Dear PGM Capital Blog reader,

On Wednesday, November 14, things turned south for crypto currencies, with an average drop of approx. between 10 – 14 percent of their respective market capitalization.

INTRODUCTION:

A cryptocurrency (or crypto currency) is a digital or virtual currency that uses cryptography for security.

Many cryptocurrencies are decentralized systems based on blockchain technology, a distributed ledger enforced by a disparate network of computers.

A defining feature of a cryptocurrency, and arguably its biggest allure, is its organic nature; it is not issued by any central authority.

The first blockchain-based cryptocurrency was Bitcoin, which was launched in 2009 by an individual or group known under the pseudonym, Satoshi Nakamoto, which still remains the most popular and most valuable.

Today, there are thousands of alternate cryptocurrencies with various functions or specifications. Some of these are clones of Bitcoin while others are forks, or new cryptocurrencies that split off from an already existing one.

CRYPTOCURRENCIES FROM BOOM TO BUST?

The 2018 cryptocurrency crash (also known as the Crypto carnage, Bitcoin crash and the Great crypto crash) is the biggest sell-off of most cryptocurrencies from January 2018.

After an unprecedented boom in 2017, the price of bitcoin has fallen by about 65 percent during the one month from 6 January to 6 February 2018.

Subsequently, nearly all other cryptocurrencies also peaked from December 2017 through January 2018, and then followed behind bitcoin.

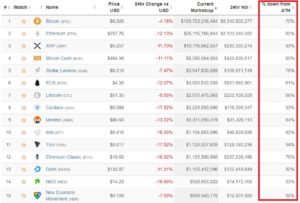

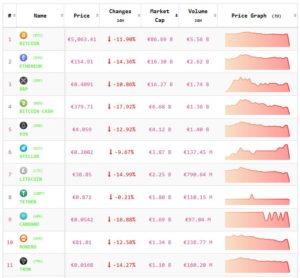

As can be seen from below table, of mid August 2018, cryptocurrencies have collapsed 80% from their peak in January 2018, making the 2018 cryptocurrency crash worse than the Dot-com bubble’s 78% collapse.

CRYPTOCURRENCY BUBBLE?

Predictions of a collapse of a speculative bubble in cryptocurrencies have been made by numerous experts in economics and financial markets.

Bitcoin and other cryptocurrencies have been identified as economic bubbles by at least eight Nobel laureates in economics.

Professor Nouriel Roubini of New York University has called Bitcoin the “mother of all bubbles.”

Central bankers, including; former Federal Reserve Chairman Alan Greenspan and investors such as Warren Buffett and George Soros have stated similar views.

PGM CAPITAL’s ANALYSIS & COMMENTS:

The mother of all bubbles:

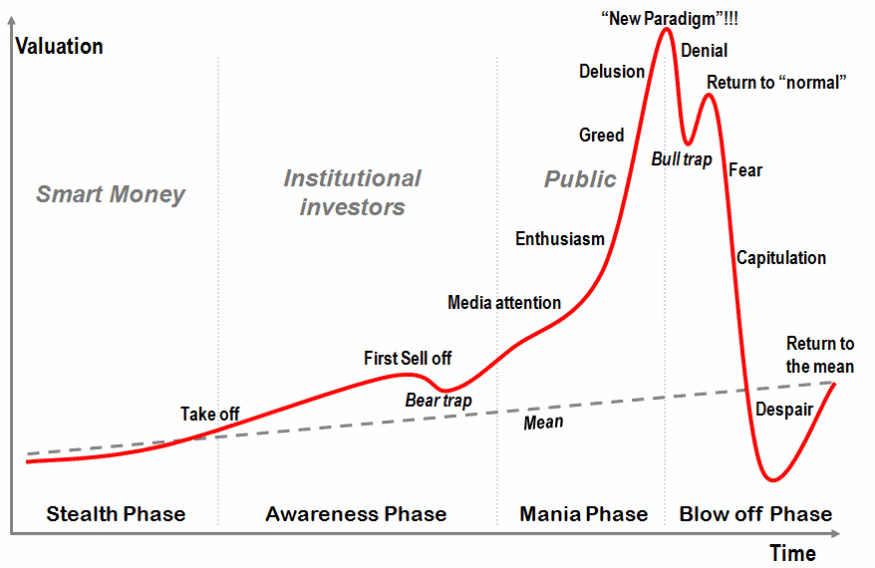

History has proven that all bubbles, from the Dutch Tulip mania in the early 1600 to the dot,com bubble to the current Cryptocurrency bubble, have the same characteristics as can be seen from chart.

Every bubble after they have burst shows a same pattern, for which, after the “New Paradigm” phrase and events like the “Bull Trap” and Capitulation phase have followed.

Based on this let’s examine the chart of the four most known Cryptocurrencies:

Bitcoin:

Ethereum:

Ripple:

Litecoin:

These above charts of those cryptocurrencies are picture perfect with the theoretical bubble curve chart, for which reason we can conclude that the above mentioned Cryptocurrencies are a bubble and currently in their capitulation stage.

The Crash in the week of November 12 2018:

Since Wednesday November 14, the entire cryptocurrency market fell on average between 10 – 14 percent. Below table shows the massacre of most popular Cryptocurrencies on this date.

It’s worth noting that the Bitcoin Cash drama has greatly affected the price, with the Bitcoin fork falling 28.88% this week.

Warning signs:

There are numerous inherent loopholes in cryptocurrencies. These so-called alternative currencies are mined through different techniques and sold to the general public. Real cash assets don’t back them, and they have no fair value other than the cost of mining.

We have warned in the past year, the audience of presentations and media shows at which we were interviewed or were a keynote speaker, about the bubble characteristic of the cryptocurrency mania.

Below video shows the presentation of Mr. James Rickards, during Vancoucer Resource Investment Conference, Canada entitled “The Future of Money; Gold, Crypto or Fiat?”, for which we advise you to listen very carefully from minute, 16:22 to 33:00.

Last but not least we want to sent a warning sign to our readers, as follows:

In today’s world of high compliance and regulations, regulators and financial supervisory authorities, will not allowed any system which isn’t transparant enough, don’t fully comply with modern regulations and don’t submit themself to supervision, control and audit of regulatory agencies, governments- and supervisory institutions.

Based on the above we can conclude that sooner or later, (most) currencies will hit a wall and that their price most probably will go to zero.

Disclosure:

We/I don’t own any cryptocurrency and have warned via several media shows, for which there are records about the risk of trading and investing in cryptocurrencies.

Until next week

Yours sincerely,

Eric Panneflek