Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you, why Investing in BP Plc (BP.L), can be lucrative for value investors.

INTRODUCTION:

BP P.l.c., formerly British Petroleum, is a British multinational oil and gas company headquartered in London, England engages in energy business worldwide.

The company was founded in 1908 as Anglo-Persian Oil Company to exploit oil discoveries in Iran. In 1935, it became the Anglo-Iranian Oil Company and in 1954 British Petroleum. In 1959, the company expanded beyond the Middle East to Alaska and it was one of the first companies to strike oil in the North Sea.

British Petroleum acquired majority control of Standard Oil of Ohio in 1978. Formerly majority state-owned, the British government privatized the company in stages between 1979 and 1987. British Petroleum merged with Amoco in 1998, becoming BP Amoco plc, and acquired ARCO and Burmah Castrol in 2000, becoming BP plc in 2001.

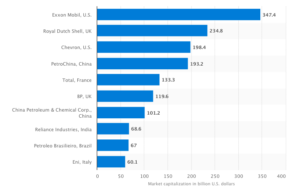

It is one of the world’s seven oil and gas “supermajors”, whose performance in 2017 made it the world’s sixth-largest oil and gas company by market capitalization, as can be seen from below chart, and the company with the world’s twelfth-largest revenue.

As of December 31, 2017, BP had operations in 72 countries worldwide, produced around 3.6 million barrels per day (570,000 m3/d) of oil equivalent. The company has around 18,000 service stations worldwide. Its largest division is BP America in the United States. In Russia BP owns a 19.75% stake in Rosneft, the world’s largest publicly traded oil and gas company by hydrocarbon reserves and production.

BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has secondary listings on the Frankfurt Stock Exchange and the New York Stock Exchange.

OPERATIONS:

BP operates through three segments: Upstream, Downstream, and Rosneft.

Upstream:

The Upstream segment is involved in the oil and natural gas exploration, field development, and production; midstream transportation, storage, and processing; and marketing and trading of liquefied natural gas (LNG), biogas, power and natural gas liquids (NGLs).

This segment also engages in the ownership and management of crude oil and natural gas pipelines; processing facilities and export terminals; and LNG processing facilities and transportation, as well as in NGLs processing business.

Downstream:

The Downstream segment is engaged in refining, manufacturing, marketing, transportation, and supply and trading of crude oil, petroleum, petrochemicals products and related services to wholesale and retail customers.

As of December 31, 2015, the Company owned 13 refineries producing refined petroleum products that it supplies to retail and commercial customers. It operates an infrastructure and logistics network that includes pipelines, storage terminals and tankers for road and rail.

Rosneft:

Rosneft has assets in various hydrocarbon regions of Russia: West Siberia, East Siberia, Timan-Pechora, Volga-Urals, North Caucasus, the continental shelf of the Arctic Sea, and the Far East. As of December 31, 2015, Rosneft owned and operated 10 refineries in Russia, owned and operated over 2,500 retail service stations in Russia and abroad.

PGM CAPITAL ANALYSIS & COMMENTS:

BP is the worlds’ eighth largest oil and gas company by revenues,

As can be seen from below chart, shares of the company have experienced substantial share price appreciation over the past two years gaining close to 50% as the company benefits from better crude oil pricing and reduced oil spill retributions.

BP and the Changing Energy Future:

BP is globally recognizing a changing energy environment. The company has incorporated a variety of energy sources into its revenue stream ranging from oil and gas to bio-fuels. In the immediate future, BP is focusing on continued expansion in gas and oil to accommodate increased market demand but is also recognizing and pursuing energy opportunities in renewable.

Below chart shows a breakdown of the projected energy consumption by 2040.

Besides the company’s activity in bio-fuel, BP is active in Wind Energy, for which it has interests in 14 sites in the US with a net generating capacity of 1,432 MW, making it one of the top wind energy producers in the country.

In January 2018 they formed a strategic partnership with Lightsource to drive growth in solar power development worldwide.

The company is now known as Lightsource BP.

Dividend:

BP has consistently been a high dividend payer. The company has sustained an increasing dividend yield for the past six years. BP’s dividend yield has also consistently surpassed the oil and gas dividend yield average of 4.52%.

Based on the closing price of Friday, April 13, the shares of the company has a dividend yield of 5.73%.

Valuation:

From the company FY 2017 financial report we can see that BP exhibits an adequate balance sheet with a sizable cash reserves from long and short-term investments.

The company’s FY-2017 financial report BP shows also an adequate income statement, for which the company has increased its total revenues to US$240 billion, exhibits better gross profit retention, as well as slightly improved operating and net income.

Conclusion:

We believe that BP offers great promise from a growth perspective, long-term debt is well covered by operating cash flow.

Based on the above we have initiated coverage of the shares of the company with a BUY rating.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek