Dear PGM Capital

In this weekend’s blog edition, we wish to elaborate, why investing in the Semiconductor Sector can be lucrative for growth investors.

INTRODUCTION:

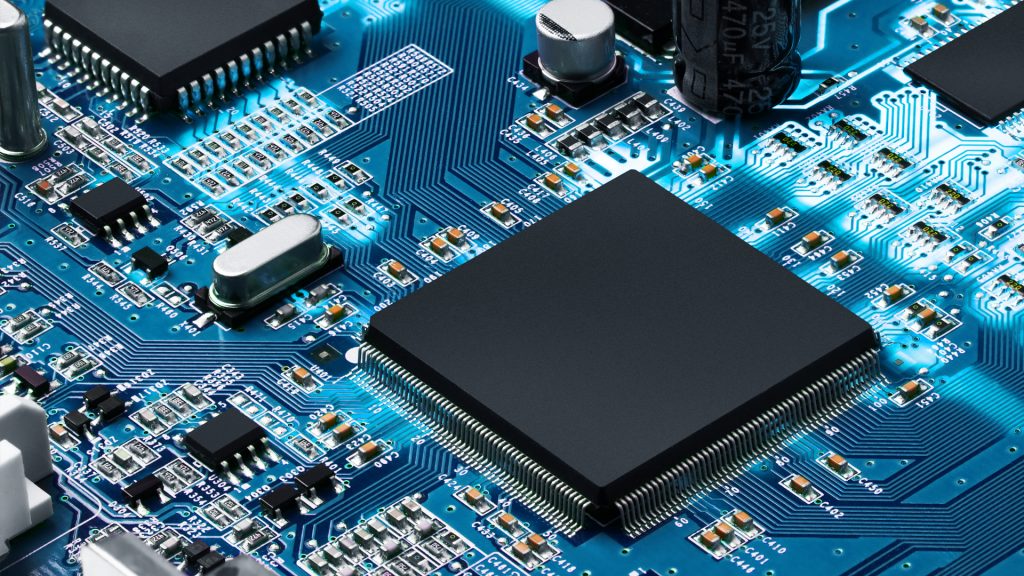

Semiconductors are materials which have a conductivity between conductors (generally metals) and nonconductors or insulators (such as most ceramics).

Semiconductors can be pure elements, such as silicon or germanium, or compounds such as gallium arsenide or cadmium selenide. In a process called doping, small amounts of impurities are added to pure semiconductors causing large changes in the conductivity of the material.

Semiconductors are employed in the manufacture of various kinds of electronic devices. They are, and will be in the foreseeable future, the key elements for the majority of electronic systems, serving communications, signal processing, computing, and control applications in both the consumer and industrial markets.

THE INTERNET OF THINGS:

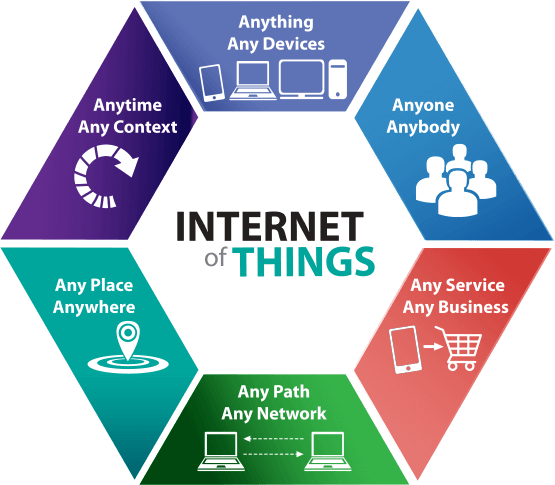

The Internet of things (IoT) is defined as the network of physical objects – “things” or objects -, that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the Internet.

The computing world is changing with IoT faster than most people realise. The new wave of computing is smart sensors, equipment & devices that can talk to each other without manual interactions. These devices are intelligent enough to take proactive actions & enable human beings with capabilities never seen before.

In today’s digital landscape, devices, machines, and objects of all sizes can automatically transfer data through a network, effectively “talking” with each other in real time.

Top five advantages of the IoT are:

- Cost reduction

- Efficiency and productivity

- Business opportunities

- Customer experience

- Mobility and agility

THE ROLE OF SENSORS:

