Dear PGM Capital Blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you, why investing in the world’s biggest cruise ship companies, – at current share price level – can be lucrative.

INTRODUCTION:

The cruise industry is the fastest-growing category in the leisure travel market. Since 1980, the industry has experienced an average annual passenger growth rate of approximately 7% per annum.

The cruise line industry is estimated at a value of US$45.6 billion with around 26 million passengers annually.

The three major cruise lines are:

Carnival Corporation:

Carnival Corporation & Plc (NYSE: CCL), operates as a leisure travel company.

The company’s ships visit approximately 700 ports under the Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises (Australia), Costa Cruises, AIDA Cruises, P&O Cruises (UK), and Cunard brand names.

As of January 28, 2020, the company operated 105 ships with 254,000 lower berths. Carnival Corporation & Plc was incorporated in 1972 and is headquartered in Miami, Florida.

Royal Caribbean International:

Royal Caribbean Cruises Ltd. (NYSE: RCL) operates as a cruise company.

The company operates cruises under the Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, and Silversea Cruises brands.

As of December 31, 2019, the company operated 61 ships and had 17 ships on order. Royal Caribbean Cruises Ltd. was founded in 1968 and is headquartered in Miami, Florida.

Norwegian Cruise Line Holding Ltd:

Norwegian Cruise Line Holdings Ltd., (NYSE: NCLH) together with its subsidiaries, operates as a cruise company in the North America, Europe, the Asia-Pacific, and internationally.

The company operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands.

As of February 20, 2020, the company had 28 ships. The company was founded in 1966 and is headquartered in Miami, Florida.

WHY INVESTING IN CRUISE SHIPS COMPANIES:

Airlines are resuming their international schedules; theme parks have begun making concrete plans to reopen, casinos and hotels have done the same, retailers that have thrown open their doors as society heads haltingly toward a new normal with face masks, limited capacities, and social distancing guidelines in place.

The three major cruise lines mentioned above, plan to take the same path and get their ships back out to sea. Carnival has even listed August 1 as the day it plans to restart operations, while Royal Caribbean has hinted at a similar timetable.

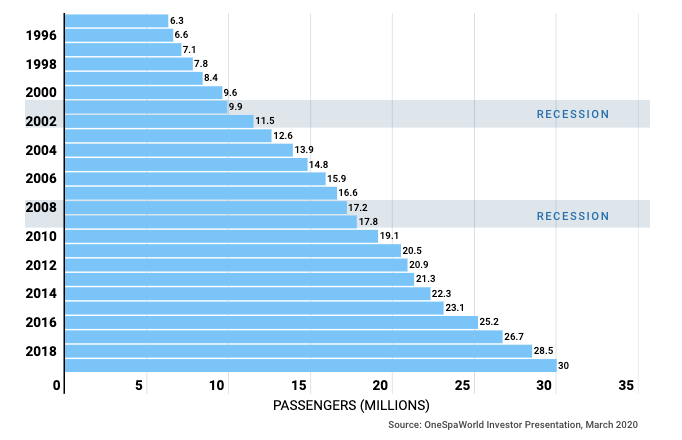

Despite two recessions over the last 25 years, the cruise business has shown unabated growth in passengers globally, as can be seen from below chart.

PGM CAPITAL ANALYSIS & COMMENTS:

The major reasons why investment in cruise ship companies may result in a positive investment return are:

Cruising continuous growing popularity particularly in Asia:

In 2015, only one million cruise passengers were from China (a similar number to Australia which has a far smaller population). However, by 2020, the Chinese government expects 4.5 million cruise passengers from China per year.

Committed growth in new passenger capacity:

To meet the upcoming demand, over the next 5 years, 139,000 berths (from 44 new ships) have been commissioned by cruising companies to be built, which is a 29 percent increase in passenger carrying capacity globally.

Baby boomers’ spending power:

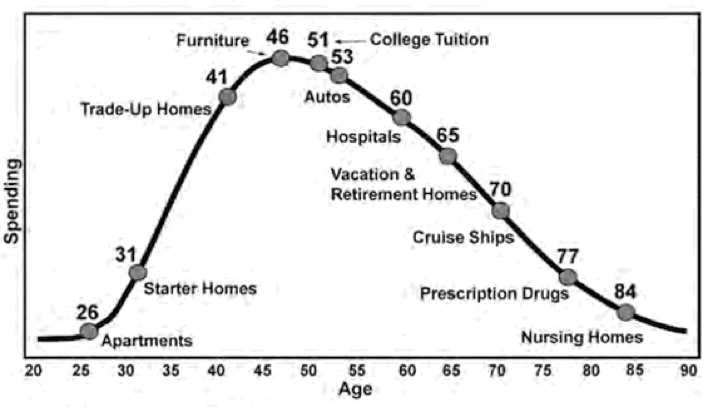

As can be seen from below chart, cruising has demographic and spending power on its side.

Baby boomers, – the wealthiest proportion of the global population – are a key customer group for cruise ship companies. With more baby boomers heading into retirement over the next decade, there will be greater demand for cruises.

Based on the above information and the very attractive share price, – due to the COVID-19 – we initiated our coverage for this sector with a STRONG BUY rating for which our preference goes toward the Carnival Corporation.

Disclosure:

We own shares of Carnival Corporation in our personal portfolio.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek