Dear PGM Capital Blog readers,

In this weekend’s blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of March 23:

- The FED announced QE infinity

- Record 3.3 million USA citizen file for unemployment

- Global coronavirus infection above 700K

THE FED ANNOUNCED QE INFINITY:

On Monday, March 23, the US Federal Reserve announced it will purchase an “unlimited” amount of US Treasuries and mortgage-backed securities in order to support the financial market.

The FED also announced it will buy certain corporate bonds for the first time in history.

In a statement, the FED said aggressive efforts must be taken in order to limit the loss of jobs and income.

The FED said also it would buy assets “in the amounts needed” to support smooth market functioning and effective transmission of monetary policy.

The Washington Post called the move “unprecedented” and said that it goes “much further than what the central bank did in the 2008-2009 crisis.”

RECORD 3.3 MILLION USA CITIZEN FOR UNEMPLOYMENT:

A record 3.3 million people filed claims for unemployment in the US last week as the Covid-19 pandemic shuts down large parts of America’s economy and the full scale of the impact of the crisis began to emerge.

Experts warn of a “catastrophic unemployment crisis” after the labor department announced jobless claims filed by individuals seeking unemployment benefits rose by more than 3 million to 3.28 million from 281,000 the previous week.

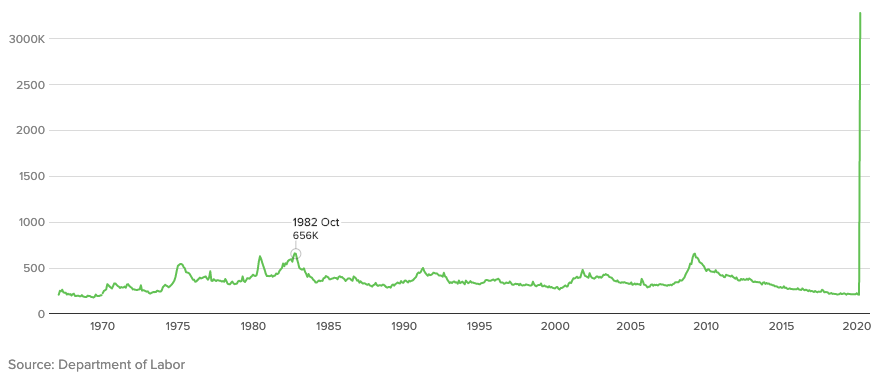

The figure is the highest ever reported, beating the previous record of 695,000 claims filed the week ending 2 October 1982, as can be seen from below chart, for First-time applications for unemployment, in the USA.

GLOBAL CORONAVIRUS INFECTION ABOVE 700K:

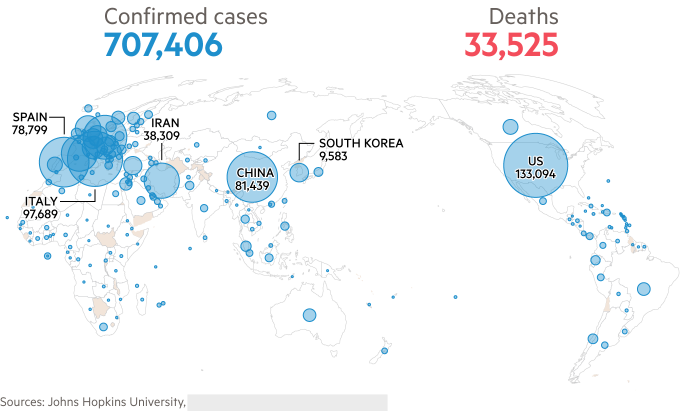

As can be seen from below chart of, Sunday, March 29, 2020, at approx. The total number of cases worldwide has surpassed 700,000 as an additional 44,279 people were confirmed to have contracted coronavirus.

The USA has so far added 9,516 cases in the past day to about 133,000, with 21 states still to report their numbers.

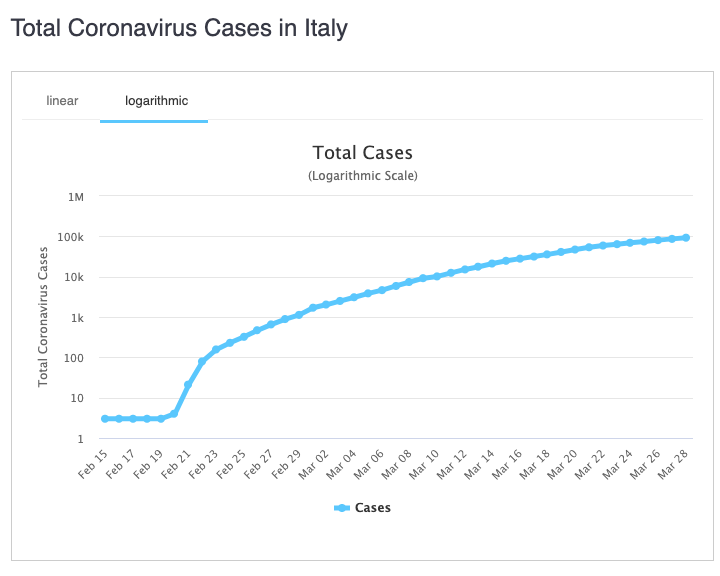

Although the growth of infected cases in the USA is increasing exponentially, the good news, however, is that the logarithmic chart of Italy, – the epicentrum- of Europe is flattening as can be seen from below chart.

PGM CAPITAL COMMENTS & ANALYSIS:

The FED QE infinity:

The vast and currently dysfunctional markets for US Treasuries, mortgages, and corporate credit have now the ultimate buyer of last resort — the Federal Reserve.

The FED’s new set of measures also means that the central bank’s balance sheet will increase markedly in size, as it becomes ensconced as the buyer of last resort across fixed-income markets. Investors should not expect any contraction any time soon, given the scale of the debt binge since 2009.

3.3 Million Jobless Claim in the USA:

The number of Americans seeking jobless aid starkly illustrates the extent of the economic devastation that the coronavirus has unleashed.

For perspective, the unemployment claims reported Thursday wipe out all the job gains for 2019 and half of 2018, and as staggering as the last week figures are, they are likely to rise in the coming weeks.

Analysts expect the USA unemployment rate, which was at a 50-year low of 3.5% in February, to top 10% as soon as next month.

Global Coronavirus infection at 700K:

After the infection curve of the coronavirus in Asia (China, Japan, South Korea, etc) has flatten, we now see that the curve in Italy, – the most affected country in Europe and the world per capita – is starting to show signs of being flatten.

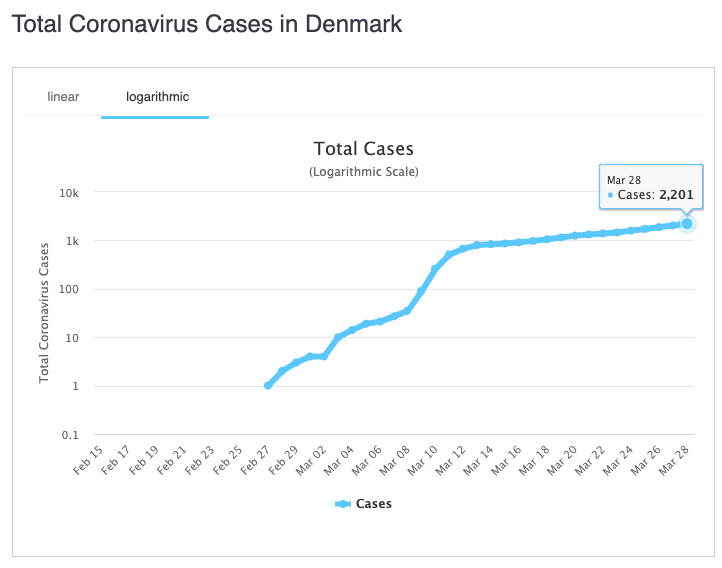

It is also worth mentioning that in Europe the curve in Denmark has already flattened and that the ones of The Netherlands and Germany besides others are also showing signs of flattening as can be seen from below logarithmic chart.

The logarithmic scale instead of the lineair scale for coronavirus infection:

The main reason why we have used the logarithmic scale in this article regarding the coronavirus infection will be explained in below video.

During the past four weeks we have worked approx. 16 hours a day. – also in the weekend – to consult our clients and provide them with the best advise during these times of uncertainties and global stress, due to the coronavirus pandemic.

History has proven, that no matter what you’re going through, there’s a light at the end of the tunnel and that capital markets are self healing.

In this rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that the market can remain irrational longer, than you can remain solvent.

Yours sincerely,

Eric Panneflek