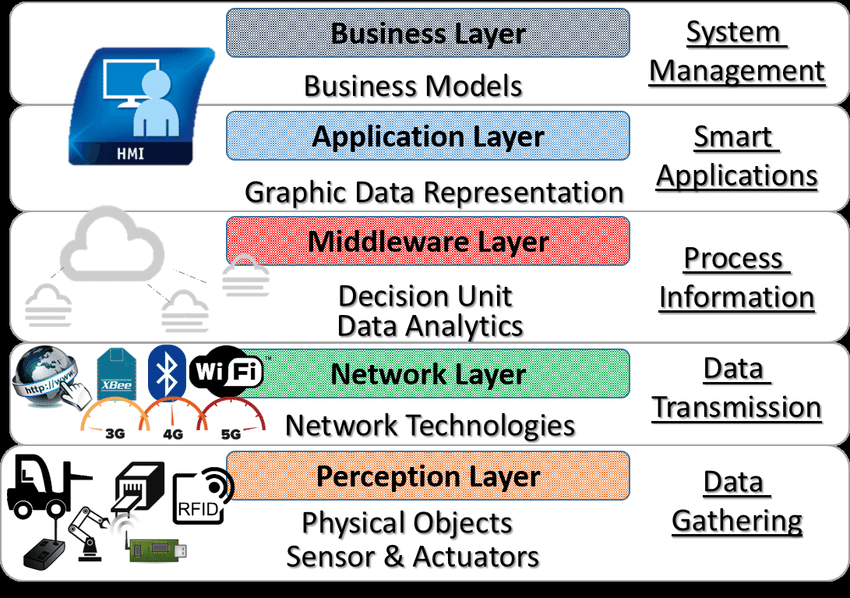

In an Internet of Things (IoT) ecosystem, two things are very important: the Internet and physical devices like sensors and actuators.

As shown in the below figure, the bottom layer of the five layers of the IoT system consists of sensors and actuators for data gathering.

The conclusion that we can draw from the above figure is, as the Internet of Things (IoT) industry grows, so do the opportunities to utilize sensors.

Most sensors operate using semiconductors and are therefore called semiconductor sensors, this combined with the usage of semiconductors in various kinds of electronic devices – connected to the IoT -, implicates that as the IoT grows the demand for semiconductors will explode.

PGM CAPITAL COMMENTS & ANALYSIS:

A global shortage of semiconductors – chips that power massive data- centers, modern autos and countless digital devices – has roiled global manufacturing and is not expected to end soon. It isn’t a blanket problem, however, as different sectors within the chip industry will continue to be affected by the shortage in different ways.

As the industry entered 2020, high demand was expected in the mobile chip area because of the rollout of 5G devices. That path was turned on its head when COVID-19 became a global pandemic, driving millions, if not billions, of people into the safety of their homes to work, go to school, be entertained and to socialize.

With demand remaining high and little additional chip-making capacity expected in the short term, the shortage is expected to last into at least next year.

Best way to profit from the SemiConductors Boom:

Here below we will analyze two companies which in our opinion are the best positioned for the current and coming boom in semiconductors:

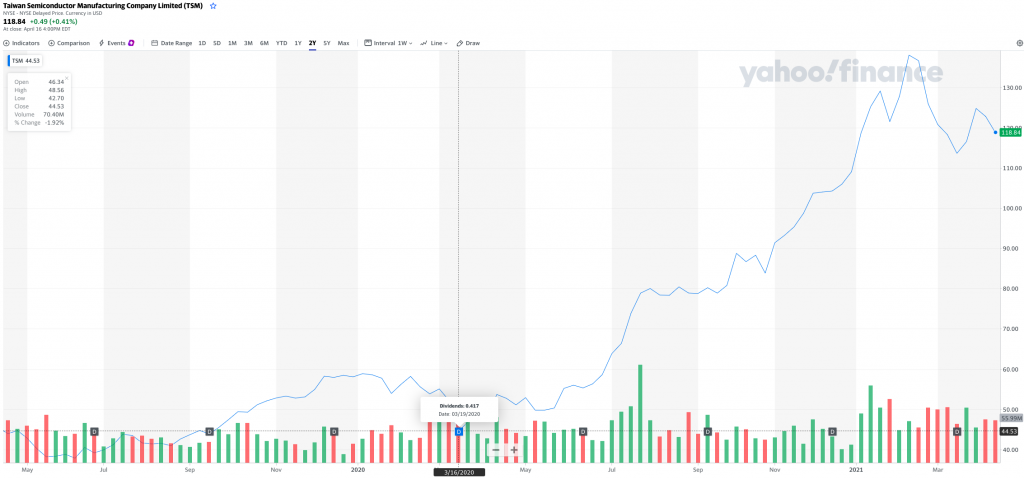

Taiwan Semiconductor:

Taiwan Semiconductor, (NYSE: TSM) a Taiwanese multinational semiconductor contract manufacturing and design company, is the world’s most valuable semiconductor company, and the world’s largest dedicated independent (pure-play) semiconductor foundry.

The below 2-year chart of the performance of the shares of the company shows that since the start of the global COVID-19 pandemic – by mid March of 2020 – shares of the company, have soared with approx. 170%

ASML Holding:

ASML Holding N.V. (ASML.AS) is a Dutch company, which develops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection related systems for memory and logic chipmakers.

The below 2-year chart of the performance of the shares of the company shows that since the start of the global COVID-19 pandemic – by mid March of 2020 – shares of the company, have soared with approx. 150%

Based on the respective fundamentals of Taiwan Semiconductor as well as of ASML, and current and coming semiconductor boom, we have started our coverage on both their shares with a BUY rating.

Disclosure:

We do not own shares of either of them yet, but have started buying them for our clients and are planning to buy them for our own portfolio in the week of April 19, 2021.

In this rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek