Dear PGM Capital Blog readers,

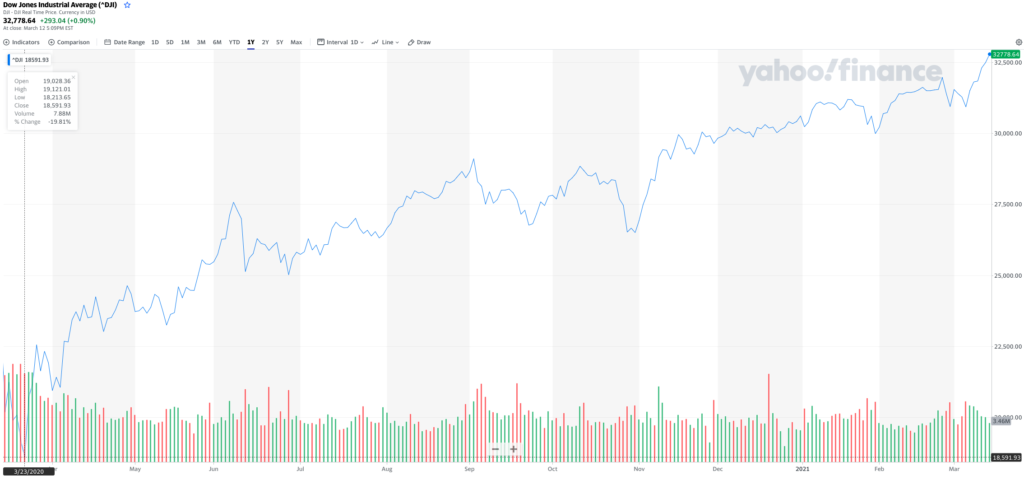

As can be seen from the below chart, the USA DOW-Jones Index is increasing steadily – since it has reached a low of 18,591.93 points -, on Monday, March 23, 2020.

INTRODUCTION:

On Wednesday, March 11, 2020, the World Health Organization (WHO) has declared that the world was in a pandemic of the COVID-19 virus, beginning with a trail of death and suffering, the start of a succession of lockdowns across the globe, which have caused almost all major world economies to entering into a recession.

Sectors of the world economy that have suffered severely due to COVID-19 lockdowns and changes in behavior on the part of the population are:

- Airlines along with the entire tourist and entertainment industry such as hotels, restaurants, cinemas and other entertainment venues have taken losses since they have fixed costs that have to be covered.

- Retail sales have pretty much recovered thanks to government stimulus and subsidies.

- On the other side, companies involved in the “Internet of Things“, due to the new normal, have seen their share prices gone through the roof.

THE STOCK MARKET AS A FORWARD LOOKING MECHANISM:

The stock market is a forward looking mechanism, which means that, a company’s stock market value can be thought of as the present value of all its future earnings.

These are related to economic growth but not on a one-to-one basis. Its value reflects what is currently happening, but also what is forecast to happen next year, the year after, and so on. Stock markets are forward-looking.

In contrast, much economic data tells you about what has happened in the past. To give an obvious example, GDP growth figures are not released until after the quarter has ended.

This means any news that impacts profit expectations can move the market before it hits companies’ bottom lines. This is exactly what has happened up to now since March 23 of 2020.

PGM CAPITAL COMMENTS & ANALYSIS:

The most asked question in the finance industry – in 2020 up to now -, from clients and professionals alike is:

Why is Wall Street (The Stock Market) booming while Main Street (The Economy) is suffering?

As well as stock prices being forward looking, there has also been an additional catalyst which has spurred markets higher in recent weeks.

This has led to an even greater disconnect between the market and economy. This catalyst is the huge stimulus package that central banks and governments have unleashed.

These stimulus packages will at the end create inflation, for which reason the stock market correctly looks ahead to price stocks accordingly.

With government shutdowns disproportionately impacting small businesses, household and business purchases were directed primarily to large public companies.

This phenomenon contributed to off-the-charts profits for many companies, driving their stock prices higher, which caused an substantiation for the divergence between observed economic struggles and market performance.

Lastly, the impact of the government’s monetary and fiscal policies on risk asset prices cannot be underestimated. To be clear, the massive amount of stimulus across the globe is no-doubt supporting market performance.

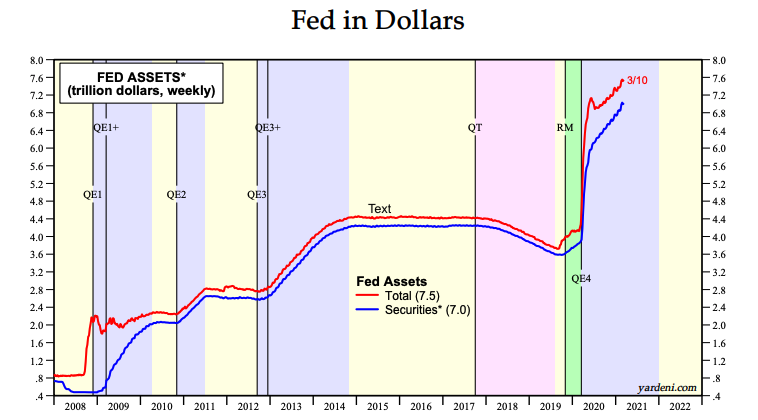

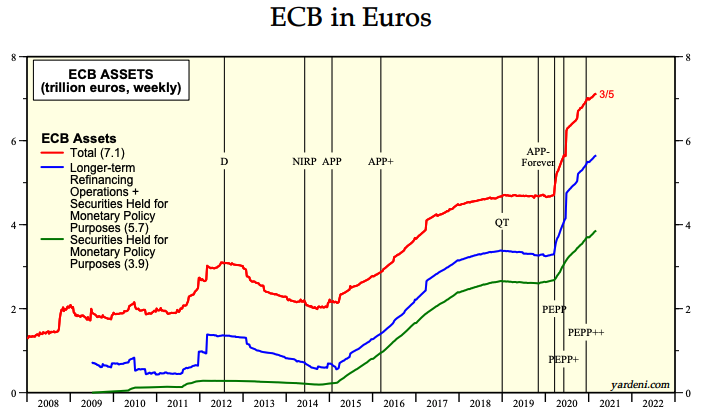

Below charts show the balance sheet of the FED and the ECB.

Excess liquidity often finds itself in risk assets and assuredly this time is no different.

Likewise, low interest rates are a tailwind for growth companies, as witnessed by the fact that growth continues to handily outperform value strategies.

Coupled with fiscal stimulus measures aimed at supporting businesses and maintaining income levels that buttress consumer spending and stave off defaults, markets are demonstrating confidence.

All the above indicates that, starting Q2-2021, when life returns more or less to normal, inflation will be the name of the game, which will increase the disconnect between Main street and Wall Street even more.

Given this context, we are maintaining our slightly overweight position on equities, especially those from Asian countries, food commodities, disruptive technologies, happy aging and Green/Blue economy.

On the other side, we are bearish on bonds and cash, for which we are double bearish on the US-Dollar.

In the rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

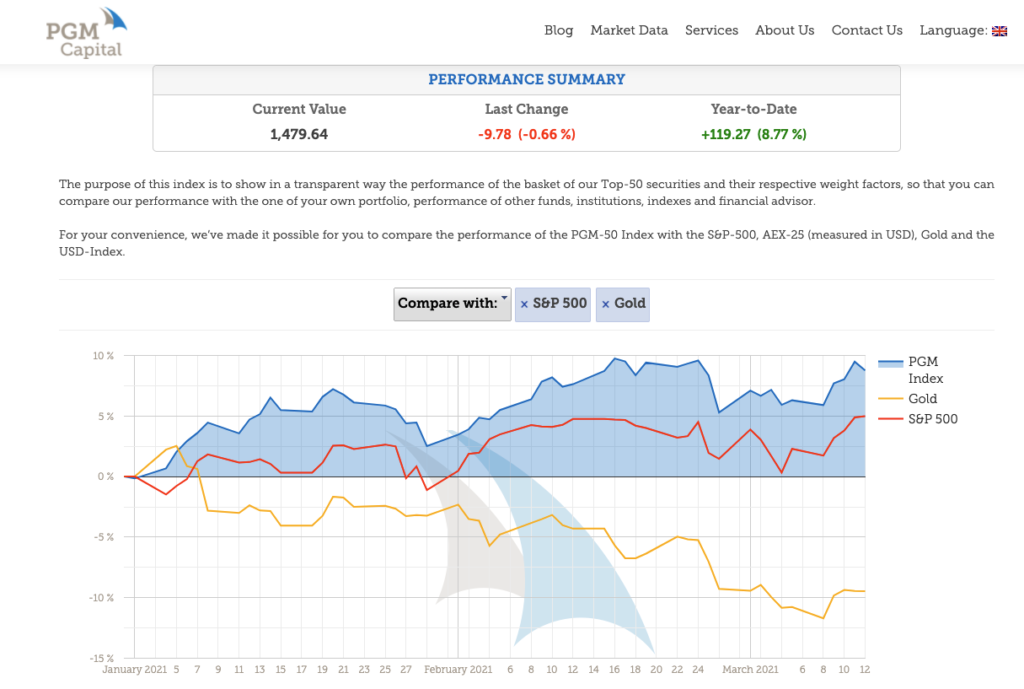

Below chart of the performance of the PGM-50 Component Index shows that YTD this index has appreciated with 8.77 percent, beating the S&P-500 and Gold, by a wide margin.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Eric Panneflek