenever U.S. Dollar markets are open, which is from Sunday evening New York City local time (early Monday morning Asia time) for 24 hours a day to late Friday afternoon New York City local time.

THE EURO SURGED AT HIGHEST VALUE YEAR-TO DATE:

The sliding US-Dollar sent the Euro surging on Friday, September 8, as high as 1.2035, against the US-Dollar.

As can be seen from below chart, Year-to-Date, the Euro has appreciated with approx. 13.8 percent against the US-Dollar.

THE CHINESE YUAN AT HIGHEST VALUE YEAR-TO DATE:

As can be seen from below chart, the Chinese currency, has strengthened Year-to-Date, with approx. 7.1 percent.

Prior to Friday’s, September 8, market opening, the People’s Bank of China raised its official yuan midpoint for the 10th straight session, to 6.5032 per dollar, the strongest since May 12, 2016.

The last time the midpoint had a stronger fixing for 10 consecutive days was in December 2010.

PGM CAPITAL ANALYSIS & COMMENTS:

The USD-Index:

The US-Dollar index hit its lowest level since January 2015 in early Thursday trading, at the 91.011 mark; this was a further decline from the 2017 low hit in the previous session.

The main reason for the falling US-Dollar, as the likelihood appears to dwindle that the Federal Reserve will hike its federal funds target rate later this year, as inflation remains tepid and political drama swirls in Washington.

The greenback is under “significant” pressure, based on geopolitical issues related to the North Korea nuclear situation and “kicking the can down the road” in raising the federal borrowing limit.

Gold:

Based on the geopolitical tensions and decline of the US-Dollar, Gold the ultimate safe-heaven surged to a 1-year high of US$ 1,346.64, as can be seen from below chart.

The Euro:

In a speech on Thursday, September 7, in Frankfurt, ECB chairman, Mr. Mario Draghi specifically mentioning the strength of the currency, saying the central bank is monitoring how it is affecting inflation and growth in the euro zone.

We believe that the euro appreciation is being a key reason why the ECB has held off from announcing a start to the wind down of its stimulus package.

The Chinese Yuan:

The Chinese currency, coming back into the global spotlight as data from its economy and key companies are beating analysts estimation.

Based on this, the Chinese Yuan keep on strengthening against the US-Dollar, for which on Friday, September 8, it surpassed the past the key 6.5 per dollar level a day earlier, and headed for its best week since revaluation in 2005.

We believe that similar with Gold, the smart money is going from West to East and that we haven’t seen the bottom of the USD-Index yet, and that it might fall in the short term to approx. 89 points, from which level we might see a dead cat bounce, before it continues with its decline toward the 70 points mark.

Until Next week

Eric Panneflek