Dear PGM Capital Blog readers,

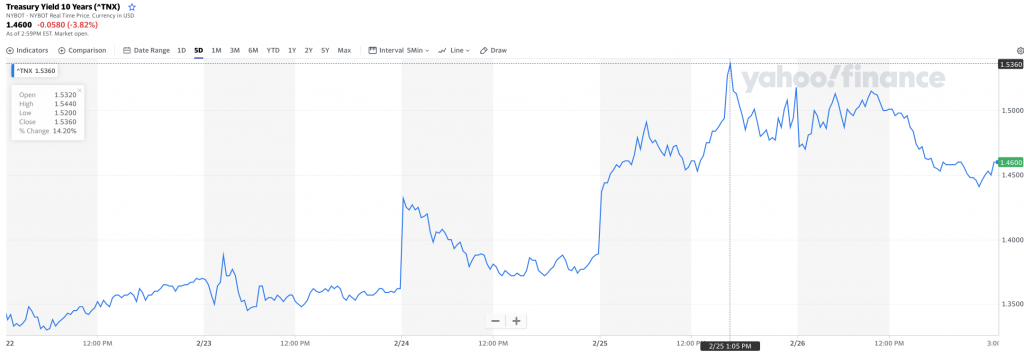

As can be seen from the below chart, on Thursday, February 25, the yield of the US-Note-year note rose sharply, as investors massively dumped Treasuries.

INTRODUCTION:

Bond prices and yields move in opposite directions, which you may find confusing if you’re new to bond investing. Bond prices and yields act like a seesaw: When bond yields go up, prices go down, and when bond yields go down, prices go up.

This inverse relationship can be summarized as below:

- The bond trades at par when its coupon rate is equal to the required yield.

- If required yield is greater than the coupon rate, then the bond price will be below par (sell at a discount)

- If required yield is lower than the coupon rate, then the bond price will be above par (sell at premium)

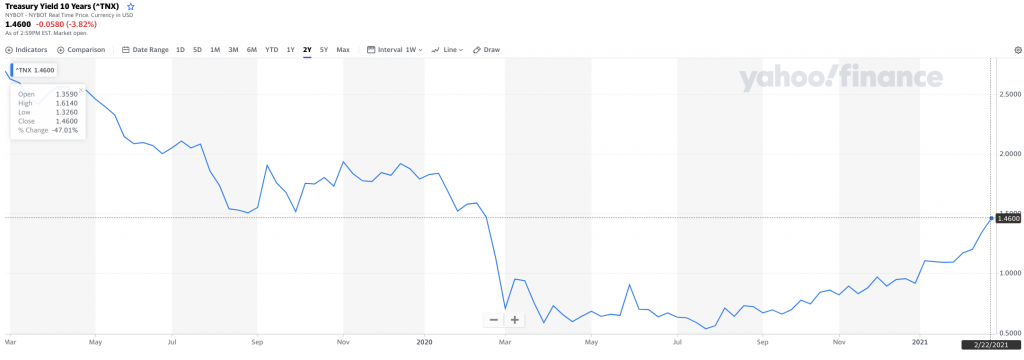

As can be seen from the below chart, the benchmark U.S. 10-year Treasury note climbed above 1.4%, – on Thursday February 25 – for the first time since February 2020.

Yields tend to rise in lockstep with inflation expectations, which have reached their highest levels in a decade in the U.S., powered by increased prospects of a large fiscal stimulus package, progress on vaccine rollouts and pent-up consumer demand.

PGM CAPITAL COMMENTS & ANALYSIS:

Put a frog in boiling water and it will instinctively jump out. Put a frog in tepid water and slowly increase the heat to a boil, and it will not perceive the danger and in turn be cooked to death.

This is because he will not notice the subtle, but deadly change happening to his environment before it is too late.

The is a useful metaphor when explaining the creeping financial disaster that inflation can inflict upon the unwary.

If your investment has a specific rate of return targeted over the medium to long term, but the inflation rate is higher than that, then you will actually be losing money in real terms. That’s hardly the sort of return that anyone is seeking.

If you have a long-time horizon, it is likely that your asset allocation consists of equities.

Outlook 2nd Quarter 2021

The COVID-19, vaccination roll-outs have begun and should accelerate in the coming months. In the circumstances, we are maintaining our core scenario, which involves growth recovering strongly from the second quarter and inflation rising in the second half of the year.

The rising interest rates can also be interpreted as “growth optimism”, especially in Asia, as the global economy bounces back from the coronavirus pandemic.

Rising interest rates and inflation goes hand in hand, however we believe that with the current level of sovereign debt, central banks will not increase their key rates, for which we believe that opposite – reducing rates further – will be more an option.

The combination of inflation, money printing and rates reduction, will be lethal for your purchasing power.

Yes investments come with risks – their value can go down as well as up, and you could get back less than you initially invest. But, if you invest sensibly and (even better) seek some professional advice, it should see your money outpace inflation.

Given this context, we are maintaining our slightly overweight position on equities, using a theme-based approach, and we became more positive on cyclical and value investments and advise our client to underweight on sovereign bonds.

Disclosure:

We do not own any bond in our personal portfolio.

In the rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Eric Panneflek